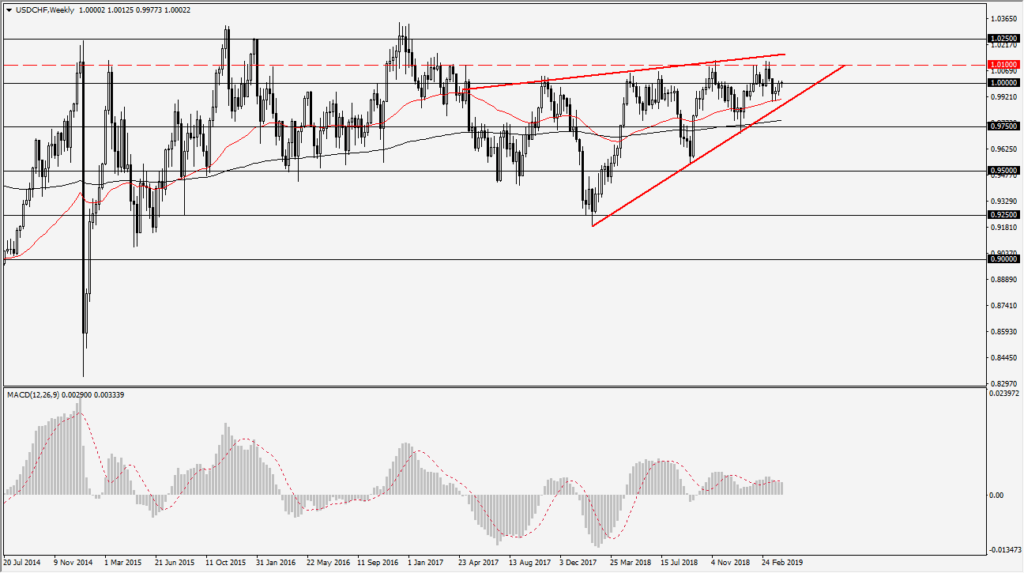

US dollar forming wedge against Swiss franc

For quite some time, the US dollar has been grinding higher against the Swiss franc, with a move that has started from late 2017. Since then, we have continued to find it both support and resistance in a rising wedge, which of course is a very bearish pattern if it kicks off. Because of this, we simply must pay attention to the lines of support and resistance to keep an eye on what could be a major move.

Tightening action

This is interesting because the action in this market continues to tighten overall, and it does suggest that perhaps we are looking at the possibility of an explosive move. As the uptrend line and the resistance line are converging, there does come a point where if we break down below the uptrend line, it is a typical “rising wedge”, which could signal a move down towards the bottom of it, meaning that the USD/CHF pair could reach down towards the 0.9250 level.

The MACD is also starting to drift lower as well, making lower highs in what is longer-term divergence. At this point in time, it looks as if the 1.01 level is going to be significant resistance, so if we can break above there it might negate most of the pattern. That being said, you should also keep in mind that the USD/CHF pair tends to move in the exact opposite direction of the EUR/USD, which looks as if it is bottoming and should turn higher given enough time. If that in fact happens, it makes sense that we could break down from here.

usd/chf daily

Various levels to watch

Looking at the chart, there are several different levels we should be watching. I have already mentioned the 1.10 level, but there is also the 50 day EMA which is pictured in red on my chart. The uptrend line of course is support, and then the black 200 day EMA will get involved. After that, you can see that at roughly 250 pips, there is support or resistance. This pair is highly technical in nature, as the Swiss franc tends to grind more than anything else. With that being said, the market certainly looks as if it does have some serious danger of breaking down.

However, if we were to break above the 1.01 level, then the next area to pay attention to as 1.0250 level, and a break out over that would of course be a major move higher just waiting to happen. All things being equal though, we are seeing a slowdown in the move to the upside, and that typically is assigned that we are starting to get a bit exhausted.

Odds favor…

The odds of course favor of move lower, based upon the EUR/USD pair, and of course the fact that every time we try to rally we find less and less momentum. As we hang about the parity level, there of course is a lot of interest in this pair, so with that being said signs of exhaustion should be sold, and then of course break downs below those levels that were mentioned previously in the article.