US CPI Numbers Show Continued Sluggish Behavior

- CPI month-over-month released Tuesday

- Core CPI figure missed the mark

- Downward trend suggests sluggish behavior in US

Early on Tuesday, the United States released the Consumer Price Index figures for the previous month. This measures the average cost to the consumer on basic services and goods.

The CPI is one of the markets’ favorite measures of inflation, so it has a significant influence on where the markets will go in the United States or the host country in question.

The headline and core CPI

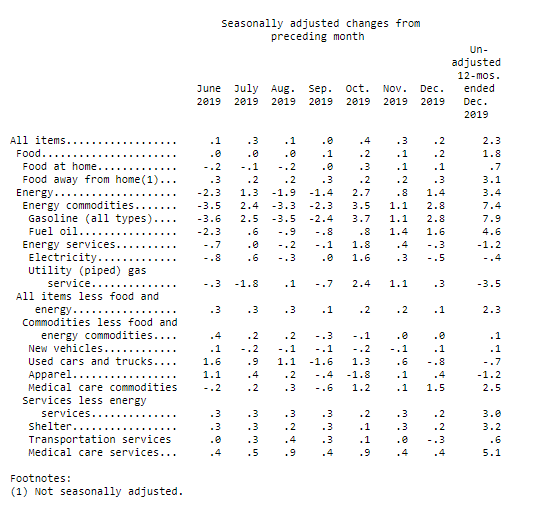

CPI table

CPI comes in two variations: the headline number and the Core CPI figure. The difference is that the Core CPI takes out food and energy, which can fluctuate quite drastically, as has been seen in the oil markets.

That being said, the numbers are paid attention to, but the core CPI tends to carry more weight as far as traders are concerned.

CPI came out at 0.2% as anticipated for the month-over-month figures. The previous announcement was not revised, as it came out unchanged from the 0.3% reading. This shows a slight downward trajectory, which suggests there is still sluggish behavior in the US, albeit positive.

The Core CPI came out at 0.1%, which was lower than the 0.2% expected with the month-over-month figure. This can certainly have an effect on stock markets, but it could be tempered slightly by the fact that several banks reported premarket, showing signs of strength.

Between the bank earnings and the CPI figures, this shows just how uneven the US economy is at the moment. Overall, it still looks positive, but it indicates that there is certainly something rumbling beneath the surface.

While there are no major concerns as far as the markets go, longer-term investors will look at this as something to pay attention to, which has been a bit of a running theme lately.

Not enough to move the Fed

The main takeaway from the CPI announcement is that, although the United States continues to grow and show slight signs of inflation, it is not strong enough to make the Federal Reserve move. There will be no rate hikes anytime soon, and this is something that the Federal Reserve has plainly stated in most of its communications anyway.

Asset prices have been rising over the better part of a decade, and nothing in this report suggests that markets are ready to turn around.

Ultimately, the stock markets and many other asset markets out there have been moving on the idea of massive amounts of liquidity being tossed into the marketplace. While inflation is extraordinarily low, that could weigh upon the US dollar, which only further fans the flames of speculation.

This is one of those situations where bad news is actually good news, within reason, and a slight miss of 0.1% on the Core CPI figures is certainly that.