Euro Continues to Consolidate Against Franc

- Euro pressing resistance of consolidation

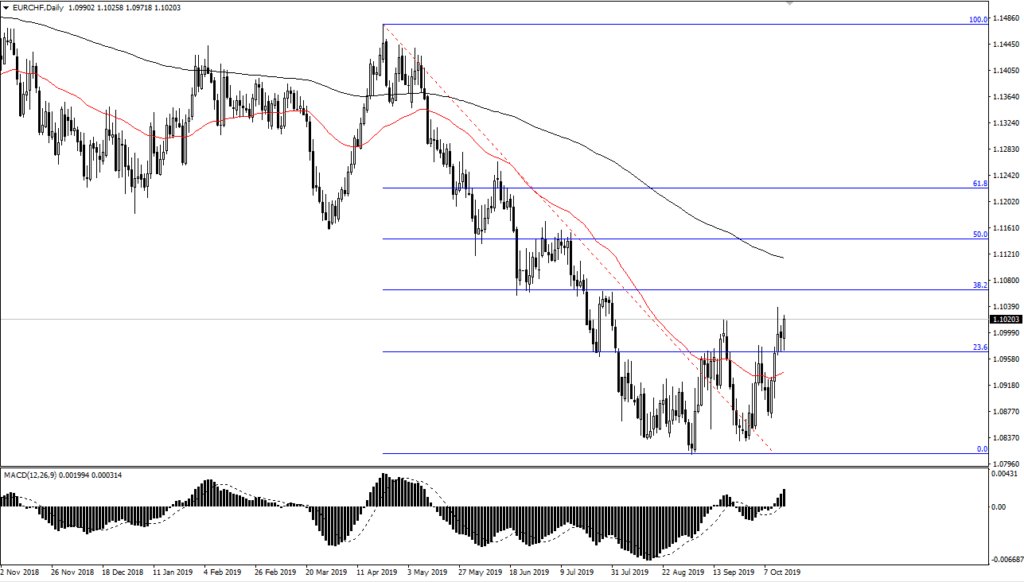

- 200-day EMA above

- 50-day EMA below

The euro continues to be volatile as we are dealing with Brexit. That is causing quite a bit of a ripple through the markets, as we try to figure out where the European Union will fall after losing its second-largest economy. Beyond that, there is also the concern of an EU recession, which works against the value of the currency. However, in the EUR/CHF pair, things are a bit different in the sense that Switzerland sends 85% of its exports into the EU. That means there is a bit of back and forth when it comes to where this pair can go.

If the pair rallies, it is essentially seen as a sign of “risk-on”, but it’s very likely to continue to see a lot of back and forth. That being said, the Tuesday session is a bit bullish, so that should be paid attention to. Currently, the 1.1050 level looks to be resistive. If we can break above that level, then the market will more than likely continue to go much higher, as it would be a breakout of the recent consolidation we have been in. At this point, we are essentially trying to figure out if this recent consolidation is accumulation, or if it’s just simply a pause in the downtrend.

Technical analysis

EUR/CHF chart

The technical analysis in this market is a bit conflicting. The 200-day EMA above offers significant resistance for longer-term traders, but at the same time, there is a significant amount of upward pressure based on the red 50-day EMA, which is turning higher. Beyond that, the 23.6% Fibonacci retracement level being overtaken is a very short-term bullish sign.

The 1.1050 level mentioned previously is important from not only a large, round, psychologically significant standpoint, but also due to the fact that the level is right about where the 38.2% Fibonacci retracement level is. If that gets broken, the 200-day EMA will not only be attacked, but it will probably be broken as well.

A lot of what moves this pair is going to be momentum-based, and it certainly looks as if there is a serious attempt to turn things around and shoot to the upside. If that happens, this move could be rather quick and significant, especially if there is some type of Brexit deal, as it will relieve a lot of pressure that’s on the European Union.

Meanwhile, the Swiss continue to offer negative interest rates and are looking very likely to continue down that path, causing investors to run away from the franc and, of course, all assets based in Switzerland. That being said, a break down below the 1.0950 level could send this market a bit lower.