Ethereum Forming Massive Bottoming Pattern

- Ethereum forming potential “rounded bottom”

- The cryptocurrency has crossed the 50-day EMA

- The coin’s value rises above $200

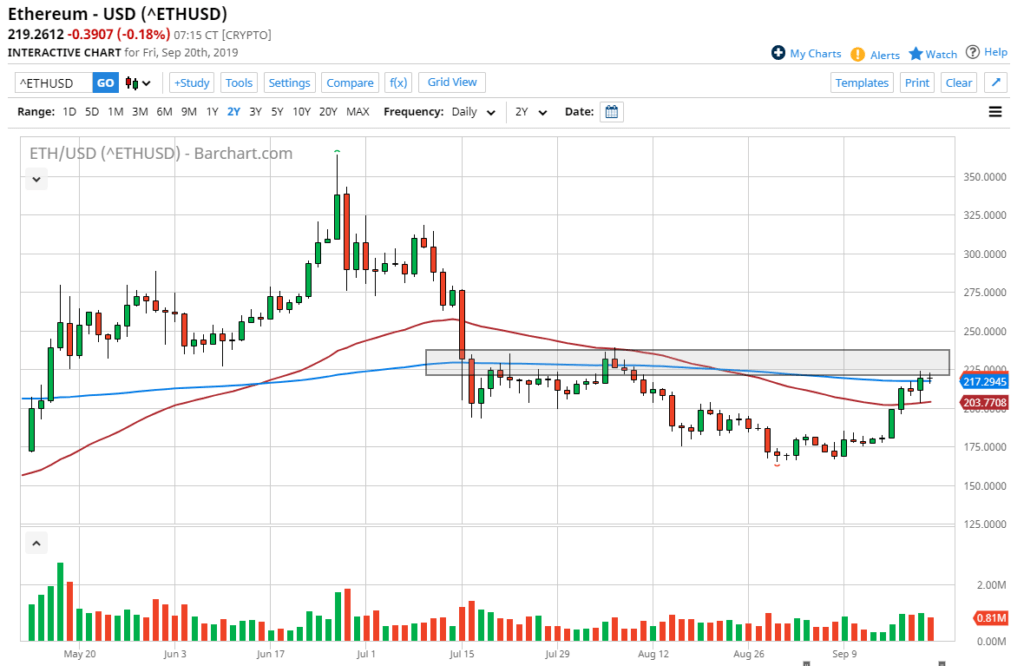

Ethereum markets have rallied over the last couple of weeks to form what is starting to look very much like a “rounded bottom” support pattern. This is quite often found at the end of a downtrend, and can signify that the next leg higher is getting ready to start. If that is the case, it is important to be watching the level just above, as it is essentially the top of the pattern. In other words, we may be on the cusp of a large technical breakout.

Ethereum daily chart

Measured move

When a market forms a large “rounded bottom”, it suggests that there has been a slow and gradual turnaround in the selling pressure. In other words, people have been buying the market slowly and deliberately, indicating real demand. Currently, the Ethereum market looks as if it has the top of this pattern roughly at the $230 level, with a bottom closer to the $170 level. Based on measured moves, this suggests that a breakout could send this market towards the $290 level, possibly even as high as $300. Rounded bottom patterns don’t happen every day, so they do tend to attract a lot of attention.

Other technical factors

Other technical factors that have occurred in the market include Ethereum prices closing above the 50-day EMA, pictured in red, for the last several days. The market has also crossed the 200-day EMA, which, by its very definition, means we could be in an uptrend. Quite often, longer-term traders will use the 200-day EMA to determine the larger overall trend. Because of this, certain algorithms and systems will jump into the marketplace and start buying.

The market has also crossed above the psychologically significant $200 level, so that will attract a certain amount of attention by itself. With that and the moving averages starting to curl higher, there are plenty of traders out there looking to buy Ethereum as things stand.

Continued run from fiat currency

Central banks around the world continue to cut interest rates, which should work against the value of fiat currency in general. As long as that’s the case, cryptos should continue to attract a certain amount of order flow, as it is one of the favorite ways for traders to get away from Central Bank meddling. The interest rate cuts work against the value of fiat currency, and with the Federal Reserve jumping into the fray, the last stalwart of hawkish financial policy has fallen by the wayside. That should be good for all cryptos, Ethereum included.

While the last couple of years have been lackluster for cryptocurrency, we could be seeing the beginning of an overall move higher with most of these markets. This will include not only Bitcoin, but several of the alternative coins as well.