Australian Dollar Looking for Bottom Against Coronavirus

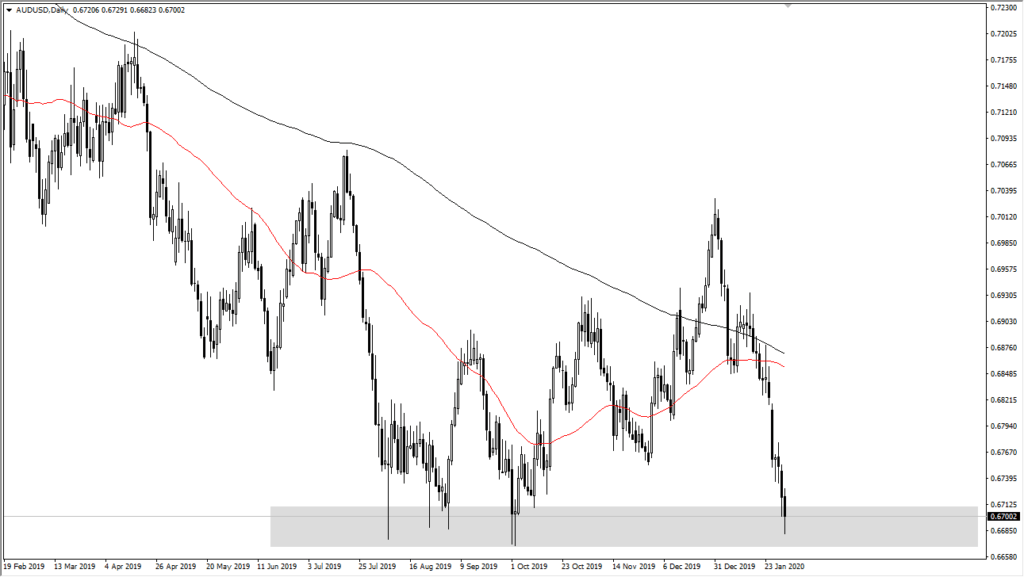

- AUD/USD reaching towards 0.67

- Major support and resistance level going back decades

- Coronavirus scare continues to be main issue

The Australian dollar continues to suffer at the hands of China and the coronavirus. The biggest concern traders have with the Australian dollar is the usual correlation between Australia and China itself.

To put some things into perspective, China uses roughly 54% of all the copper in the entire world; this is a major export out of Australia. This very clearly will have an effect on the Australian economy, as a lot of manufacturing in China has been put on hold as the coronavirus continues to rip through the population.

In order to stem the possibility of mass contagion, Chinese officials have been putting certain cities under quarantine. Many of the manufacturers that are involved in the world’s manufacturing of goods are closing factories as well. As a result, traders have been shorting the Australian dollar in anticipation of a major breakdown.

That being said, the technical analysis also suggests this is an area where a lot of value hunting could come into play.

Furthermore, in situations like the coronavirus, history has suggested that these tend to be great buying opportunities for those who are willing to pick up value. This was most recently seen with the SARS epidemic. It may have taken a lot of headlines across the world, but the reality is it was a short-term issue.

How this impacted the AUD

The Australian dollar has fallen yet again during the trading session on Friday, but it does now look as if it’s trying to find some type of bottom.

After all, the 0.67 level has been crucial for some time; and when the market reached towards this area in the past, it quite often bounced back.

Looking at the longer-term historical charts, it’s obvious that the 0.67 level has been important for both buyers and sellers. It is also worth noting that the 0.67 level is roughly the top of the consolidation area that the Australian dollar had been in during the financial crisis over a decade ago.

The bullish case

The bullish case with the Australian dollar is simply a matter of it being oversold. The 0.67 level has offered support more than once in the past, and therefore it would make sense that a certain amount of support should be built into this level.

AUD/USD yearly

When a market breaks down the way that the Australian dollar has, it takes an extraordinarily strong move to break the pair down further and simply slice through one of these barriers.

One would have to assume that once the coronavirus scare leaves the headlines, the Australian dollar will be one of the more attractive currencies. This is suggested by the 0.67 region, which has been important going back several decades. That being said, a certain amount of patience would be needed to take a long position.