Crude Oil Gaining Traction on OPEC and Trade Optimism

- Speculation on OPEC cutting production

- China claims “constructive phone call” over the weekend

- Expected demand pick up in this environment

- Conflicting forces still an issue

During the weekend, the conversation between the Vice Premier of China and Treasury Secretary Stephen Mnuchin via phone call was labeled by the Chinese as “constructive”. The fact that the Chinese have come out and stated this is interesting and highly credible, as they have been much more reserved about touting success than the Americans.

As a result, there are traders on Monday suggesting that perhaps crude oil will continue to go higher due to increased demand. The demand will pick up if there is an avoidance of the global trade war, which would have a significant negative effect on transportation and demand for crude oil in general.

OPEC meeting

During the month of December, OPEC will have a meeting in Vienna to determine what the next course of action is. There have been rumblings about a potential production cut, which could bring down the supply of crude oil globally. This is one of the few things that will help in a situation where there is an oversupply, and there is most certainly an oil glut.

In fact, tanker companies are complaining that we are starting to see full tankers docked and simply waiting for better pricing to come to port. This is a scenario that has been observed before, and it does not work out well for crude oil.

Because of this and the fact that the Americans continue to pump out more crude oil every month, it is fair to surmise that OPEC is seriously thinking about cutting production in the relatively near future. There have been talks that this may occur in December, so paying attention to what OPEC is going to do during the meeting will be paramount.

Conflicting issues still out there

There are still plenty of conflicting issues, not the least of which is the question of whether or not the global economy is picking up or slowing down.

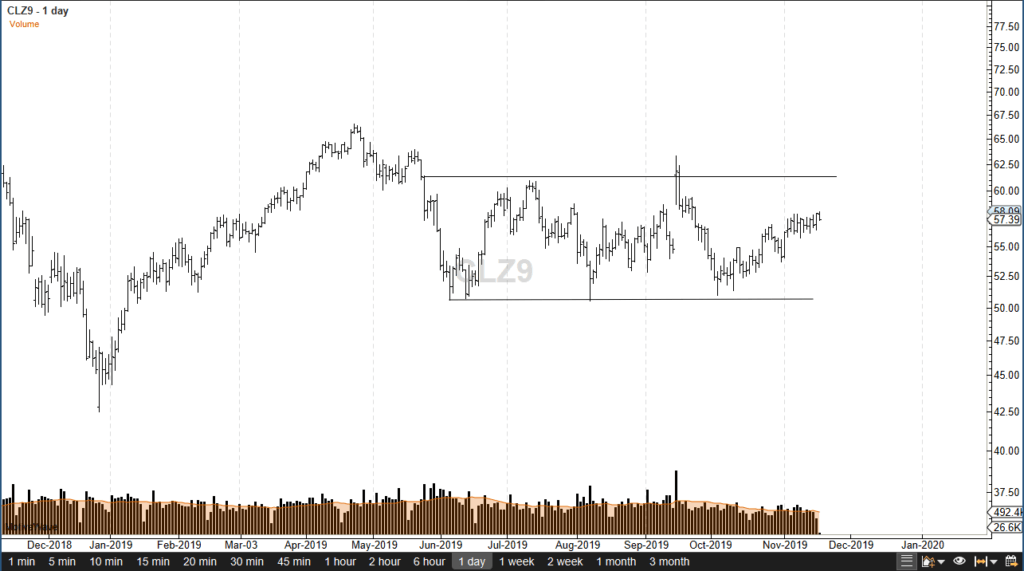

Crude Oil futures December contract

Currently, the West Texas Intermediate Crude Oil market has been consolidating. Recently there has been more of an uptrend, but we have not broken above the crucial $60 per barrel level.

A break down below there could be rather negative for the market. Ultimately, this is a market that will be an excellent barometer as to where the global economy will go in general. Even if you are not a crude oil trader, paying attention to this market and the two barriers to see whether or not it’s more of a “risk-on” or a “risk-off” type of environment is advisable.