Euro bouncing against Yen on Thursday

As we discussed the EUR/USD pair earlier on Thursday, now looking at the EUR/JPY pair, we can see that there is plenty of support for the Euro overall. This is the best situation to be in, when a currency does the same thing across the market. With that being the case, sometimes the stars align and you can take advantage of them.

EUR/JPY

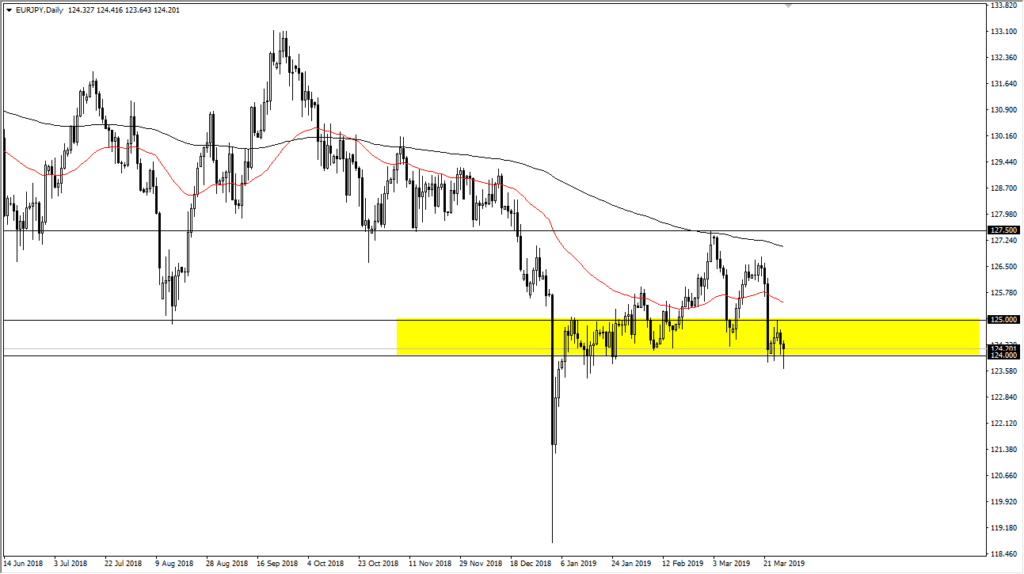

The EUR/JPY pair broke down initially during the trading session on Thursday but has seen plenty of support just below the ¥124 level. By bouncing the way we have, it looks as if we are forming a bit of a hammer. At this point, it’s likely that the buyers will continue to try to defend this area, and the fact that the EUR/USD pair is trying to hang on to the 1.12 level tells us that the market is starting to change its overall attitude. It will be quite interesting to see how the next couple of days play out.

EUR/JPY

Potential trades

At this point, you should be leery about over trading the Euro, but it does look like we are starting to set up some type of bigger move. As the markets all align in the same direction, it’s likely that the trades will come flying in from all directions. If the Euro rallies on both of these charts, it’s likely that you will need to pick one or the other, because the problem with over leveraging the situation. After all, if you decide to start buying the Euro and both of these charts rollover, then you will take double the losses. However, when you look at these charts, it gives you an idea as to the overall direction of the underlying currency.

Risk appetite

Keep in mind that the EUR/JPY pair has a certain amount of risk appetite built into it, and as risk appetite grows, this pair will rally as the Japanese yen is a safety currency. In other words, you can pay attention to stock markets and the like to see whether or not risk appetite is rising or falling. If it’s rising, then this pair will tend to rise right along with it. The question now is whether or not the risk appetite will be strong enough to break above the ¥125 level. If it does, then that’s a very good sign.

However, if stock markets were to start falling and there is more of a risk off attitude around the world, we will probably see a break below the candle stick for the trading session on Thursday, opening up the door to much lower prices. If that were to happen, this market could drop all the way down to the ¥121 level. However, keep in mind that the EUR/USD pair would almost have to break down below the 1.12 level significantly for that to happen as the Euro would be falling apart at that point.

In conclusion

In conclusion, this is a chart that is well worth paying attention to whether you are trading the EUR/JPY pair, or perhaps even the EUR/USD pair that we had discussed earlier. Currencies tend to work on a relative strength scenario, so paying attention to the relative strength will give you the right trading either one of the markets we have discussed today. That being said, if we drop from here in the Euro overall, it should be pointed out that the EUR/JPY pair has quite a bit of room to run to the downside in comparison to the EUR/USD, or at least would have a much more clear path lower. On the other hand, the EUR/USD pair has an easier time going higher based upon structure so pay attention to the Euro and choose accordingly.