Bitcoin continues to impress as central banks look to ease

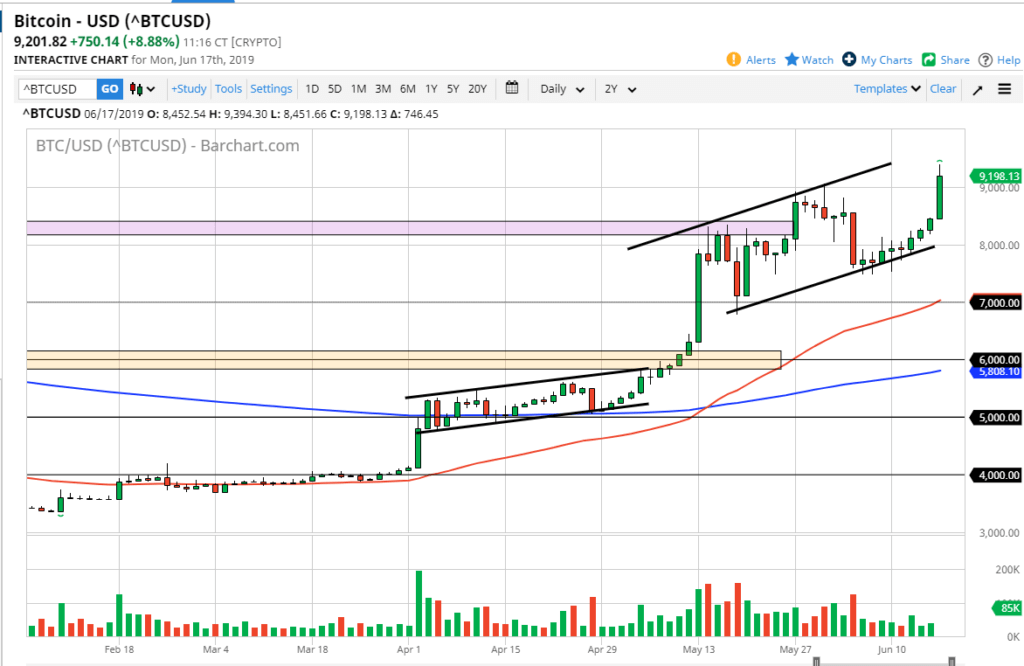

As we have seen over the last several months, bitcoin continues to show signs of strength. The Monday session wasn’t any different as we broke above the $9000 level, carving out a fresh, new high for this latest move. That being said, there are a multitude of reasons why this market may continue to go higher from here.

Central banks are extraordinarily loose

Central banks around the world continue to be very loose when it comes to monetary policy. This of course has money flowing away from fiat currencies and into the crypto markets. With the Federal Reserve having a statement released on Wednesday, that could be yet another reason for crypto to gain value as the Federal Reserve steps away from any hint of tightening, and adopts a relatively loose policy, just as the European Central Bank has, and most certainly the Bank of England has.

The size of the candle also matters

Bitcoin

The size of the candle for the trading session of course signifies and perhaps we are going to see buyers jumping into the market, and the fact that we have cleared the $9000 level shows signs of strength yet again. Beyond that, the candle is much larger than the previous 10 or so, so that shows a new rush of money into the marketplace. That of course is a good sign, as it shows more people willing to step in and pick up crypto.

Various levels

there are multiple levels that we should be paying attention to, not just the $9000 handle that has been broken. When you look at the channel on the chart, you can see clearly that the $8000 level should be supportive, so I think that any pullback at this point will find buyers closer to that handle. Quite frankly, I would be a bit surprised to see the market reach down there but it is essentially the “floor” in the market currently.

The most obvious level above will be the $10,000 handle, as it is a large come around, psychologically significant figure. That will attract a lot of attention, so obviously any time we get close to that area we will probably see sellers coming back in to push back. I do believe that eventually we can break above there though, but it’s obviously going to take several attempts. In the meantime, I believe that the pullbacks will continue to be thought of as value.

The main take away

the main take away is that Bitcoin is now a market that is obviously bullish and cannot be treated any other way. I like the idea of picking up Bitcoin every time we pull back, as long as we can stay above the 50 day EMA, which is pictured in red on the chart. That also extends down to the $7000 handle, so quite frankly there is no scenario right now where we should be looking at selling. Value hunters should come back into this market plays, pushing towards the inevitable 10,000 level above.