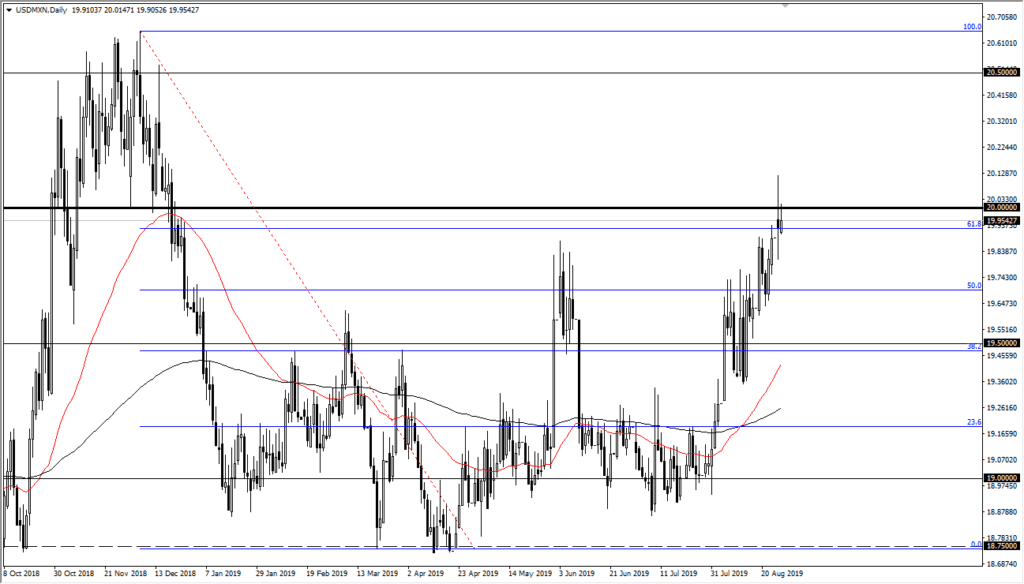

US dollar overextended against the Mexican peso

- US dollar reaches 20 MXN

- Continues to show resistance at this area

- Reaches the 61.8% Fibonacci retracement level

- Overextended

Looking at the USD/MXN pair, you can see that we have reached the 20 pesos level, which of course is a large, round, psychologically significant figure. Keep in mind that this pair is highly representative of Latin America and perhaps even more importantly the emerging markets. In that sense, it gives you an idea as to where risk appetite is going, even if you don’t trade the peso.

Major round figure

USD/MXN

It is worth paying attention to that the 20 MXN level has offered enough resistance to keep the market down a bit. Ultimately, this is a market that has gone straight up in the air after a very volatile move closer to the 19.50 MXN level, as we have seen a major “risk off” type of situation. At this point, the market is very likely to start paying attention to the global flow of risk appetite, and the fact that we continue to see trouble at the 20 MXN level tells us that there is a little bit of a push back when it comes to this run towards safety. Remember, in order to buy the Mexican peso, a trader is looking for growth in the Third World.

Technical analysis for Mexican peso

The technical analysis for this chart is rather interesting. The 61.8% Fibonacci retracement level of course attracts a lot of attention in the fact that it coincides quite nicely with the 20 MXN level is worth paying attention to. The fact that we formed a very neutral looking candle stick, perhaps a proxy for shooting star, on Monday shows that we have run out of momentum. During Tuesday trading we are trying to recover but you can see that the market has sold off again at that same 20 MXN level. Ultimately, this looks very likely to signal that we are ready to pull back a bit.

The 50 day EMA has broken above the 200 day EMA recently, which is what is known as the “golden cross”, showing underlying strength in this pair. Marrying that with the idea of the exhaustion at the 20 MXN level, it looks like we are probably going to get a pullback. The pullback will more than likely go looking towards the 19.75 MXN level, which is the top of the choppiness from just last week. There is a lot of order flow down there that will be influential in this market.

It is because of this that a short-term pullback is ideal for longer-term buyers to get involved. It simply offers value in the greenback, something that isn’t that easy to find. The alternate scenario is that we simply blow past the highs from the Monday session which of course would show a parabolic rise in the greenback and reach towards the 20.50 MXN level. Then we go looking towards the 20.70 MXN level as it is the 100% Fibonacci retracement level. Until something changes rather drastically, I have no interest in shorting this market.