British Pound to Continue Falling

- British pound continues consolidation in a downtrend

- 2250 continues to attract orders

- 50 day moving average just above

The British pound has found a little bit of support during the trading session early on Thursday, but we are still in a major consolidation area, at a major level. Typically, consolidation means continuation of the overall trend. This doesn’t mean that we can’t rally from here, but there are several reasons to think that the British pound is going to continue falling.

Plenty of fundamental issues

The very fact that the British Parliament has been suspended until after the deadline to leave the European Union suggests that a no-deal Brexit is much more likely. With that being the case, the market will have a sudden flush lower in reaction to the realization, but then there will come a day where things stabilize. That will be the absolute worst of the downtrend, and then longer-term value hunters will come back in to start buying.

Ultimately, this is a market that will be a longer-term career-making “buy-and-hold” situation. That being the case, though, you also need to realize that we are quite some time from there. As things stand right now, the Bank of England is nowhere near tightening monetary policy, so there’s no reason to think that the British pound should rally for the longer term, with the exception of the occasional “relief rally”. That would be a perfect way to explain the bounce from the 1.20 GBP level.

Technical analysis

GBP/USD daily chart

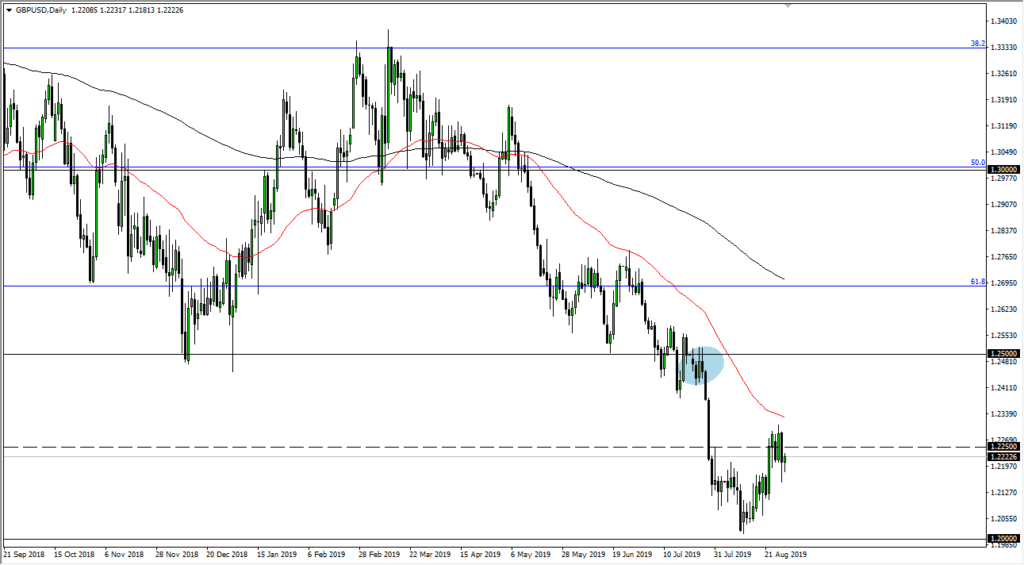

The technical analysis for this pair is still negative even though we have had a run higher as of late. Yes, we have bounced from the 1.20 GBP level, but quite frankly that is a large, round, psychologically significant figure which should attract a lot of attention.

Now that we are hovering around the 1.2250 GBP level, we are essentially in “no man’s land” when it comes to the larger levels. This pair tends to move in 500 pip increments, meaning that at the 1.25 level there is going to be massive resistance. At this point, it seems very unlikely that we would break above that level. In the meantime, this is a consolidation area that will go back and forth and perhaps show quite a bit of choppiness.

As we head into the long weekend, with the Americans being on holiday on Monday, this could add to a little bit of illiquidity at times. This means that most traders probably won’t be in a hurry to put a lot of money to work. At this point, the other thing that should be paid attention to is the 50 day EMA, which attracts a lot of longer-term traders. It should offer significant resistance. Selling rallies continue to work, although the moves may be relatively small as we are at the end of the summertime, and most traders are still away on holiday.

The 1.20 GBP level underneath should continue to be attractive for short sellers, and the fact that we have bounced from there simply means that there was a lack of momentum. It’s hard to believe that the market won’t attempt to get back down there yet again. Certainly, headlines will come out validating that idea.