New Zealand dollar looking for support against CAD

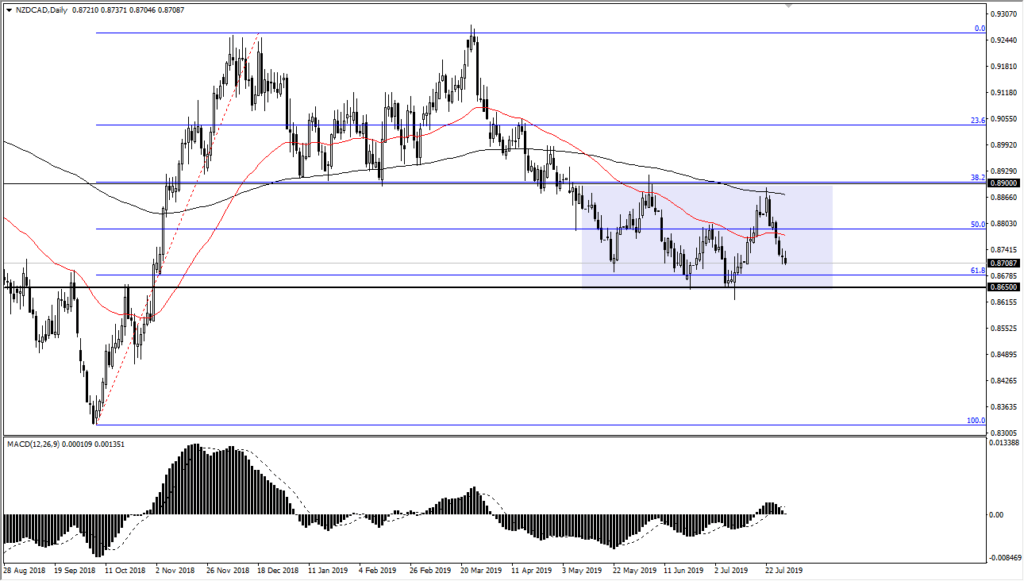

The New Zealand dollar has been falling for some time against most currencies, and of course the Canadian dollar is no different. We have fallen all the way from the 0.89 handle towards the 0.87 level over the last two weeks. Because of this, it’s no surprise that eventually there would be value hunting at these low levels. The fact that we are trying to form a bit of a hammer during the trading session on Wednesday at a vital level of course suggests that we may be getting rather close to finding the floor.

61.8% Fibonacci retracement level

NZD/CAD

Looking at the NZD/CAD chart, you can see that we have been falling quite steadily over the last couple weeks. However, the market looks very likely to see a certain amount of interest in this area considering that it is the 61.8% Fibonacci retracement level, and the round number of 0.87 as well.

At this point in time it’s very likely that value hunters will come back into the marketplace, and if we can break above the 0.8733 handle, it should continue to push much higher, with the initial target being the 0.88 handle, and then possibly the 0.89 level in a round trip of the most recent selloff.

Commodity currencies

The commodity currencies that we are looking at operate on a couple of different fundamentals, obviously. The Canadian dollar is highly correlated to crude oil which is taking a bashing during the trading session on Wednesday, while the New Zealand dollar benefits, at least against the CAD. That being said, the New Zealand dollar is highly sensitive to agricultural commodities, and Asian growth so there is a little bit of a push/pull type of attitude here. This is why I think that any rally based upon technicals or any other reason will probably be sluggish and more of a grind than anything else.

The main take away

It’s more likely than not that this pair is going to trade on technical is more than anything else, so therefore a bounce would make quite a bit of sense. It’s hard to quantify the crude oil and the Asian influence on this market, because quite frankly the headlines are so fluid when it comes to the idea of global growth due to the US/China trade war, and of course the possibility of oil demand has a softer than expected inventory number came out during the trading session on Wednesday as well. In other words, it was bearish news for crude oil.

I believe that this is a short-term trade, probably lasting for a few weeks but it certainly looks as if we have gotten ahead of ourselves to the downside and that there are plenty of value hunters out there willing to step up. There was a huge amount of demand in this region in the past, so certainly this makes quite a bit of sense. Ultimately, the 0.89 level should be the target.