US Dollar Climbs Higher Against Canadian Dollar as Oil Falls

- Crude oil correlation with Canadian dollar continues

- Oil market suffering from a severe lack of demand

- Americans producing more than enough to cover their needs

- Coronavirus fears drive money away from commodities and into treasuries

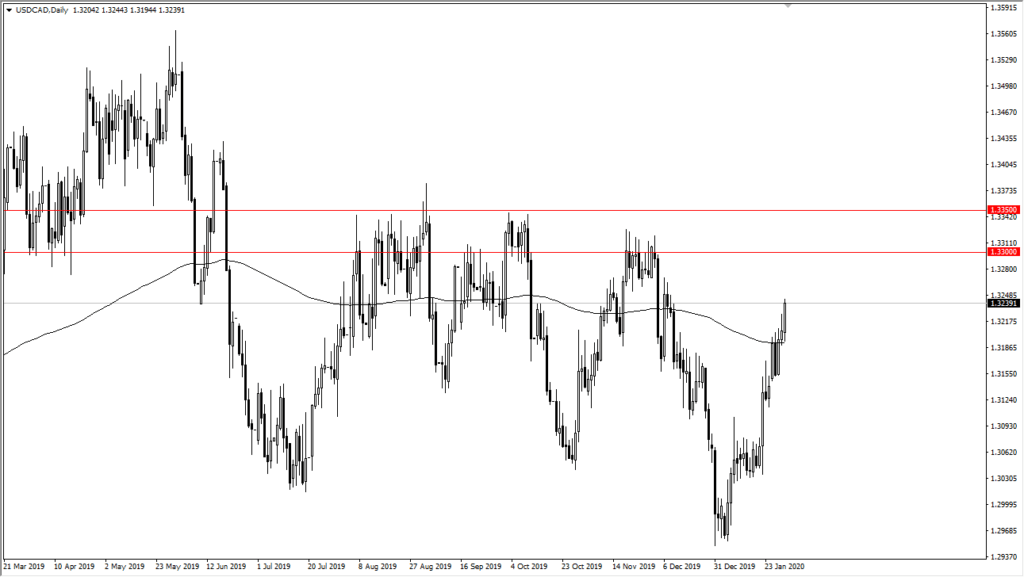

There is a near-absolute correlation between the CAD and crude oil. While the US dollar has continued to see strength against the Canadian dollar, the oil markets are very soft and tentative. Ultimately, both markets will continue to see a lot of volatility, but they are starting to get stretched.

The US dollar can continue to strengthen overall, as has been the case for some time now. What is interesting here is that the Canadian dollar is often used as a proxy for the crude oil markets, and that’s exactly what is being seen here.

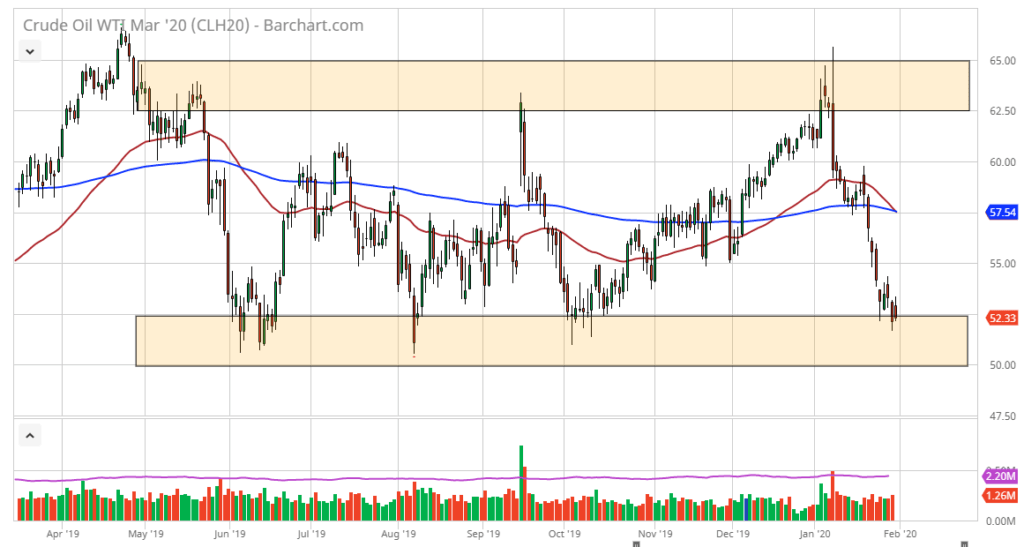

Crude oil suffers from low demand

Crude oil markets have struggled for some time. The last couple of weeks have been brutal on not only the West Texas Intermediate market, but also Brent markets. The West Texas Intermediate Crude oil market has fallen down from $65 to $52.50 per barrel.

It is very likely that this market is trying to find some support as it extends from the $52.50 level down to $50.00. This correlates quite nicely with the USD/CAD pair, which is starting to rush towards what looks to be a resistance barrier.

Coronavirus effects on commodities

The coronavirus coming out of China continues to have people rushing towards safety, which means dumping commodities such as crude oil. This market worries about whether or not there will be demand due to the fact that China may well slow down.

If that is going to be the case, then it will take another one of the major players out of the equation, or at least bring down the demand from that player.

The United States dollar gets a boost due to the fact that the US Treasury markets will attract money for their safety element. This is one of the most commonplace markets for traders to get involved in. It is considered to be a “cash equivalent” for larger funds, so money continues to drive into that area.

Technical analysis for the USD/CAD

WTI crude oil

The charts show the near-absolute correlation between crude oil and the USD/CAD. The currency pair has the 1.33 level above looking like potential resistance, as we have now broken above the top of the shooting star from the previous session on Thursday.

USD/CAD chart

With that being said, there is a ton of resistance between here and the 1.3350 level, so a reversal is very likely. This will be further exacerbated if the WTI Crude Oil market can bounce from this general vicinity.

There is an area where market participants could see some type of reversal, and both of these markets are approaching those levels rather quickly. Ultimately, they are both getting slightly overextended, so a relief rally for both crude oil and the Canadian dollar could be imminent.