Crude oil markets show resiliency

Crude oil markets initially broke down during the trading session on Monday, mainly in response to Donald Trump threatening the Chinese with more tariffs, and the Chinese retaliating by suggesting they were going to be bothered with the meeting next week to deal with trade negotiations. There was a general “risk off” type of attitude in Asia. This was especially exacerbated by Japan not being at work. With that being the case, liquidity was a major issue and may have caused more trouble than necessary.

Hanging on

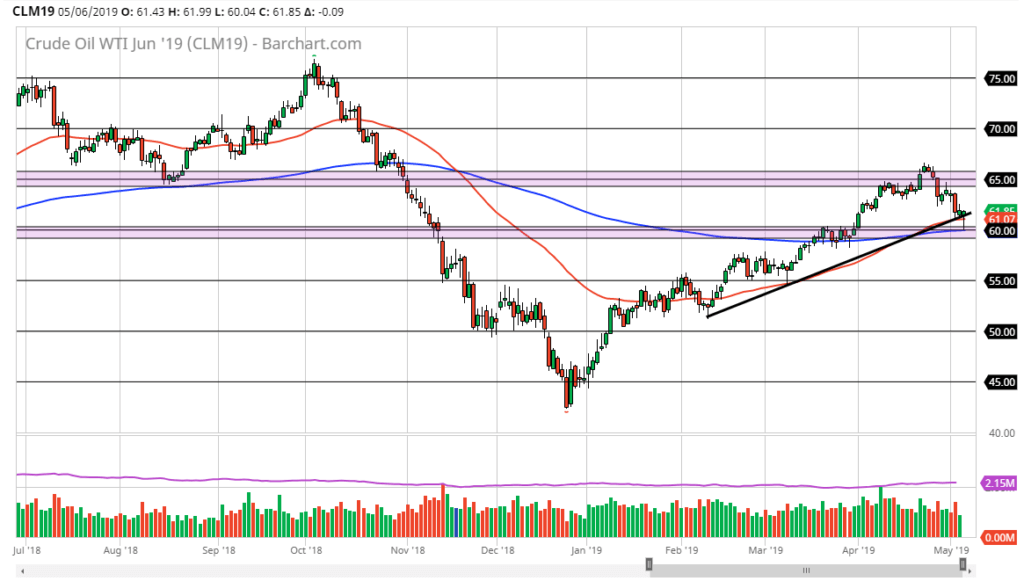

It looks as if the market is trying to hang on, as we had fallen rather hard to kick the week off, but found enough support near the 200 day EMA, pictured in blue on the chart, and of course the $60 level which is also the psychologically important. While we had broken through the trend line, which of course is a very negative sign, it’s obvious that the buyers came back into the market to lift this market back up. By the time we started to head towards the end of the open pit session, we ended up forming a bit of a hammer. The hammer of course is a very bullish sign, and therefore it looks like the buyers have made their statement.

Major support underneath

WTI Crude Oil daily

While we do have a major support underneath, especially near the $60 handle, if we were to break down below there this market could unwind rather drastically. I would anticipate that a move below the $59 level could blow out a lot of stop losses, and that could bring in more selling pressure going forward. That could unwind this market down to the $55 level, but after the action during the day on Monday, it looks very likely that the buyers will hold the line.

Potential targets

There are several potential targets above, but quite frankly it looks very likely that we are going to go to the $64 level, and then possibly even the $65 level. I do believe that the $65 level is going to be extreme resistance though, so it’s difficult to imagine a situation where we can break out of. At this point, we are still very much in and uptrend so it’s likely that we could get to that area but obviously we are going to need some type of catalyst to get above there. If we can make a fresh, new high, then we could be looking at a move all the way to the $70 level next. In the short run though, it’s difficult to imagine a scenario where we simply slice through that resistance.

The potential play

At this point, it looks like buying short-term pullbacks probably continues to be an opportunity to pick up a bit of value, and perhaps make a few dollars. All things being equal though, expect a lot of volatility and choppiness going forward as the market tries to figure out where wants to go next. In this environment, position sizing will be crucial as well so keep it small.