Currency Trading for Dummies – Forex First-Time Traders’ Guide

People all over the world have access to the largest financial market worldwide – the forex market, courtesy of the advancement of technology. Forex is short for foreign exchange, and free-floating ‘forex’ has its roots back to the early 1970’s.

As World War 2 came to an end, a ravaged world sent its financial and political elite to the United States. Perhaps the most important conference in the last century, the Bretton Woods negotiations led to the birth of the financial system as we know it.

In the mid-1940’s, one of the outcomes of the Bretton Woods agreement was to make the U.S. Dollar the world’s reserve currency. Nations around the world agreed to peg (the Dollar) to a fixed rate to gold, so that Dollars could then be exchanged for gold at (that fixed rate). This ‘gold standard’ was once again in place in the world’s financial system having been used earlier in the century.

The United States could not honour the agreement for long and in 1971, President Nixon broke the pledge to convert the Dollars into gold. As a result, this set the stage for free floating of currencies (fiat currencies) in the international market.

It was the beginning of how we know the forex market today, only without the internet or indeed any computerization!. The market, called the interbank market, was a “playing field” for major banks and financial corporations that needed to exchange vast amounts of money.

The interbank market exists today, forming the basis of the market overall, but its entry is exclusive to the mainstream institutions. With the help of the internet, brokers in the 21st century intermediate access to this market for retail traders. As long as he/she opens a trading account, funds it, and has a stable internet connection, trading in the largest financial market is easier than has ever been.

Currency Trading for Dummies

The short introduction above is only meant to present you with a brief history of this market and the roots of online trading. Nowadays, trade forex meaning buying and selling currency pairs to speculate on their volatility.

In the forex market, currencies are paired together, so buying one means selling the other. In other words, this is all about valuation. One currency is worth a specific amount when compared with other currency. There always needs to be something else to set (or compare) a currency against. It is an exchange rate after all.

One of the functions of the foreign exchange market is to present the economic state of different countries or regions around the world. The rule of thumb goes that the stronger an economy is, the stronger the currency will be. For this reason, traders try to anticipate trends in the currency market based on how well an economy performs.

The rest of this article aims to present a ‘currency trading for dummies’ guide, highlighting the most important things to know when trying to make sense of the world of currency speculation.

Forex for the First-Time Traders

The beauty of forex trading is its relative simplicity – anyone can do it. Anyone can understand what to do in order to open and close a trade, though profiting from it is the hard part.

In the end, whether you are trading or investing, all one needs to know is the market direction. Will the price of a security (in the case of forex trading, of a currency pair) rise or fall? If the trader thinks it’ll rise, he/she will buy the currency pair and make a profit if the pair follows their prediction. If not, traders make a loss. It is like flipping a coin (binary) – only two possibilities exist; up or down.

However, trading is not gambling. Mastering the art of speculation in financial markets comes at the end of a process where traders learn forex trading step by step. From simple to sophisticated concepts, there are a number of ideas and strategies one can learn. In the end, it all reverts back to the direction of a trade; either the trader is right or wrong.

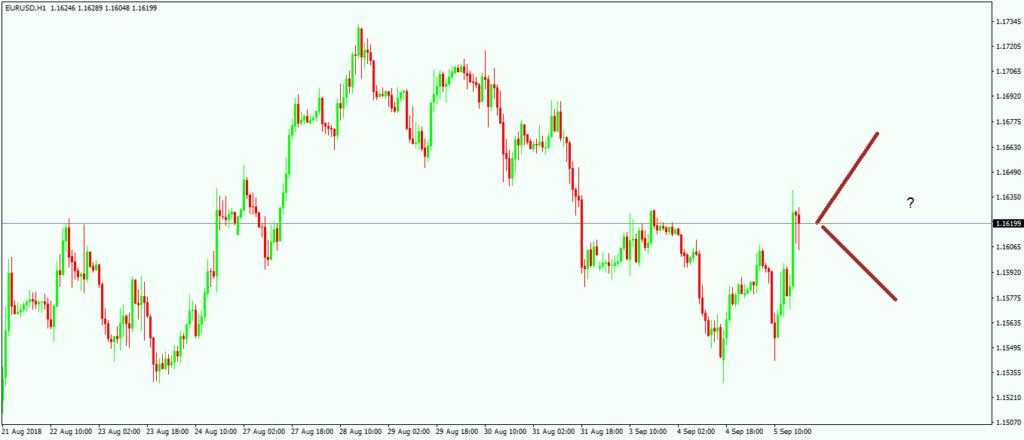

See the EURUSD chart above. The current price sits at 1.16195, and the only way to make a profit is to correctly position for future direction; up or down. If a trader thinks the pair will move lower, he/she can sell it and repurchase it from lower levels. When buying it, the trader hopes to sell at higher levels.

The distance between the entry and the closing price of a trade represents the profit or the loss. It is counted in pips, and a pip is typically the fourth digit in most major currency pairs. For instance, if the EURUSD pair rises from 1.16195 to 1.16300, the trader will make a gross profit of 11.5 pips.

Basic Forex Trading Terminology

When talking about buying and selling a currency pair to make a profit, the trading terminology for this is going long or short respectively. So if a trader refers to selling a currency pair, he/she is “shorting”, hoping to gain from a fall in price.

By shorting a currency pair, traders are expressing a bearish view. For a bearish trade to be profitable, the market must fall.

The opposite happens when traders go long. This is referred to as being bullish and as such, they will ‘go long’ or buy a currency pair with a view to seeing the price rise. They express their bullish view by ‘going long’ at the market price or at a predetermined level.

A trader has a number of ways to open a trade. Either he/she uses a pending order (buying or selling from higher or lower levels, only if and when the price of a currency pair reaches those levels) or entering the market at the current price.

Currency pairs have nicknames too. Traders often refer to the GBPUSD pair as “Cable,” to the Australian Dollar (AUD) as the Aussie dollar, to the Canadian dollar (CAD) as the Loonie – after the Canadian bird.

When central banks issue a statement or decision, market participants look to see if it is hawkish or dovish. Hawkish is the equivalent of bullish, only that the central banks is expressing their view on the economic status of the country. Dovish, on the other hand, is the equivalent of bearish, and central banks use a dovish tone when highlighting negative developments in their economy.

Different Trading Styles Explained

Depending on the trading style, three basic types of traders exist. First, some traders buy and sell multiple times during the trading day. They practice intraday trading and aim for small and marginal profits. Called scalpers, they “scalp” their way in and out of the market all day, sometimes booking only a few pips.

Second, traders that keep positions open for hours, days, or even weeks, are called swing traders. Such traders have more patience, use trading strategies and set-ups on longer timeframes and have a greater tolerance for risk.

Thirdly, some investors use only very long timeframes. They usually favour multi-week and monthly charts and have a different time horizon for their trades. They tend to have significantly funded accounts and more experience. Depending on the trading style, traders use either technical or fundamental analysis or a combination of both.

How to Trade Forex Successfully – Technical Analysis Explained

Traders use technical and fundamental analysis to form an opinion about a market. Technical analysis refers to building a forecast or a market scenario only considering historical charts.

Nowadays, all forex brokers offer at least one trading platform to log in and trade the market. All currency pairs have charts that show the previous price action on various timeframes, starting from one to five minutes, all the way up to a monthly timeframe.

Technical analysis deals with interpreting the charts to build a forecast, or to base an educated guess on future price action. More precisely, traders use information from the past to predict the future.

It may sound to many like wizardry, but it isn’t. Technical concepts have stood the test of time, and many of them have existed for over hundreds of years. The idea is not to forecast all future price action, but the next stage in the market. Depending on the volume traded, it is enough to speculate on the largest market in the world successfully.

Technical analysis evolved from basic trend following to complicated theories and indicators. Nowadays, traders use sophisticated oscillators to interpret the market, as well as trading theories like Elliott Waves, Drummond, Gann, as well as tools like Fibonacci ratios or Andrews’ Pitchfork to name a few.

It is recommended that first time traders try a demo version free of risk before applying monies to a live trading account. A demo account is similar to a live one in every way apart from monies being invested and traders get the chance to sample the technical indicators, apply all trading theories and check the broker’s platforms and other options.

Scalpers tend to use technical analysis, although some trade economic announcements. More precisely, scalpers use oscillators and trend indicators on much smaller timeframes to profit from as many market moves as possible. Swing traders who use technical analysis tend to favor trading theories like Elliott Wave Theory or more macro-fundamental themes. They may also apply oscillators on timeframes such as the 4-hour or daily and patiently wait for a trade’s outcome. Rarely do scalpers or swing traders use fundamental analysis alone. First-time traders in forex will favour ‘news trading’ as technical analysis can be complicated to understand initially.

Forex Trading For Beginners – A Fundamental Analysis Approach

News trading is a form of fundamental analysis. Any currency trading for dummies guide will encourage people to use news trading. Why? The answer is straightforward: the market tend to move more significantly on the release of important news.

We have already noted in this article that one way to trade a currency pair is to compare the economies of the two relevant currencies. Using the same metrics (economic data), traders can form an opinion about which economy performs better than the other. Consequently, a fundamental trade can be based on this bias.

Fundamental analysis, therefore, deals with interpreting economic news, though not exclusively. It refers to everything that falls outside of technical analysis. Natural phenomena, geopolitics, political speeches and central banks decisions all form part of the fundamental analysis which can change a macroeconomic outlook.

Investors usually focus on the fundamental approach to speculate (trade) and use technical analysis to reinforce their decisions. It is said that a good trade needs both fundamental and technical analysis, though the truth is that it depends very much on one’s trading style.

Forex Trading Platforms for the Retail Market

Retail traders favor the MT4 or MetaTrader4 platform. The reason is that most brokers offer this as a cheaper alternative to building one in-house. The MT4 is a remarkable platform. It has everything a trader could want for from both a technical and fundamental aspect. If there is an indicator that the MT4 does not offer within the default settings, traders can easily import it. Nowadays all brokers have a mobile and web version too, so trading on-the-go is also possible and convenient.

How to Choose Best Brokers for Your Forex Trading

Every day more and more people are getting connected to the Internet for the first time. It means that the potential market for brokers looking for retail traders increases by the day. Brokers earn a fee or commission for intermediating access to the interbank market. There is stiff competition among brokers and traders have to consider what makes a good forex broker for their specific needs.

In the quest to choose the best broker, traders must start from a regulatory standpoint. Regulated brokers cannot act on their own as they need to follow rules and guidelines set by the regulator. Regulation comes with responsibilities. Regulated brokers protect their clients’ interest and offer greater confidence than unregulated firms.

Funds segregation in a custodial bank is a must. This ensures a broker cannot use funds to pay other traders’ withdrawals, thus avoiding malpractices such as a Ponzi scheme. The type of brokerage house is also important. Look to avoid market-makers and opt for ECN (Electronic Communication Network) or STP (Straight Through Processing) brokers. Market-makers can trade against their traders’ positions, creating a conflict of interest. As such, there is the potential inclination to ‘use’ customers for their personal gain.

Finally, the type of trading accounts and markets offered are a major consideration. Nowadays, a forex broker does not just provide access to the currency market, but also to commodities, bonds, options, equities, and other asset classes. The more markets offered, the better.

Start with the Basics

This article was aimed at being a basic tutorial explaining currency trading for dummies. Terminology may sound unfamiliar, but it is a learning process. Every trader starts somewhere, and this is the right place for forex first-time traders to learn what the forex market is about. From here on, curiosity and a desire to learn will make you a successful trader. Are you ready for the journey of a lifetime?