British Pound Pulls Back Against Japanese Yen

- 200-day EMA in focus

- Brexit continues to cause twists

- US/China trade talks go nowhere

The British pound against the Japanese yen is considered to be a risk barometer for the forex markets. As a general rule, as people are a little bit more optimistic, they tend to buy this pair, just as in times of negativity they tend to sell it. It isn’t so much about the British pound, and more about the Japanese yen, which is considered to be the “safest currency” out there. Because of this, as we encounter geopolitical issues, sometimes this pair can take quite a bashing.

Brexit

For the last three years, Brexit has held the British pound hostage. There are a significant amount of headlines that continue to throw this currency around. In a less liquid pair like GBP/JPY, this is going to be especially true. Ultimately, as money flows into the Japanese yen, it will have an influence on this pair. However, Brexit has put the focus on the British pound itself. As headlines come out, we continue to see the market move back and forth.

Recently, there have been some positive comments coming out of both the Irish Prime Minister and UK Prime Minister Boris Johnson. With that, it’s very likely that the market will continue to be noisy and hopeful. This is what the last couple of sessions have been about, but now that we are facing technical resistance, we will get more answers.

Technical analysis

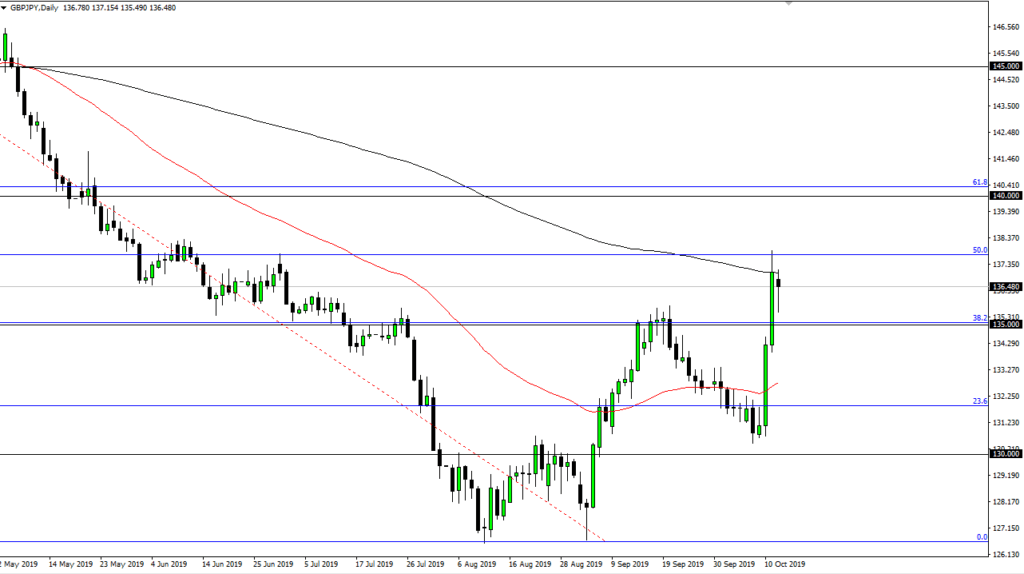

GBP/JPY chart

The technical analysis in this market is relatively simple at the moment, as we are testing the 200-day EMA. With that, it’s obvious that the market cannot break above there right away, as we have pulled back significantly during the trading session on Monday. However, the buyers have come back in, so the candlestick for the trading session on Monday can be used as a bit of a proxy.

The break down below the bottom of this candlestick makes it a “hanging man”, which is a very negative candlestick. This could open the door to breaking through the ¥135 level and dropping down towards the 50-day EMA, which is currently near the ¥133 level. On the other hand, a break above the top of the candlestick and the 200-day EMA would open up the possibility of a run to the ¥140 level.

Keep in mind that the occasional headline will throw this market into complete disarray, so it’s almost impossible to trade with any significant size right now.

Beyond that, it’s almost impossible to trade with confidence in view of the next random headlines. Small-position sizing is the best thing a trader opt for right now to protect their account. That being said, we are a bit overdone over the last couple of days.