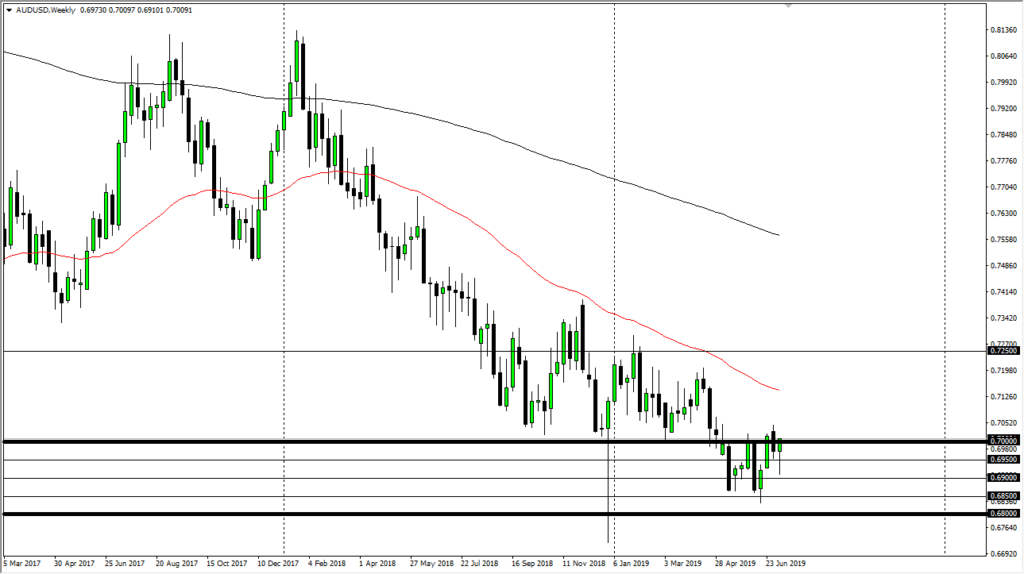

Australian dollar bounces for the week

The Australian dollar fell initially during the trading week but has turned around to show signs of life again. The weekly close is a hammer, and that of course is a very bullish sign. The fact that we are breaking above the 0.70 level, it looks likely to continue to add upward pressure to this market. Ultimately, if we can break above the candle stick of the previous candle stick, then we could go looking towards the 50 day EMA.

Hammer

AUD/USD Weekly Chart

The candlestick is of course a very bullish sign, so it’s very unlikely that sellers will take over again. Keep in the back of your mind that the market is trying to form some type of bottom, and of course we have the Federal Reserve looking to cut interest rates. That will of course be very influential on the US dollar, and by extension half of this market.

Perhaps people are looking at the US/China trade relations with some sense of hope, but at this point it seems to be very unlikely that any significant long-term change has come about. I think at this point people are simply looking more at the Federal Reserve but if we can get good news out of the US/China situation, that could send this market much higher.

Australia and its attachment to China

Australia of course has a special place among commodity currencies, precisely because it is so highly levered to the Chinese economy. With that being the case, it’s very likely that any good news should send this market straight through the roof. I would buy short-term pullbacks, as the longer-term charts are showing signs of bottoming. The 0.68 level has been historically important, and the fact that we have started to tilt upwards is a promising sign.

That doesn’t mean that this is going to be an easy move, but it certainly looks as if the buyers are starting to make their presence known. The 0.7250 level above is a significant target, and that’s where I think the market will eventually go once it gets a little bit of momentum.

The play going forward

The market certainly looks very bullish, so think it’s only a matter time before we get buyers on these dips and I do think that we are trying to build up enough momentum to finally turn things around. Granted, this is going to be very noisy turn of events but I think it’s also going to be what could be a nice set up for a longer-term play. The Australian dollar of course is highly sensitive to gold as well, and gold is starting to get a bit of a boost at the same time. Ultimately, this means that the Australian dollar could win under the idea of gold rallying significantly, but at the same time could rally due to the US/China trade relations working out, and gold falling in a “risk on” move. In other words, this could be a win-win situation.