Australian Dollar Completely Ignores Poor Retail Sales

- Retail Sales month-over-month disappoint

- Trade Balance also fell short of expectations

- AUD traders seem to completely ignore situation

- Chinese willingness to drop some tariffs against US playing out

The Australians released a few economic figures during the trading session on Thursday, including Retail Sales month-over-month and the Trade Balance figures. This gives the market a look into the Australian economy and how things may or may not be going.

However, it is obvious that the markets have completely ignored these figures, as the Australian dollar has gone in the opposite direction of what one would anticipate.

The announcements came in lower than expected

The announcements that were released by the Australian authorities were both less than anticipated, with Retail Sales month-over-month coming in at -0.5%, as opposed to the forecasted -0.2% for the month. Furthermore, the Trade Balance numbers came in at AU$5.22 billion, which was less than the AU$5.65 billion expected.

Furthermore, the Trade Balance numbers were skewed by the coronavirus in China, as China is Australia’s largest trading partner. If and when that gets contained, and economic activity returns to normal, there should be a rather quick rebound in Australia.

The Chinese also announced overnight that they were going to drop some of the tariffs lower against US commodities, suggesting that perhaps they were serious about moving forward to facilitate further trade. This will make Australia one of the biggest winners in the equation, as they supply so much of the raw materials to China.

The forex world tends to treat the Australian dollar as a proxy for China anyway. That’s because the Chinese currency is relatively manipulated, as the People’s Bank of China sets a reference rate.

Market looks beyond weak retail sales

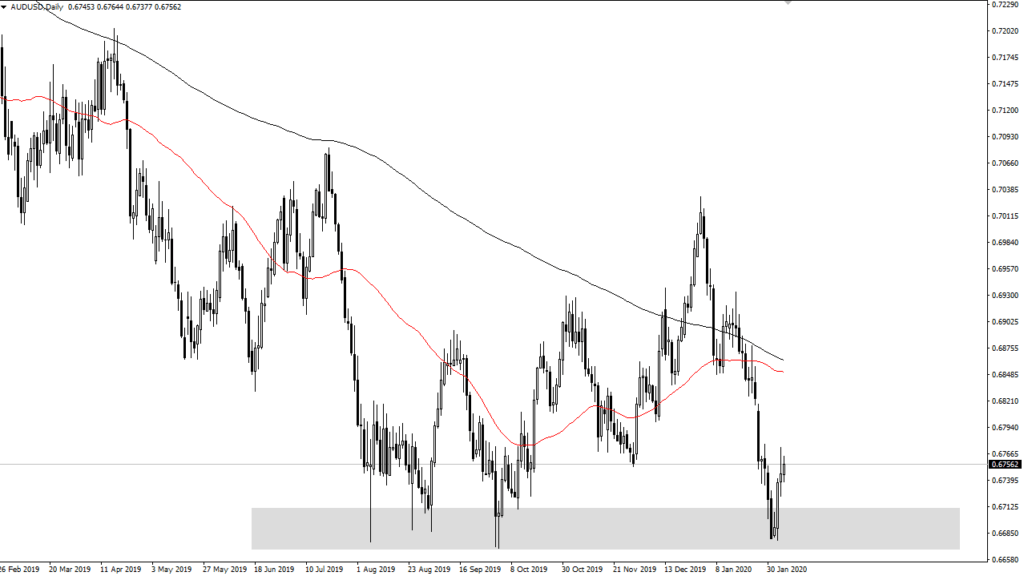

AUD/USD yearly chart

As the Australian dollar is above the 0.6750 level and rising after these announcements, this shows that the market is starting to look past the immediate situation in Australia and towards the future. The Australian dollar is at extreme lows, as the 0.67 level was the top of the consolidation range during the financial crisis over a decade ago. It looks as if traders out there are trying to bet on some type of rebound in China, and thereby a rebound in Australia.

Finally, RBA Gov. Philip Lowe recently suggested that the central bank has a view that global growth will increase this year. The resulting knock-on effect should be good for a commodity-producing economy such as Australia.