Is Ethereum going to play catch-up?

Recently, we been speaking about the strength of Bitcoin. It’s obvious that the Bitcoin market has started to take off, and although Ethereum got a bit of a bump recently, we haven’t necessarily taken off. So that brings the question as to whether it’s going to play catch-up to its big cousin Bitcoin.

The technical layout

The technical layout for Ethereum is relatively bullish. That doesn’t mean that is going to be explosive, and quite frankly the days of the crypto currency exploding 10 or 12% to the upside are over. Quite frankly, the psychology of the market isn’t going to allow that to happen as far too many people saw what happened in the past. If you get a 10% gain in just 90 minutes, it’s very likely you will take it due to the fact that the market gave back all of those gains so drastically before.

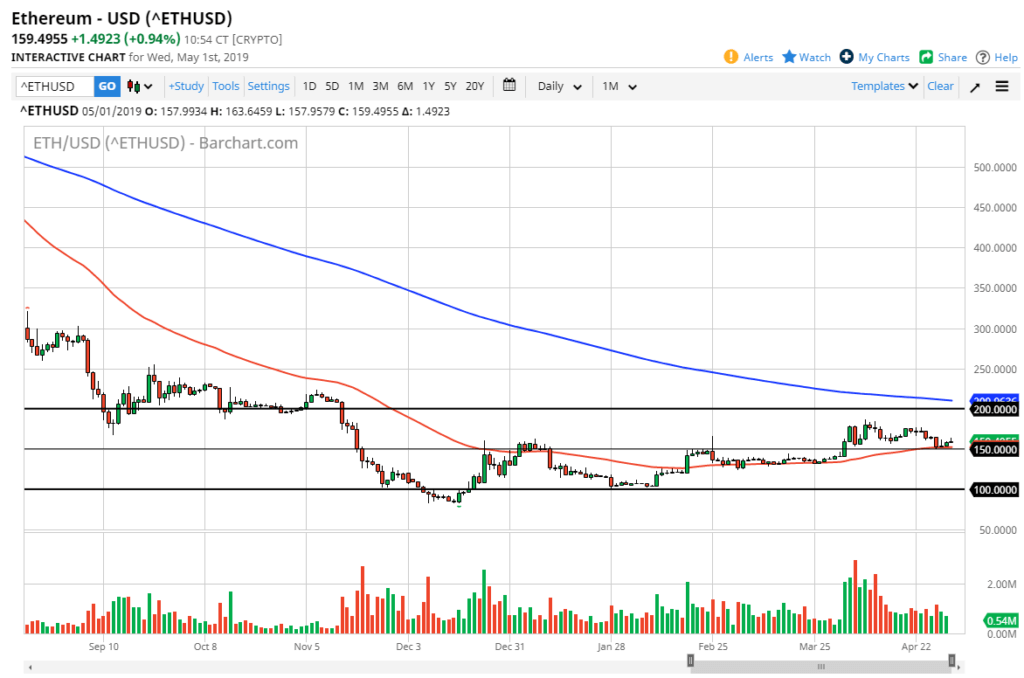

That being said, the 50 day EMA, pictured in red on the chart, is sitting just below and looking to pick this market up. What makes it even more interesting is that it sits just above the $150 level, which of course has a certain amount of psychological impact. Beyond that, the level has also previously acted as resistance, so market memory comes into play as well.

To the upside, we have the $200 level which is even more psychologically impactful. The 200 day EMA is sitting just above there, so it could be a bit difficult to break out and over. That being said, it does look like the market will find value hunters in this area, perhaps trying to gain $50. That’s not to say that it’s going to happen overnight, however it looks like the market will eventually reach to that area if you are patient enough.

Ethereum chart

“Accumulation phase”

My thesis at this point is that crypto is in the middle of an accumulation phase. In other words, we are watching the so-called “smart money” accumulate the market at low levels. Given enough time, other buyers and the herd will jump in and continue to push to the upside. I suspect that the accumulation phase will end and we will start to get into the next part of market structure, the “market phase”, when we start to rally rather drastically after we clear the 200 day EMA. At that point in time, those who have bought down at these low levels will start to realize significant gains. However, the accumulation phase has no timetable. If you are willing to buy Ethereum at this lower level, you need to be patient.

The main take away

The main take away of the analysis is that buying dips in Ethereum to build up a larger core position seems to be wet larger traders are doing. This is very similar to the Bitcoin market, which as you know tends to lead the rest of the crypto universe as to directionality and momentum. While focus is starting to shift towards Bitcoin, the backdoor plate could be Ethereum.