USD/JPY finding support

The US dollar initially fell during the Monday session as Asians sold off risk appetite. However, as the Americans are starting to step into the marketplace for the week, it appears that there is a bit of a recovery going on currently. This is a relatively good sign as the Japanese yen is considered to be a “safety currency”, and that of course represents the attitude of traders around the world.

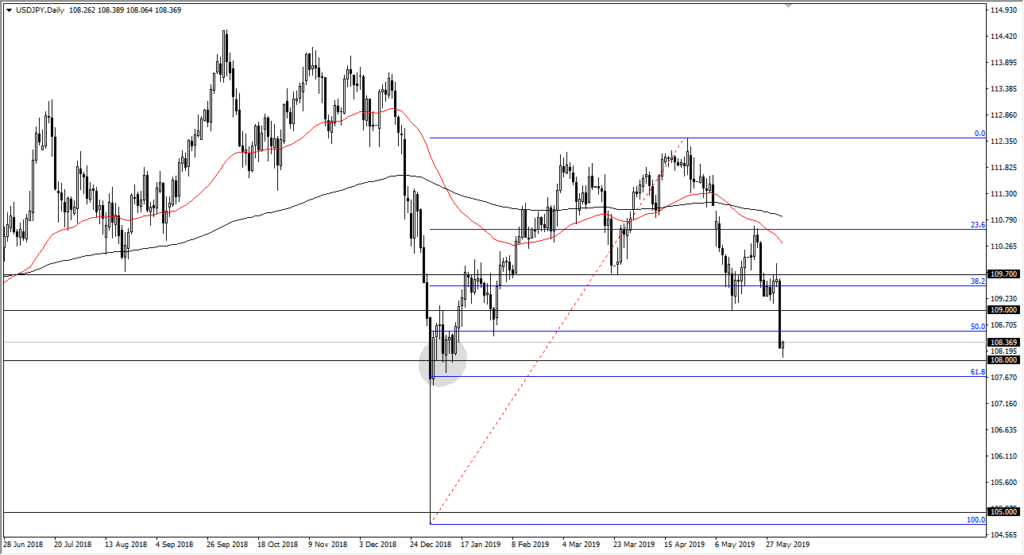

Major support level

The ¥108 level has been major support in the past more than once, and it now looks as if it is trying to do the same thing. While it is early during Monday trading, it’s obvious that there is some life in this pair still, so it wouldn’t be a huge surprise to see this market bounced towards the ¥109 level. After that significant break down during the day on Friday, the question now is whether or not that was capitulation, or was it the beginning of something rather ugly? Only time will tell but it certainly looks as if the market is trying to get its act together.

USD/JPY

Overdone?

It’s very possible that this pair has been overdone to the downside, because quite frankly although things are bad, there hasn’t been a major change in the last few days. Yes, Donald Trump has suggested more tariffs for the Mexicans, but the Mexican president has done quite a bit to defuse the situation. Beyond that, the United States and Mexico have a meeting in the next few days and this is probably just a negotiation tactic more than anything else. That has spooked the markets, but quite frankly at the end of the day I don’t know that anything has significantly changed. It’s very likely that Donald Trump will reverse his stance, or at least accept some type of negotiation with the Mexicans. If that’s the case, then it’s another trade war averted.

To the downside

Any time you have a scenario, there’s also an opposite scenario. In this case, if we were to break down below the ¥108 level, we could reach down to the 61.8% Fibonacci retracement level at the ¥107.70 level. Below there, then the market could unwind down towards the ¥105 level, so quite frankly this is an area that needs to hold. If it doesn’t, then we simply start selling off and wipe out the entire move to the upside. That being said, it comes down to whether or not this area can hold. If it does, then there is the possibility of filling the gap above.

The main take away

The main take away to this pair is that we are at an area that it might be worth risking a small position to the upside. We could fill the gap above which is all the way at the ¥111.15 level. Obviously, it would take a lot of work to get back up there but this could be the beginning of the market turning around. The alternate scenario is that we break down below the 61.8% Fibonacci retracement level, which gives us plenty of room to run to the downside. Pay attention, we are about to see a nice trade.