Aussie Forming Breakout Pattern Against the Franc?

- AUD has been oversold

- Continues to make higher lows

- Massive bounce from 0.65

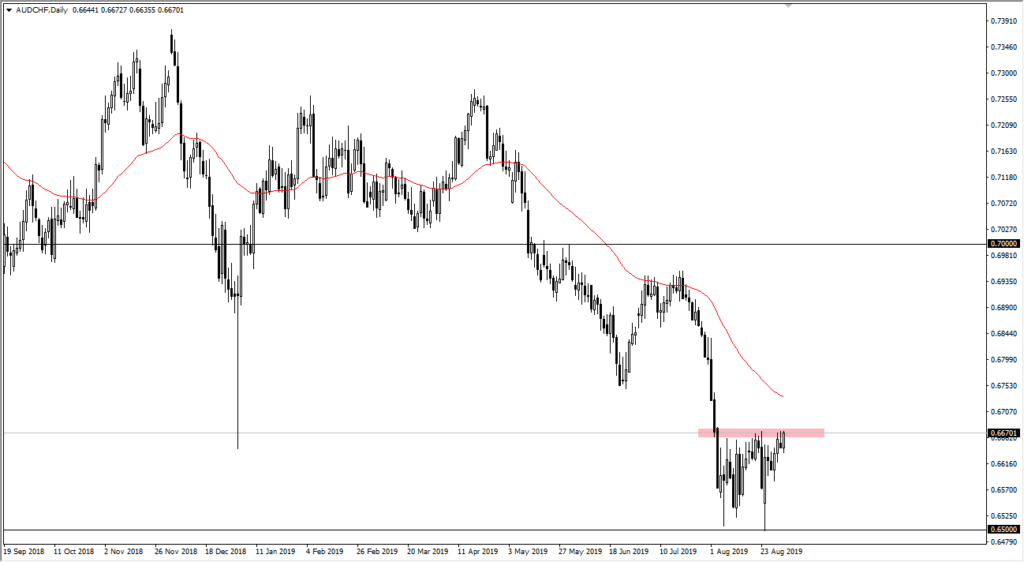

The Australian dollar has rallied a bit during the trading session on Tuesday, reaching towards the highs again over the last couple of weeks. The 0.67 level above could be significant resistance, perhaps standing near the 0.6675 level. This level has been pressed more than once, so it’s very likely that we will continue to see a lot of interest in this market right now. Short-term pullbacks look likely to continue to attract order flow, and it will be interesting to see whether this is a “risk on” move, or simply a relief rally.

The technical structure

AUD/CHF daily chart

The technical structure of this pair is very poor from a longer-term standpoint. However, you could also make a case for a “double bottom” at the 0.65 CHF level underneath, as we have seen quite a bit of a bounce over the last week or so, confirming the previous lows. If we can break out above the 0.6675 level, and perhaps even the 0.67 level, then it would confirm that “double bottom” underneath. It looks like we are going to get that breakout, or perhaps pull back to reach into the potential consolidation.

As such, the daily close will be crucial, and if the daily close reaches above the 0.67 handle, then it’s likely that the market could go as high as 0.69, and possibly even reach the 0.67 level after that. On the other hand, if it pulls back below the bottom of the range for the trading session on Tuesday, then we will probably look towards the 0.6550 region, possibly even the 0.6552 level.

Risk on/risk off

Remember, these two currencies are the polar opposites of the chiller when it comes to risk appetite. People buy the Australian dollar in times of economic certainty, and it shows more of a “risk on” attitude. At the same time, you could say that the “risk off” attitude of global markets has people buying the Swiss franc. As such, it takes one of the perfect setups, such as the GBP/JPY, to show just how global sentiment is functioning. As a result, it will be interesting to see how this plays out, as it could give a “heads up” on several other markets.

Pay note to global stock markets, because if they fall apart it’s likely that this pair should roll over. However, if there is some buying strength out there, it’s likely that the market could go much higher. This would be a great barometer to play the global markets, as there are so many different things out there moving around that could throw this market in either direction. There is a very crucial level just above, so it is worth paying attention to as it could give us a “heads up” for the next 200 points.