US Dollar Gains Against Chinese Yuan Amid Coronavirus Fears

- US dollar approaching 7 handle

- Rising in a sign of fear

- Breaks above 50-week EMA

Far too many retail traders pay attention to the USD/CNY pair, measuring the United States against the Chinese yuan. These days, it is one of the more important currency pairs because it can give an insight into what the risk appetite around the world is.

This is especially important right now in an atmosphere of fear, with the coronavirus supposedly raging through mainland China.

Technical analysis for USD/CNY

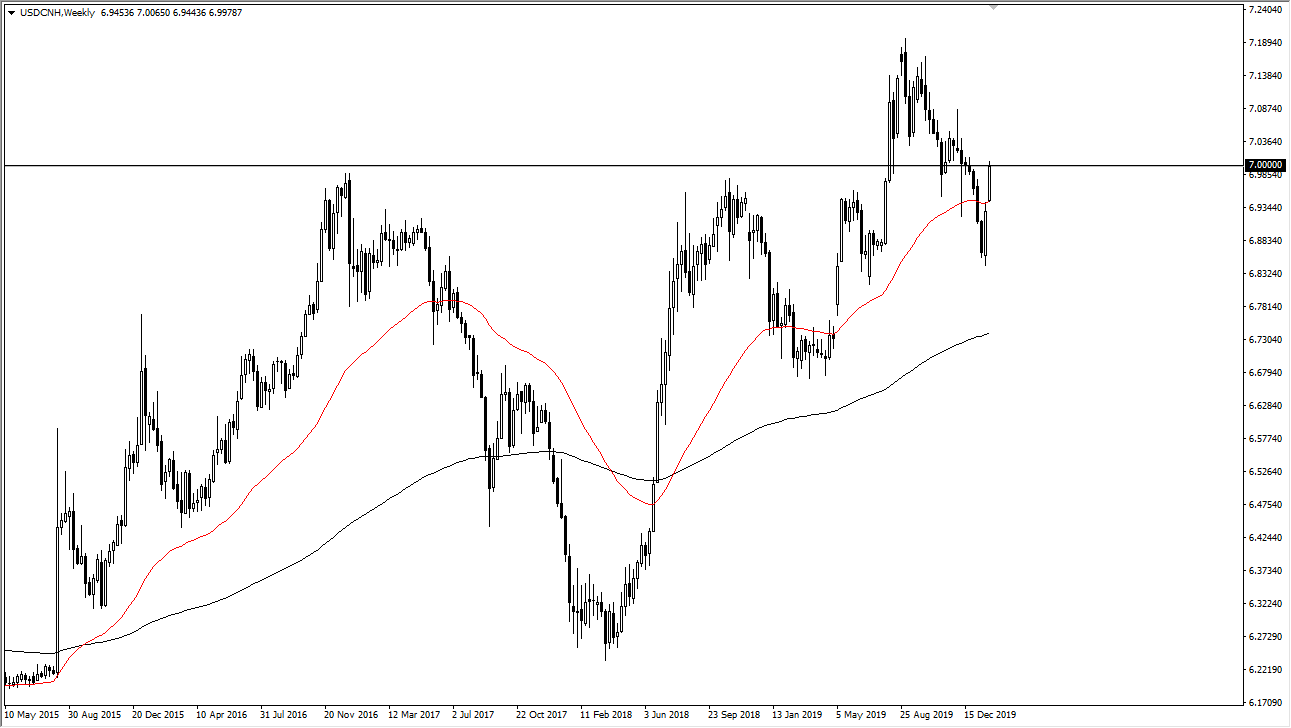

US dollar / Chinese yuan weekly chart

The technical analysis for this pair is quite interesting as we close out the week near the 7.0000 handle. This is an area that always attracts a lot of attention, because it wasn’t that long ago that it was thought of as a “line in the sand” by the market.

The 7.0000 level has a lot of psychological influence, which can be seen from when it had previously offered massive resistance. However, earlier this year, the US dollar broke that level and then reached towards 7.18. The market has since pulled back from there, as the United States and China came to terms with the so-called “Phase 1 deal.”

The 50-week EMA has been broken to the upside, showing that the market is starting to shift momentum. The USD/CNY is currently trading between the 7.0000 level and the 50-day EMA but is ready to break through the top of that range.

When it does, the market overcoming the psychological barrier could well open the door to the 7.10 level above. Then, pullbacks will have to be looked at through the prism of a longer-term uptrend.

Further thoughts

The market has since bounced over the last couple of weeks, as the coronavirus suddenly took over the headlines. There are certain economic ramifications to the coronavirus in China, with factories shut down, travel restricted, and several cities the size of Chicago quarantined.

In other words, the Chinese economic engine has been ground to a halt. Furthermore, the US dollar itself is considered to be a safety currency, as in times of concern traders will quite often look for US treasuries for safety.

China has a host of issues right now, well beyond the coronavirus. The debt to GDP levels is astronomically high, much higher than in the past, with traders punishing the currency as a result.

It looks as if the market could very well continue the entire uptrend. Then, it won’t be until the market breaks down below the 6.85 level that one could make the argument of a “lower low”, which would be the first step to a downtrend.

The last couple of candles on the weekly chart have in fact closed at the very top of the range, which is a very bullish sign for the greenback.