Euro in Downtrend as It Acknowledges Lower Level

- Euro bounces slightly at major figure

- Currency still in major downtrend

- Markets awaiting the Federal Reserve

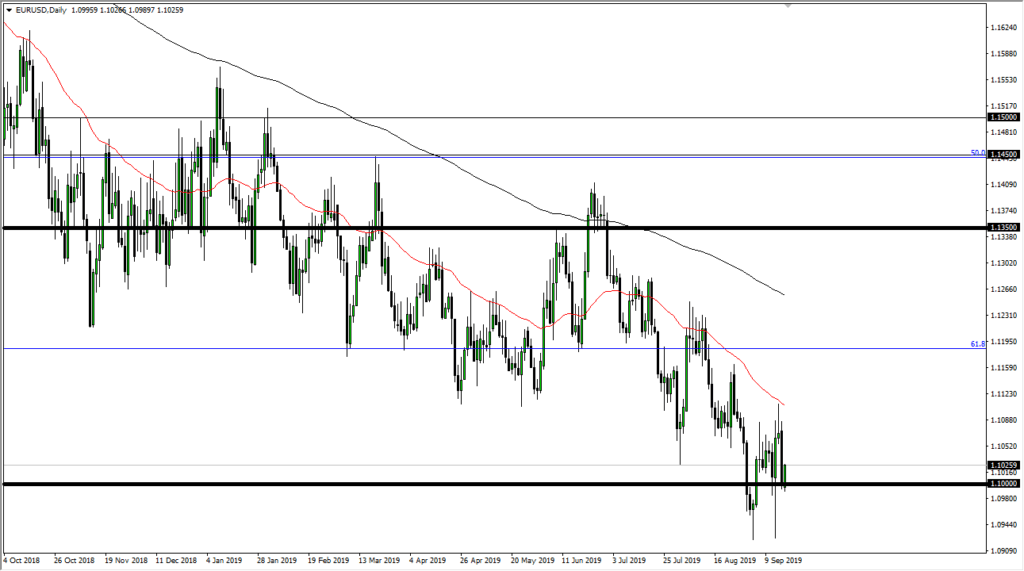

The euro fell towards the 1.10 EUR level early during trading on Tuesday, but it has bounced a bit from that in acknowledgment of the large, psychologically significant figure. The 1.10 EUR level has been important more than once, but it should also be noted that the market has in fact sliced through it a couple of times. With that in mind, it’s not so impossible to consider that the market will go further to the downside.

Major downtrend

EUR/USD Fibonacci chart

The EUR/USD pair has been in a major downtrend for some time, as seen by the 50-day EMA above the latest high and the 200-day EMA sloping lower above. While the market has been very choppy, it has been consistently driving lower over time. This has been the case for several years now, and any rally has been a nice selling opportunity given enough time. However, patience will be needed if you are looking to sell this currency pair.

Federal Reserve Decision Upcoming

The Federal Reserve has an interest rate decision coming out on Wednesday, so that will have a major influence on what happens next in this pair. An overly dovish Federal Reserve could give the market a bit of a bounce. However, if they are not dovish enough, that could send this pair to the downside, as it would signify that perhaps the Federal Reserve will still be “behind the curve” when it comes to chasing the market expectation of liquidity. Keep in mind that the European Central Bank is dealing with the idea of Germany going into a potential recession, with Italy already being there. That continues to weigh upon the euro, so now the short-term focus will be on what the Americans are going to do next.

The future for this market

The setup in this market continues to be a “fade the rallies” type of situation. Every time the euro has rallied over the last couple of years, the market has sold it right back off. It’s going to take something rather intrusive by the central banks to flip the trend, which seems very unlikely to happen. Ultimately, if this market does rally significantly, it may just be prolonging a downturn.

The 50-day EMA, which is the moving average painted in red, is the initial barrier that people will have to overcome if they wish to change the trend. After that, the 1.12 level comes into play.

The longer-term outlook for the pair tends to suggest that the move could go down towards the 1.05 EUR level, as the trend is well below the 61.8% Fibonacci retracement level. Quite often, the trade ends up going down to the 100% Fibonacci retracement level. With that in mind, from a technical-analysis standpoint, the downtrend should continue.

It will take something rather significant from the Federal Reserve to change the overall trend. This doesn’t mean that the short-term markets will bounce, but that should be a nice selling opportunity.