USD/JPY finding buyers on Thursday

The US dollar initially fell during the day on Thursday as per usual against the Japanese yen, which isn’t much of a surprise considering that the E-mini S&P 500 contract started to sell off during the Globex session. There was a bit of a mixed bag in Asian trading, so again that also didn’t help the situation. However, by the time the Europeans came on board we started to see a little bit of fear come out of the market, and by extension a move away from the Japanese yen.

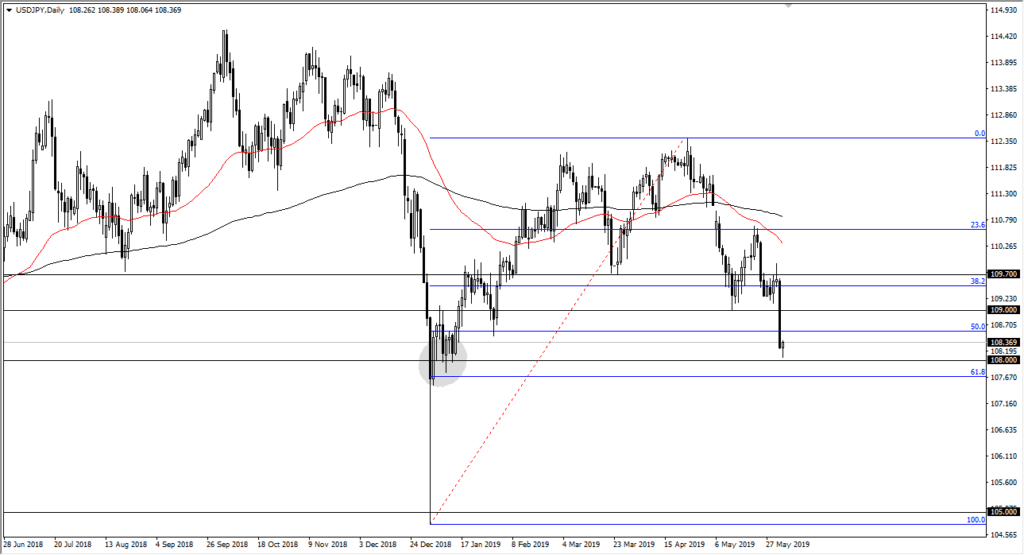

USD/JPY chart

The fear gauge

As we have seen a lot of positive momentum come into the marketplace as far as stocks are concerned, the Japanese yen has been sold off. At this point it’s a bit difficult to tell for ready to go much higher, but there are a couple of clueless on this chart that gives us at least the best case of likelihood. At this point, it looks as if the stock markets can rally and continue to rally, this pair should go higher. One of my favorite benchmarks will be the S&P 500 at the 2900 level. If we can break above there and sustain that move, this pair will continue to go higher.

On the other hand, if we get a sudden sell off in the stock market again, and let’s be honest that can happen, this pair will more than likely roll over and go heading back towards the support level at the ¥190 level. A break down below there opens up the door to even further yen buying, sending this market to the ¥108 level.

While the US dollar is considered to be a safety currency because of treasuries and the like, the reality is that the Japanese yen is thought of even more so as a safety currency because a lot of hedge funds and speculators were borrow Japanese yen because of the interest rate being so low. If they are starting to lose money, they repatriate that money to pay off those loans to get ahead of the currency fluctuation.

The potential target

the potential target in this pair is the ¥111 level. That is the gap above that has yet to be filled, so it would make sense that we make a move towards that area sooner or later. It doesn’t have to happen right away, but it does typically happen eventually. Things are lining up for that move, so it does make quite a bit of sense. If the stock market continues to show a lot of strength and positivity, that could be the one thing we need to truly pick it up in this market. That’s not to say that it’s an automatic win, but the market certainly looks like it is ready to go higher.

The biggest problem of course is that fear swings both to and from extremes, as a simple tweet or something to that effect can cause somebody problems for the world’s markets. It doesn’t appear that the issue of sudden movement is going away anytime soon. Keep your position size small.