British Pound Dives Against New Zealand Dollar in View of Brexit Backdrop

- Boris Johnson wants comprehensive deal with EU

- NZD affected by coronavirus concerns

- Asian currencies rebound slightly

The British pound has been hit relatively hard during the trading session on Monday to kick off the week, showing signs of pulling back from a major resistance barrier against the New Zealand dollar.

However, the market has seen the British pound get hammered against several currencies to begin with, so losing ground against the New Zealand dollar should not be much of a surprise.

Brexit concerns on EU agreement

As if Brexit hasn’t been in the headlines long enough, now there are fresh concerns about whether or not the British and the Europeans can come together to form some type of agreement. The comments made by Boris Johnson on Monday suggest he wasn’t willing to settle with the EU on anything along the lines of a partial deal. Rather, he was looking for a comprehensive deal like Canada has.

This brings fears that perhaps the UK and the EU will have to default to the WTO agreement that both have signed, which could have issues when it comes to adding tariffs.

As usual, comments will continue to move the British pound back and forth, but it should be noted that it was a little overbought to begin with.

Coronavirus impacting the New Zealand dollar

While most will not make the immediate connection, the New Zealand dollar is highly sensitive to the Chinese economy and will therefore be moved by the concerns around the coronavirus.

However, the fear that has been in the financial markets may have been overdone. So, to kick off the week, there has been a rebound after the initial sell-off in Shanghai.

If Asia is to recover, the New Zealand dollar will by default do the same, as a majority of New Zealand exports go into that region. The technical analysis in this pair doesn’t indicate this will last very long.

GBP/USD pair looking bullish

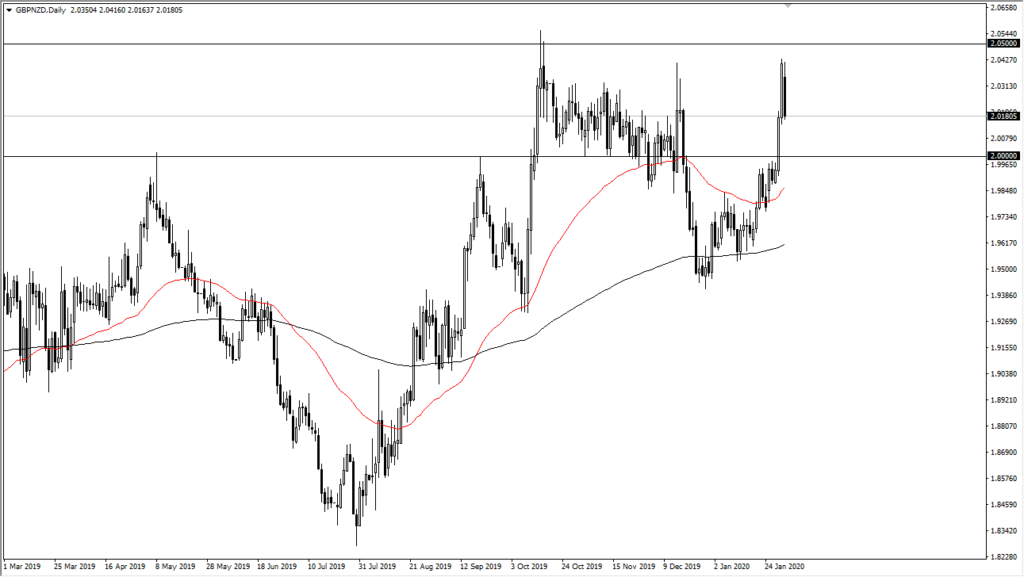

GBP/NZD 6-monthly chart

The technical analysis for this pair is still very bullish. The pullback suggests that the 2.05 level will continue to offer resistance, but not necessarily that the pair can’t go any higher. After all, the 2.05 level has offered significant support and resistance over the years, just as the 2.00 level has been. The market is essentially stuck between the two levels, with the 50-day EMA turning higher, and quite sharply so.

While there are concerns about Brexit headlines, the reality is that the United Kingdom is far beyond the worst of the situation, while Asia and the Pacific are just starting out with the reality of a massive contagion. Because of this, the uptrend should remain intact with an eye towards both of these levels for direction.