GBP/JPY shows signs of support amongst massive headline risk

The British pound tends to trade against the Japanese yen based upon risk appetite more than anything else. When we see people out there afraid, quite often this pair will fall as the Japanese yen is considered to be one of the “safe currencies” in the world. Because of this, the fact that we start to see stability in the face of so many negative headline suggests that perhaps things are changing.

Vital level of support

GBP/JPY

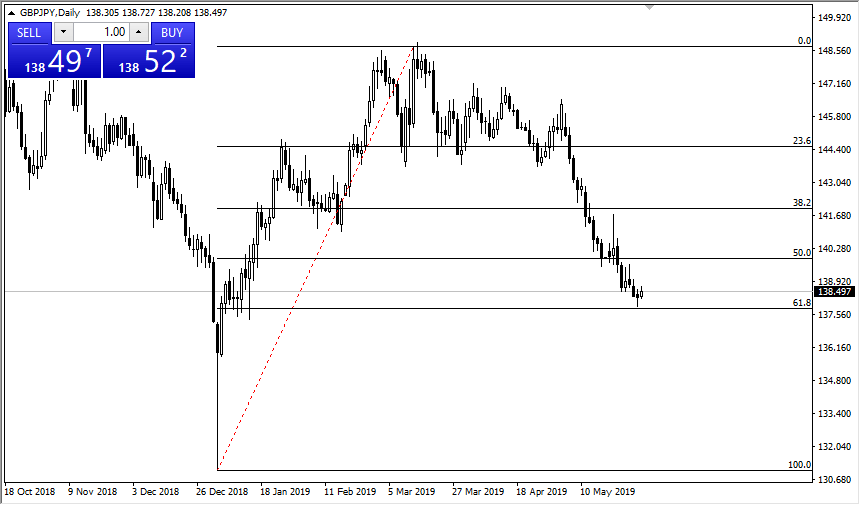

As you can see up on the chart, the ¥142.50 level has offered a significant amount of support over the last couple of sessions. Considering that Friday has been so volatile in the S&P 500, one of the premier gauges of risk appetite, the fact that the candle is even remotely positive is rather impressive. The ¥142.50 level has been important in the past, and the scene of a gap that has now been filled. The question now is whether or not we can rally?

I find it rather interesting that we are simply sitting here as we await the Chinese response over the weekend due to new tariffs coming out of the United States, which of course will have an effect on what happens here. The British economic numbers earlier in the day on Friday were pretty good all things considered, and as a result this could be giving a bit of a boost for Sterling anyway.

The Thursday session formed a bit of a hammer, so it shows that a lot of buyers came back into the marketplace. The 38.2% Fibonacci retracement level from the bottom is somewhere in that area, as we should see a lot of market memory in that area.

Both scenarios

Looking at this chart, there are couple of different scenarios that we should be taking a look at. One of course will be that the risk appetite in the market picks up, and then we rally towards the ¥144 level, perhaps even the ¥145 level. This would be due to some type of progress in the US/China trade talks more than anything else. At that point then we could start to focus on good news out of Britain.

The other scenario would be breaking down below the hammer from the Thursday session, which opens the door to the ¥140 level. That would have to do with more negativity coming out of global trade negotiations between the Americans and the Chinese, and therefore people will run for the hills so to speak.

If that happens, it will eradicate the support rather quickly, because this will be more of a panic and we could go down to the ¥140 level at that point rather quickly. One would have to think that is the more likely of the two scenarios, but the fact that we have held as well as we have is somewhat encouraging.

Buckle up, Monday should be rather interesting as we should get a lot headlines over the weekend that will throw this pair around quite drastically.