US Dollar Making A Stand Against South African Rand

- Rand proxy for emerging markets

- Major technical level

- Impressive candlestick

The US dollar has fallen against the South African Rand early during trading on Monday but has bounced quite nicely to form a bit of a hammer. This is a bullish sign and tells us that perhaps there may be a run to safety from here. After all, the South African Rand is a proxy for emerging markets, and typically only rallies when there is a huge move into risk appetite. It’s difficult to imagine that in this scenario, so it makes quite a bit of sense that the dollar has found buyers.

Technical analysis

USD/ZAR

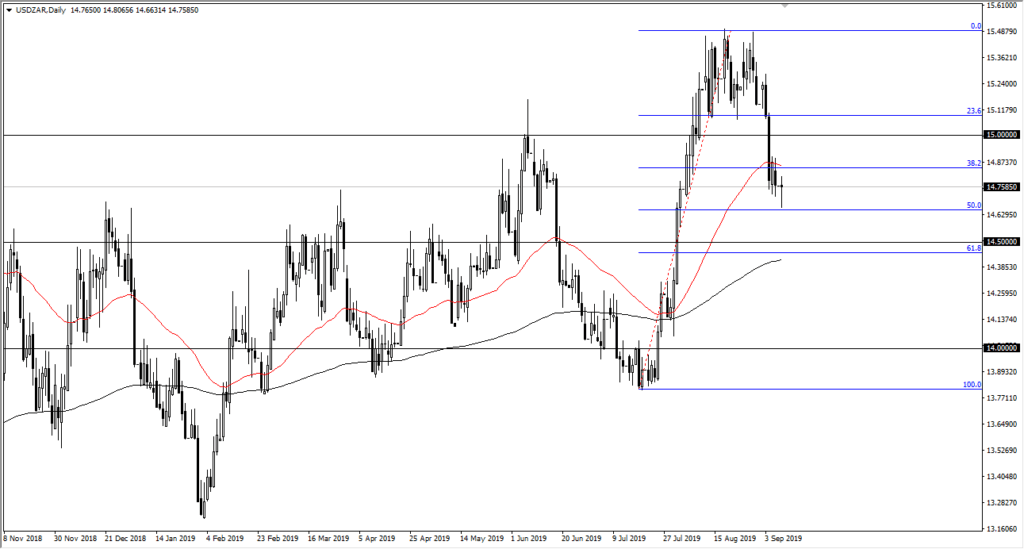

The technical analysis for this market is rather interesting. We are forming a hammer right at the 14.75 Rand level. Just below, we have the 50% Fibonacci retracement level, and it should continue to attract quite a bit of attention. Beyond that, the 14.50 Rand level is massive support not only from a structural standpoint but from the fact that we have the 61.8% Fibonacci retracement level and the 200 day EMA. At this point, this is an area that had previously been resistive, so it makes quite a bit of sense that the buyers are interested.

If we were to break above the top of the hammer, then we could go higher, perhaps reaching towards the 15 Rand level, perhaps even the 15.47 Rand level. Ultimately, this is a market that will continue to find buyers based upon the fact that we have massive amounts of concern around the world when it comes to global trade, global growth, the US/China trade situation, Brexit, and a whole host of other geopolitical problems.

Bonds leading the way

The US Treasury markets have been attracting a lot of money, and it does make sense that they will continue to do so. Ultimately, this is a market that will continue to see noise going forward. However, we have also sold off quite drastically and now that a lot of the weak hands have been shaken out, it’s very likely that the trend can continue. Keep an eye on the US bond market, it will lead the way.

Alternate scenario

The alternate scenario is that we break down through the 200 day EMA, which would probably send this market down to the 14 Rand level. That would be very destructive and negative, at least for the US dollar. Quite frankly, this is a market that would need to see some type of huge “risk on” move globally to see the South African Rand start picking up a lot of bullish pressure. This is a market that should continue the uptrend, but we always need to keep an eye on the alternative scenario. All things look strong at this point, so keep an eye on this pair, as it not only makes a great risk appetite based currency pair, but it also gives traders an idea of where risk appetite is globally.