Forex Trading Strategies That Work – Get Your Currency Trading Basics

The forex market, with its vast liquidity is the most significant financial market in the world. Trillions of dollars’ worth of transactions take place every single day.

Such liquidity makes room for volatility and, on in currency market, volatility leads to speculation.

The art of speculation refers to buying low and selling high. Or, selling high and covering at lower levels.

No matter the industry, or just in real life, that’s the definition of profit. If the difference between buying and selling, or selling and buying, is positive, a profit is made.

It is no wonder that traders from around the world, with various backgrounds, developed forex trading strategies to speculate on the most liquid market in the world.

The definition of “Forex Trading Strategy” implies a trading plan that tells traders when and where to buy and sell a currency pair. A trade must have an entry and exit level, as they are part of any forex trading strategy.

| Broker | Bonus | More |

|---|

Forex Trading Strategies That You Must Know to Succeed

One of the best ways to trade forex is to define what kind of trader you are. What suits you best, from a time-horizon point of view?

It refers to the time taken for a trade. Scalpers are traders that keep a position open for a very short time and target a small profit.

They don’t keep positions open overnight, so they avoid unnecessary costs like negative swaps. To profit, scalpers take multiple trades during the trading day.

Typically, scalpers are people that have little or no patience. They don’t see the point of keeping positions open for a long time, as they are in for a quick buck.

In some ways, they are right. Forex traders have the impression that the market trends all the time, but that is just not true.

Therefore, because they look at the lower timeframes to find their trades, scalpers take advantage of the smallest trends that form. Hence, they can make a profit even in a lull or non-moving days, and this is one of the reasons why scalping works even when the currency market consolidates.

Swing traders, on the other hand, have a different time horizon for their trades. They look for a few hours and keep a trade open even a few weeks, a normal time for swing trading.

As such, position sizing differs too. To make the most of a trade, scalpers have a more aggressive attitude.

They use a higher volume, to cover for the small change in the opening and closing prices. Swing traders do the opposite, as their positions’ volume differs due to other factors that affect a trade.

Finally, investors don’t have any time pressures. These traders use differences in the macroeconomic picture for their forex trading strategies, so fundamental analysis plays a vital role.

As you can see, the starting point of any forex trading strategy is to define the period that suits your style best. Only after that, the focus shifts to the trading tools to use.

Tips and Tricks for Selecting the Market to Trade

The next thing to focus on is the market to trade. The currency market offers plenty of possibilities as dozens of currency pairs exist.

Moreover, stiff competition forced forex brokers to add other markets to the trading dashboard. Therefore, from the same account, one can trade stock indices, commodities like oil, gold, and silver, besides the regular currency pairs.

The best way to trade forex is to protect your account from unnecessary exposure. Overtrading kills a trading account because traders feel the need to do something just because the market is open.

But the currency market doesn’t move all the time. In fact, most of the time it consolidates.

Statistically, prices spend most time in consolidation, then in corrective waves. The way to identify consolidations or potential consolidations, is to check the economic calendar to see if there is significant data to be released.

If yes, the market will most likely spend the time in a range. However, that will affect investors and swing traders, not scalpers.

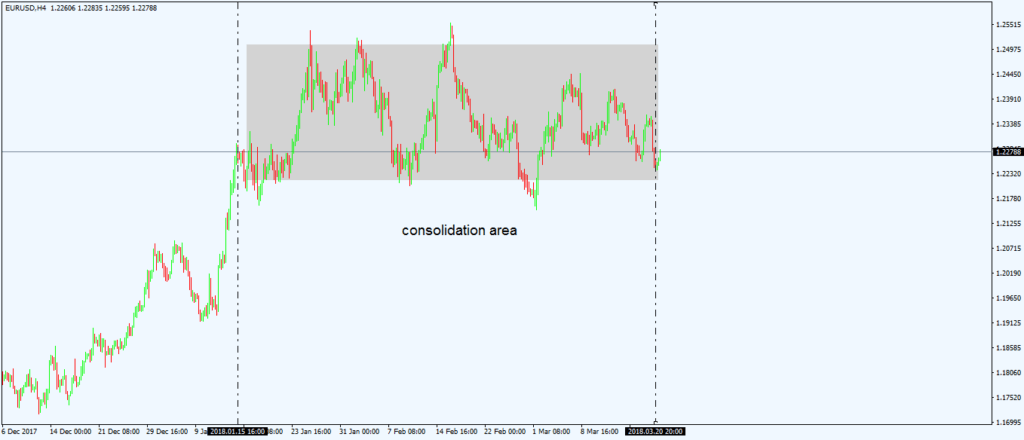

Consider the recent EURUSD price action for the entire 2018. For almost three months, the market consolidated in a relatively big range of about two hundred and fifty pips.

It’s not like there was not important news to move the market – just that the market wasn’t impressed by any of those releases and needed more time to consolidate.

The market waits for something: an interest rate change, a monetary policy decision, something that the economic calendar will show.

As such, traders’ interest focus on the next event all the time. At first, it was the Federal Reserve of the United States first 2018 FOMC (Federal Open Market Committee).

It turned out the Fed did nothing and Yellen, while at her last press conference as the Fed Chair, didn’t say much. Next, the ECB (European Central Bank) March interest rate decision and press conference came.

Before it, traders just waited to see what Draghi and Co. will say about the Euro and the strength of the Eurozone economies. It turned out; the market kept the ranges.

Finally, the Fed meets again, this time with Powell as the lead. At the time of writing, the range still holds, as the Fed didn’t hold the press conference yet, nor released the FOMC Statement.

However, if we are to have an educated guess about when the market will move, the chances are that the Fed meeting will be the catalyst.

Away from short term policy traders often look at the FFR rates (Fed Fund Futures). This is a prediction in the futures markets about if the central banks (in this case the Fed) will raise rates. The futures markets bet on the decisions at upcoming meetings and this can help the spot market price in any changes they may think will happen.

Because it is a dollar-driven event, one may choose to focus on currency pairs that don’t contain the dollar in their components. In doing that, they’ll avoid the dollar’s volatility due to the upcoming economic event and protect the account from unnecessary exposure.

Hence, selecting the market plays a critical role in finding optimal forex trading strategies.

How to Enter and Exit a Market

Day trading and trading in general, not only requires a disciplined approach to the market. The entry points, as well as the exit points, give the outcome of a trade.

Impatient traders enter ‘at market’. Effectively, it means they buy or sell a currency pair at the market, at the current prices.

They always feel they will miss the big move, so the FOMO (Fear of Missing Out) element plays a vital role in their trading decision. Typically, scalpers fit into this category.

Swing trading and investing require a disciplined approach. Traders calculate the margin to deploy on any given trade, and the levels to do so.

They don’t just go into a market but do that for a reason. Either the consolidation area ended, or something in the macroeconomic picture changed course.

The so-called positional trading begins with scaling. Scaling refers to dividing the volume of a trade into multiple, smaller positions, with the idea of gaining a better-averaged entry level.

For scaling and positional trading, swing traders and investors use tools like pending buy-stop and sell-stop orders, pending buy-limit and sell-limit orders, trailing stops and conditional orders, as well as custom-made indicators and trading tools.

With a pending stop order, traders want to buy from a higher level than the current market price. Like the EURUSD chart from above, some traders just want to avoid such a long consolidation.

Therefore, if they think the bullish trend will resume, they’ll place a pending buy-stop order at the top of the range. Hence, when the market breaks higher, the trading platform will automatically fill the order.

The same happens when traders want to sell from lower levels. The only difference is the name of the pending order: a pending sell-stop order.

Opposite from the sell-stop orders, buy limit orders wait for a pullback before going long, while sell-limit orders sell on a spike. Both help traders ride bullish or bearish trends.

Using pending orders shows a disciplined approach to trading. It shows a plan is in place. Hence a money management approach to trading exists. For this reason, the best ways to trade forex is to use pending orders as much as possible.

Countertrend Trading vs. Trend Following

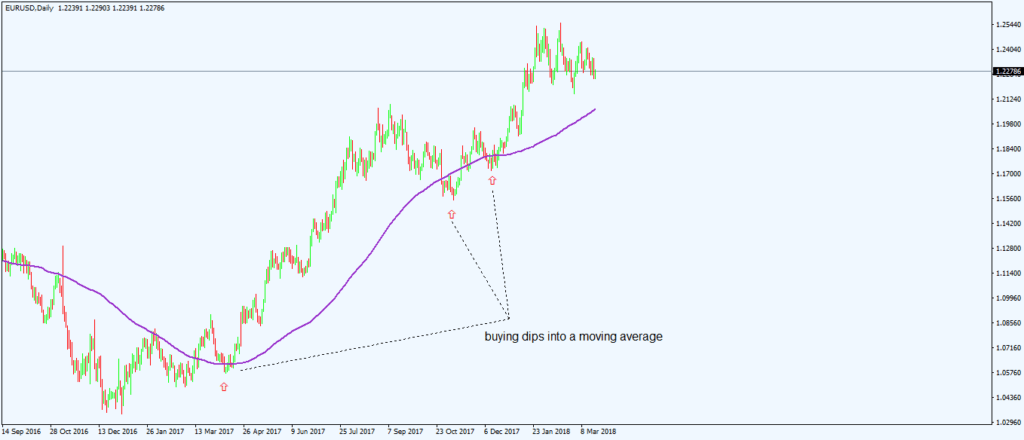

Because the “trend is a trader’s friend,” the most famous forex trading strategies follow trends. Traders use trend indicators, like Moving Averages or the Bollinger Bands indicator, to buy dips in bullish trends, or to sell spikes in bearish ones.

The chart above shows the EURUSD price action for the last year or so, with an SMA(100) on it. The SMA stands for Simple Moving Average and, in this case, it considers one hundred candles before plotting a value below the current price.

A straightforward interpretation follows the trend indicator: every time the market dips into it, traders jump on the long side. As a side note or a warning, the best ways to trade forex using moving averages is to plot more than one on a given chart and interpret the overall price action.

Also, bear in mind that the more the price tests a moving average, the less likely is that it will act as a support or resistance.

Trend following is a conservative approach to forex trading. Traders use trend indicators to spot trends on bigger timeframes, then turn their attention to the lower ones to detect reversal patterns.

Countertrend trading, on the other hand, belongs to aggressive traders. It bears more risk, but also a bigger reward.

Recognizing and exploiting price patterns has always been the goal of generations of traders. Most of the price patterns we know today, part of a pattern recognition approach to trading, were documented on other markets than the forex market.

Namely, the stock market was the “playground” for technical traders to document patterns. The exciting part is that reversal patterns, the ones used in countertrend trading, are more numerous than trend following ones.

As a trend following patterns, the most relevant are the ascending and descending triangles, pennants, and bullish and bearish flags.

On the other hand, head and shoulders, wedges, double and triple tops and bottoms, bullish and bearish engulfing, morning and evening stars, the hammer and the shooting star, are just some of the reversal patterns used in countertrend trading.

Hence, while trend following is more popular, more countertrend trading patterns were documented as traders strive to find the best entry possible.

Conclusion

There is no holy grail in charting the forex market. What works for one trader, might not work for another.

Availability plays an important role too. Many traders believe they can have a day job and then spend two hours trading in the afternoon to make millions. Reality begs to differ.

Trading is not a video game, but entities with real money move the market. Retail traders, like the average Joe that invests his/her savings, have little or no say in the way the forex market moves.

To have an idea, consider that only about six percent of the daily forex market turnover belongs to the retail traders. Six percent!

Now that’s not enough to move the market. If there’s the slightest doubt in your mind, check for yourself.

Merely watch the price action on the main currency pairs on a bank holiday. That is when the retail traders move the market. The result? The market barely moves.

For this reason, forex trading strategies that work must be aligned to the big guys’ interests. In fact. the best ways to trade forex are in the direction of big trends, as this is how to spot and follow the smart money.

Therefore, focus on the more significant timeframes for the overall positioning, and use the smaller ones to scalp when the market doesn’t move. If the trading account allows hedging (opening both long and short positions at the same time in a trading account), use this feature to trade on both sides of the market while keeping the bigger exposure in the direction indicated by smart money.