Euro makes a statement on Friday

The Euro broke higher during the trading session on Friday in early trading, as Jerome Powell has stated that interest rates were “about where they need to be.” This suggests that the Federal Reserve most certainly will be raising rates this year, but quite frankly a lot of that may have been priced into the market already, but this is the first real attempt at clarifying and confirming the position. In a sense, the Federal Reserve has now just given the marketplace exactly what it wants.

Greenback weakness

There should be a bit of greenback weakness due to this statement, and of course with the US dollar being one of the strongest currencies over the last couple of years, it may have some room to go. The first place that people will sell the US dollar is in the EUR/USD pair as it is the largest market in the world. If the US dollar is going to lose value, it almost always does against the Euro in the end.

That being said, the Euro isn’t necessarily going to be strong, but it does need to be repriced. The ECB recently has suggested that it’s going to continue to be very soft when it comes to monetary policy, but with the Federal Reserve becoming softer by the day, the oversold condition of the Euro becomes quite apparent. That being said, there are a lot of economic concerns in the European Union which of course don’t help the situation.

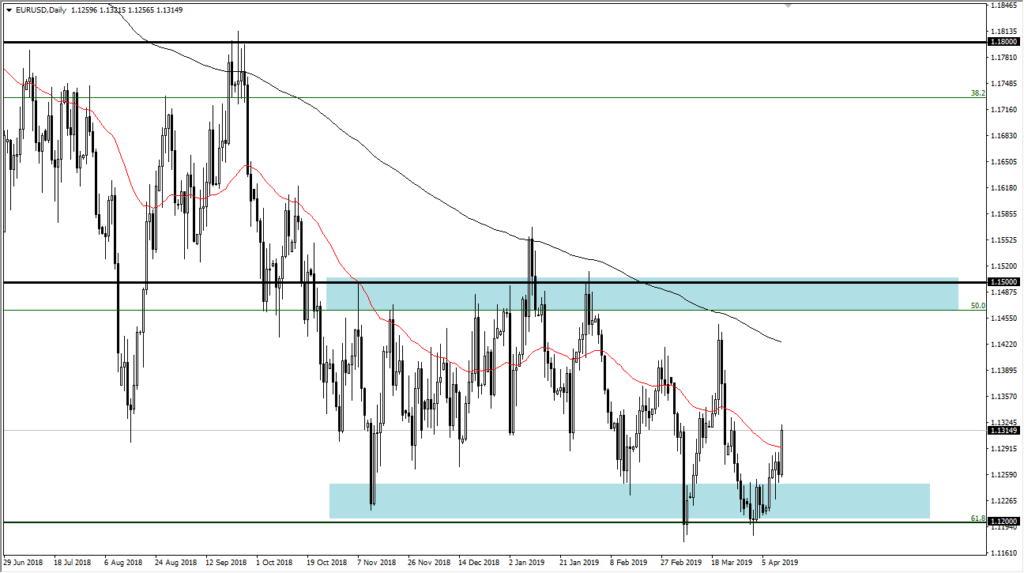

EUR/USD daily

The range continues

Quite frankly, we been in a range for some time, with the 1.12 level underneath being massive support, while the 1.15 level above is massive resistance. We have been banging around in this area for quite a while and there’s nothing on this chart that suggests that’s going to change in the short term. With that in mind, it’s very likely that we will go looking towards the top of the range as we have been meandering around the bottom and have now seen an explosive move to the upside. This is just more of the same, but in a 300 pip area.

50 day EMA

The 50 day EMA has been crossed quite convincingly early during the session, and as a result this should bring in fresh buying as well. There is a bit of resistance near the 1.1325 handle, but it is minor at best and it looks as if it will probably give way. That’s not to say there can’t be a pullback, and quite frankly a pullback could be a nice buying opportunity as well. After all, the Wednesday candle stick was a nice hammer and it should now offer plenty of support near the 1.1250 level. There should be enough order flow underneath that level to keep the market somewhat afloat.

The main take away

The main take away of this market is that we are probably going to continue to do what we been doing for quite some time. The action early Friday tends to confirm this, so therefore traders will be looking for value in the Euro on dips to take advantage of. Keep in mind that it may take quite a while to get towards the top of the range, so of course patients will be needed to take advantage of any set up.