US dollar continues to congregate in tight range

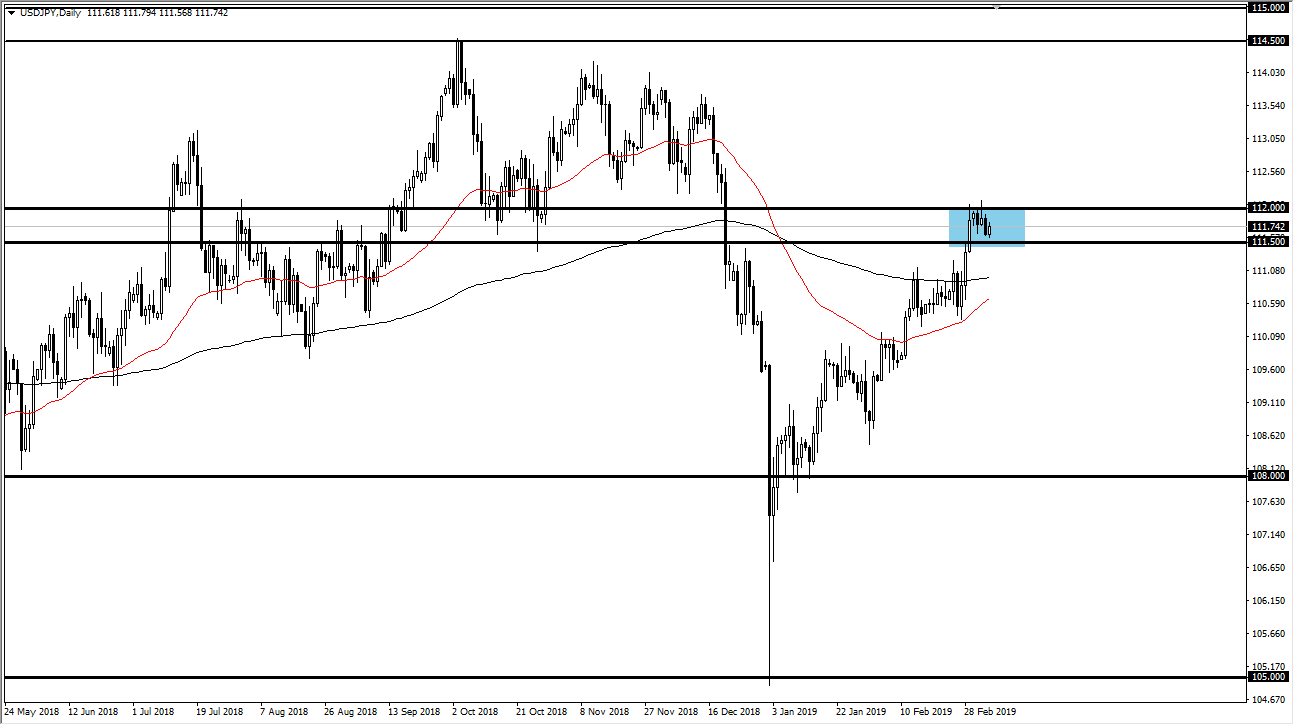

The US dollar continues to congregate around the tight range that we have seen all week against the Japanese yen. Looking at this chart, it appears that the ¥111.50 level should continue to offer support, while the ¥112 level should continue to offer resistance. However, with tomorrow being the jobs number in the United States, we have the potential for a significant move by the end of the session.

SHOULD BE QUIET UNTIL JOBS FIGURE

This market will more than likely continue to be very quiet until we get the jobs figures coming out of the United States, as it is one of the biggest economic numbers that we get per month. The question isn’t so much whether or not there were jobs at it, but whether or not the Federal Reserve will remain soft for some time. One thing you can count on during the announcement and shortly afterwards is a lot of volatility.

BAD NEWS IS GOOD NEWS?

Sometimes bad news can be good news. In other words, if the Federal Reserve looks to be very dovish and the economic figures give us more of the same idea, then in the bit of a twist, this pair may actually climb as it tends to follow stock markets. For example, if it appears that the Federal Reserve is stuck with a soft stance, stock markets will generally take off to the upside. That should send the S&P 500 into breakout mode, which typically this pair will follow. Ultimately, if the jobs number is a bit too good, it may have people worried about the Fed tightening again, and that may send stock markets lower, which could cause a bit of a pullback.

POTENTIAL TARGETS

If we do get the break out above the 112 young level and make no mistake we mean a daily close above that level, then it’s very likely that we will target the ¥112.50 level, and then the ¥113.50 level after that. That should coincide quite nicely with a significant break out above the 2820 handle in the S&P 500. However, if we break down below the ¥111.50 level, then I suspect that the market will make a move towards the 200 day EMA at the ¥111 level.

The third scenario, and one that can be quite common on Nonfarm Payroll Fridays, is that the market goes back and forth and simply doesn’t do anything. Because of this, that’s why until you get a daily close out of these levels you should be very cautious. It’s not uncommon at all to see people lose a lot of money trying to chase the trade. If you have the ability to trade short-term charts and scalp the market back and forth, that might be a strategy as well, with these two well-known borders as guide rails.

THE MAIN TAKE AWAY

As the USD/JPY pair is very sensitive to the bond market, which in turn is very sensitive to the employment situation, it should be one of your main markets to watch after the jobs figure, to give you an idea of what the risk appetite is. There have been times where we’ve watched this pair rally a bit, but maybe not necessarily in an area we are interested in taking a trade, only to use that bullishness as a “risk on” signal, and used that information to buy other currencies such as the Australian dollar, New Zealand dollar, etc.