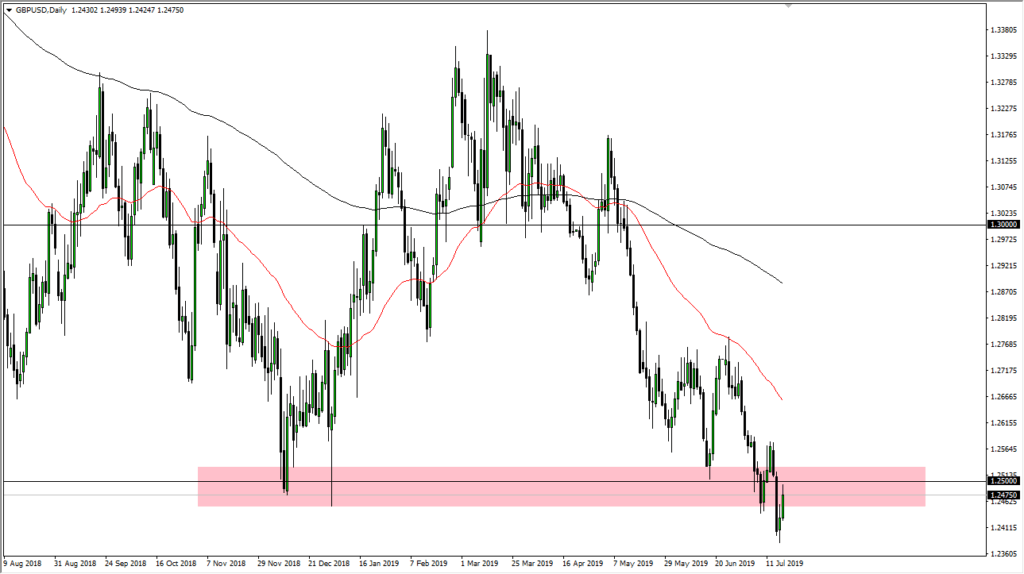

British pound approaching crucial 1.25 handle

The British pound rallied significantly against the US dollar during the trading session on Thursday, reaching towards the 1.25 handle. That’s an area that has been previous support so it should now be resistance. We have sawtooth action going through the major area, and that does tend to take out a lot of the order flow. If that’s going to be the case, the 1.25 level will be much less important.

Psychologically significant figure

GBP/USD

The psychologically significant figure of 1.25 attracts a lot of attention, because quite frankly large orders tend to be attached to the large figures, and therefore it’s likely that the area has attracted a lot of volume. There is resistance not only the 1.25 handle, but it seems as if it extends at least 60 pips higher. Beyond that, we also have resistance at the 1.2750 level.

All of these areas could cause significant selling pressure, and as we are in a downtrend it makes sense that we would continue to see this pair drop. Beyond that we have the 50 day EMA which is racing towards the current price action, and that of course will attract a lot of attention by itself.

Federal Reserve

The Federal Reserve is looking to cut interest rates, and that of course does work against the value of the US dollar. However, the problems with the Brexit continue to be a major issue, and therefore it’s likely that the concerns about having no deal will outweigh anything that the Federal Reserve is looking to do. Remember, even though they are cutting rates, the British leaving the European Union without a deal is probably more significant than a 25 basis point cut.

While this does give a little bit of a reprieve to the British pound, the reality is that the British pound looks toxic against almost any type of currency, not just the greenback. With that being the case, it’s obvious what traders are focusing on here.

The play going forward

The play going forward is to simply sell the British pound. It’s the same situation that we been in for some time, and every time we rally you should be looking at the chart as offering value in the greenback. Yes, the Federal Reserve is going to work against the value of the greenback but at this point the significant possibility of a “no deal Brexit” outweighs anything else when it comes to the British pound. The 1.25 level has been support, so that of course offered significant resistance. I see several areas above that could cause major resistance, so quite frankly it’s only a matter of time before we continue the downtrend.

The 1.2560 level above is also resistance, so even if we were to break above the 1.25 handle, the market has plenty of reasons above to cause issues. Overall, the market is very negative and there’s no need to fight it. The Forex world is littered with the bodies of those who have been trying to “pick the bottom” of this currency pair.