Crude Oil Inventories Show Continued Concerns

- Crude Oil Inventories miss yet again

- OPEC production cuts a desperate move

- Global demand continues to slow

During Wednesday’s session, the Energy Information Administration in the United States released the Crude Oil Inventories figures for the last week. The number is inverse, meaning that the more negative the number, the better off crude oil will be as it shows increasing demand as inventory shrinks, so does supply goes the theory.

Inventory announcement

The Energy Information Administration released the Crude Oil Inventories figure for the week, with a drawdown of 1.1 million barrels. This was much less than the anticipated 1.5 million barrels to be removed from inventory.

This shows that we are still struggling to build up demand for crude oil in the United States, and as the United States is one of the better performing economies around the world, this is not a good look. Beyond that, it shows just how much of a difference the United States has made as far as supply is concerned. Fracking continues to be a thorn in the side of OPEC countries.

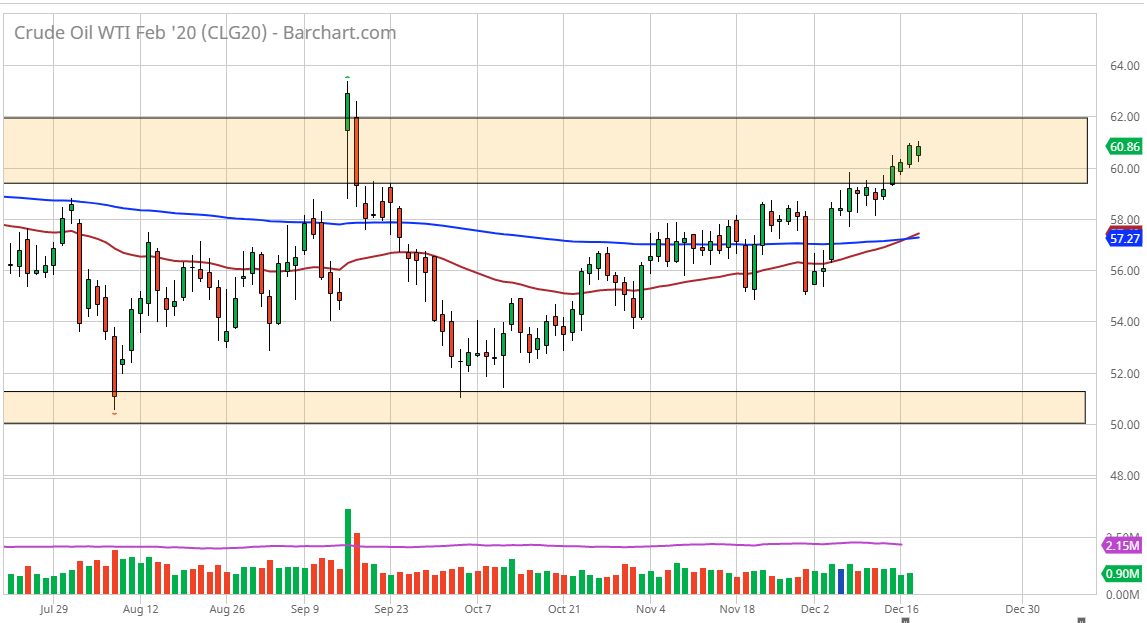

The previous week was a build of 800,000 barrels, which only makes things worse. Demand simply isn’t there and it seems as if things might be getting a little bit worse in general. That being the case, the market is likely to continue to be a bit leery of a potential break out. It appears that we are going to continue to see crude oil range bound, unless something changes going forward.

Sluggish market

While the crude oil markets have been somewhat positive as of late, the fundamentals are still a mixed picture at best. Yes, the US/China trade negotiations have produced the idea of a “Phase 1 deal”, but those details are still foggy. OPEC has produced a production cut, but at this point they are only somewhat influential, and certainly not as much as they used to be. The United States continues to pump out oil hand over fist, and that will continue to be a major problem.

Looking at the overall picture for crude oil, it’s going to come down to a global demand situation. Plus, the fact that the Americans still aren’t necessarily knocking it out of the park when it comes to demand does not bode well. However, if the crude oil market in the West Texas Intermediate grade broke above the $62.50 per barrel level, then it may show that there is going to be more demand going forward.

WTI Crude Oil