US stocks drift lower to kick off week

The US stock markets opened up a bit muted during the trading session on Monday to kick off the week, as there seems to be a bit of a malaise when it comes to the idea of putting money at risk. In fact, the only place that we are seeing significant gains would be in the energy stocks, as the Donald Trump administration has said it will no longer exempt countries from US sanctions if they continue to buy crude oil from Iran, including both China and Japan which are the second and third largest economies in the world. While this did send crude oil much higher and through the crucial $65 level in the WTI Crude Oil market, we also saw quite a bit of strength in the energy sector in tandem.

Lack of momentum

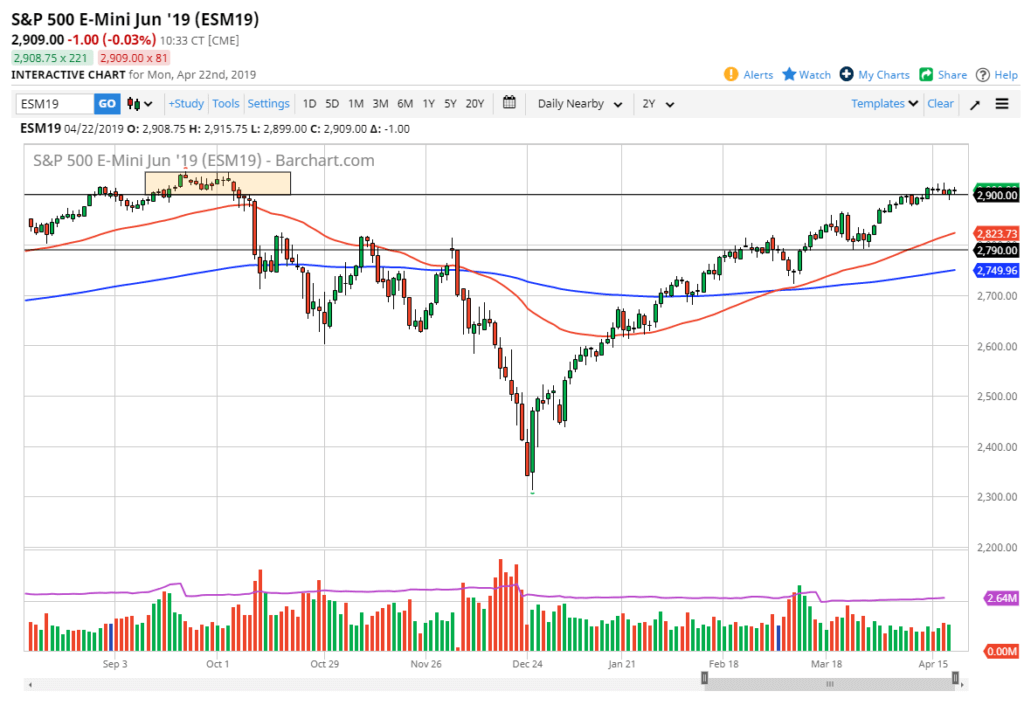

One of the things that the stock market has been suffering lately in the United States has been a lack of momentum. We are at extreme highs in the S&P 500, as there is an area between the 2900 level and the 2940 level above that seems to be very noisy from the previous highs. We simply cannot break above there in the short term, but we aren’t necessarily breaking down either. Quite frankly, this is a type of market that can put traders to sleep. That being said, there should be a significant trade coming soon and there are a couple of traders down the road that could kick this off.

Keep in mind that we are within 1% of our highs in the S&P 500, so we need to keep things in perspective what this means is that although there is a lack of momentum, and we could very well break down, the most likely path of directionality will be higher over the longer-term.

S&P 500 daily chart

Looking for value

One of the things that traders are probably going to be doing is looking for value. After all, the market has gone straight up for the last several months, so of course traders would be a bit reluctant at these extreme highs. With that in mind it’s likely to cause a bit of profit taking or perhaps indecision, so looking at pullbacks for value makes quite a bit of sense. After all, how many times have you heard that the market is “overbought?” How many times has the market gone even higher, perhaps after a slight pullback? That is essentially what I’m looking for right now.

There are several levels of support underneath that could come into play, not the least of which would be the 2880 level, the 2850 level, and then even more significantly than that would be the 2790 handle. Pullbacks should attract a lot of attention at these various levels. However, if we break above the 2940 level, then it means we simply continue the longer-term uptrend and reach towards a major resistance at the 3000 level.

All things being equal, it’s going to be very difficult to sell this market, as it’s obviously very bullish, and a lot of momentum, and perhaps even more importantly: a lot of money sitting underneath.