Tesla Earnings Impressive

- Revenue higher than anticipated

- Deliveries are up

- Production ramping up

- Stock surges 10% in after-hours trading

Tesla issued an earnings report on late Wednesday, posting fourth-quarter results that impressed Wall Street and beat most expectations. This came against the backdrop of faster-than-expected local production being launched in China.

The company had also record deliveries at the end of last year, which continues to propel them forward.

Earnings came out bullish

The earnings report came out stronger than anticipated across the board. For example, the revenue that Tesla reported was $7.38 billion, as opposed to the 7.06% billion expected by Wall Street.

Furthermore, the adjusted earnings-per-share came out at $2.14, which was higher than the $1.74 anticipated by Wall Street. Obviously, this will continue to be a propellant as the top line numbers were so strong.

Tesla also guided towards an increase in deliveries over and beyond last year, as they suggested that deliveries should be well over 50,000 units in 2020. The company also met its guidance range for 2019, delivering 367,500 units to customers. Fourth-quarter deliveries for 2019 totaled around 112,000 units delivered to customers.

Ramping up production

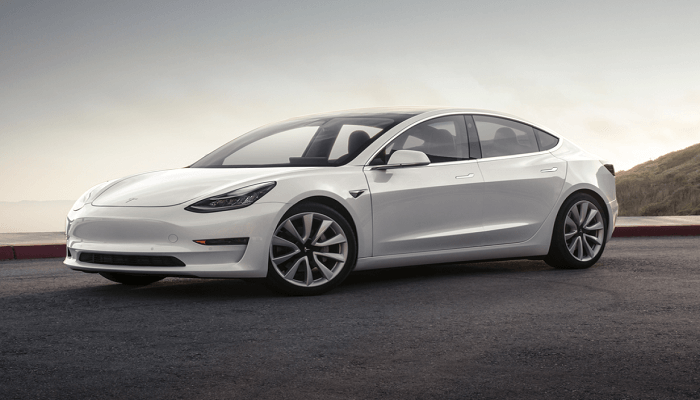

Ramping up Model 3 in Shanghai and Model Y in Fremont, production will easily outpace the deliveries seen over the past year. Both solar and storage deployments could also grow by at least 50% in 2020, according to Tesla CEO Elon Musk.

It should be noted that first-quarter results could be impacted by the coronavirus outbreak, as production in China is slowing down. However, that should be a transitory concern, and if the numbers come in and the market punishes the stock, it primes Tesla to turn around and shoot to the upside later in the year.

During the earnings release, Tesla said it expected production for its Model Y vehicle would also begin at its new Shanghai Gigafactory during 2021. The Fremont facility has already begun ramping up production for the model this past month, ahead of schedule.

Of particular interest for Wall Street analysts has been the company’s cash position, which has improved recently. Cash and cash equivalents improved by $930 million to a record $6.3 billion during the last quarter, which Tesla claims is greatly influenced by cost controls. Gross margin narrowed to 22.5% in the fourth quarter from 22.8% last quarter and 24.3% in the same period last year. Tesla suggested this was due to a higher proportion of lower-margin Model 3 vehicles being sold.

The reaction to Tesla’s earnings

In late market trading, Tesla surged over 10%, as it has been one of the most heavily shorted stocks out there. That being the case, its explosive move to the upside will certainly be the reaction to one of the most highly visible companies that trades in the United States and beyond.