Silver Market Finds Buyers

- Silver market breaks top of daily hammer

- 50% Fibonacci retracement level has offered support

- Currently at 50-day EMA

Silver markets have been rather soft over the last several weeks, but considering that there was a 15% gain during the month of August alone, this should not be much of a surprise. The market cannot go straight up in the air forever, so the fact that it would pull back the way it has is no surprise.

However, 15% in one month is more than most assets, although silver does tend to be rather volatile. This leaves the market ending the week looking for support, which it may not find in the current climate.

Central banks easing

The central banks around the world continue to offer quantitative easing and lower rates. That, of course, has people looking for so-called “hard assets”. Silver and gold both fall directly in that category, but silver has an outlying fundamental driver as well, being an industrial metal. In other words, silver can also take off to the upside if there is a lot of manufacturing going on.

With that being the case, the US-China trade talks provide both a good and a bad reason for owning silver. However, the market seems to be focusing more on central banks around the world. That is probably is the longer-term story.

With the potential of massive inflationary pressures coming out due to quantitative easing going forward, one would have to think that, sooner or later, fiat currencies are going to get hammered. In fact, several of them already are.

Technical analysis

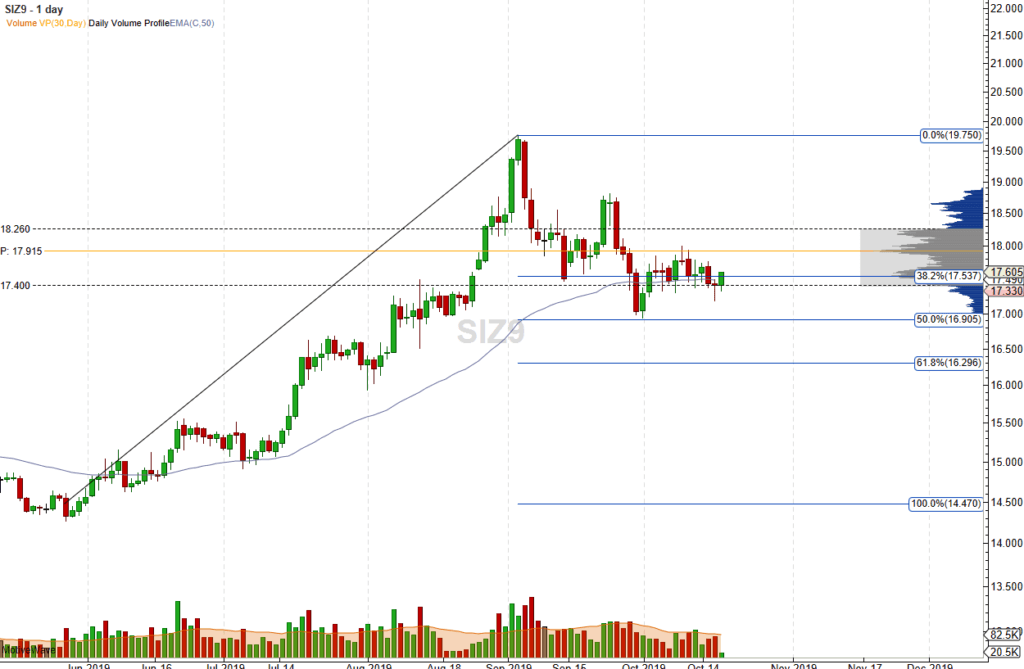

Silver market chart

The technical analysis for silver is interesting as the 50% Fibonacci retracement level recently offered a significant bounce. By doing so, longer-term traders will continue to pay attention to the possibility of a longer-term trend. The 50-day EMA is cutting through the recent price action. That will attract the longer-term traders as well.

Ultimately, this is a market that has seen an uptrend for quite some time, although one would be forgiven to feel worried about recent trading.

As central banks around the world continue to juice the financial system, that should only add more interest in this market. From a much longer-term standpoint, one could make an argument for a potential descending triangle. The action during the trading session in the early hours on Thursday suggests just that.

It’s very likely that the $18 level above will be watched too. If this can get broken, it should bring a new rush of money into the marketplace. It will be an obvious break of resistance and, of course, these large numbers do attract a lot of attention by larger firms and traders.