Euro to Continue Grinding Lower

- Euro shows lackluster rally on Friday

- Shooting star on Thursday

- Psychological bounce running out of steam already

- 50-day EMA offers massive resistance

The Euro has rallied a bit during the trading session on Friday, after initially pulling back. This was probably more due to the job numbers missing in the United States, rather than anything else. Longer-term issues will continue to plague the Euro, and it certainly looks as if the overall trend should continue going forward. The trend has been relatively reliable, albeit choppy to the downside.

50-day EMA and lackluster rally

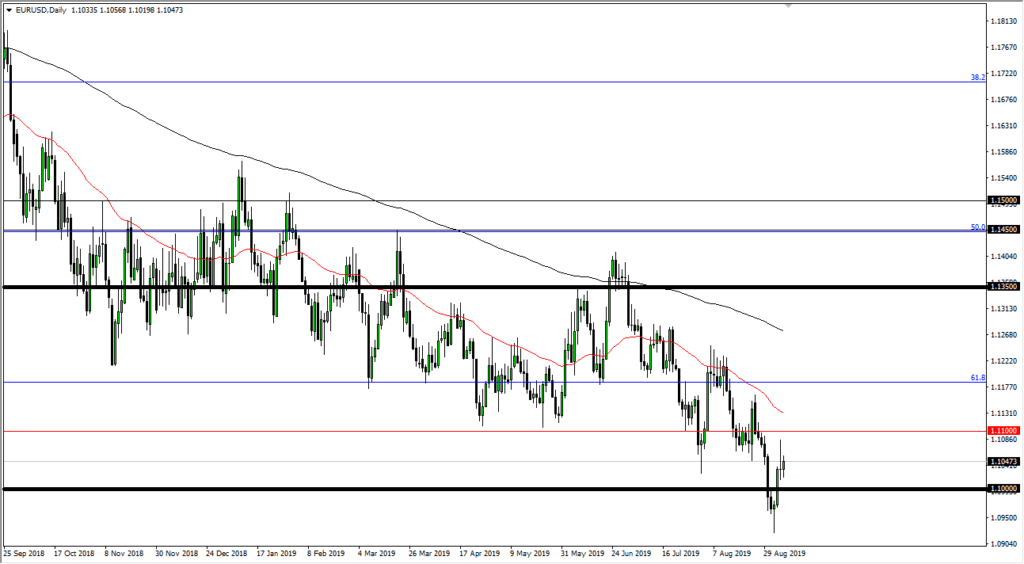

EUR/USD daily chart

While we did get a bit of a rally during the trading session on Friday, after the US jobs number came out slightly under expectation, the reality is that this pair continues to favor the US dollar for quite a few different reasons. When you look at the rally during the trading session on Friday, it is a bit lackluster overall, and the markets stopped shortly after the jobs figure was announced. The red 50-day EMA above has shown relatively reliable resistance. It is starting to reach towards the 1.11 handle, which was the scene of selling pressure late in the day on Thursday.

The lack of momentum to the upside shows just how little enthusiasm there is for the Euro, so one should probably take away the idea that the overall choppiness and negativity remains. In short, this is a simple continuation of the longer-term trend, which has been greenback-friendly.

Bond yields

The US bond yields still offer positive return, something that most of the European bonds can’t say these days. This has people more interested in owning the US dollar as money tends to go where it’s treated best. Think of it this way: if you are a fund manager, are you more interested in owning a bond that reduces 2% yield, or one that is guaranteed to lose 1% if held to maturity? That’s essentially the question people are asking themselves at this point.

Central banks are likely to cut rates, so although the US interest rates will be low, they will still be higher than European ones. This is a worldwide phenomenon, and with over $17 trillion worth of bonds around the world now offering negative yield, the United States might be the only game in town.

What to expect

In a nutshell, you should expect more of the same of what we have seen over the last year or so. It is a slow and steady decline in the value of the Euro, and now that we are decidedly below the 61.8% Fibonacci retracement level, it’s very likely that we will go looking towards the 100% Fibonacci retracement level, albeit very slowly. That would send this market looking towards the 1.05 area, which has caused massive buying pressure in the past. Whether or not we can break through is a question for another time, but it certainly looks as if it is the intended target.