British pound continues to reach higher against Japanese yen

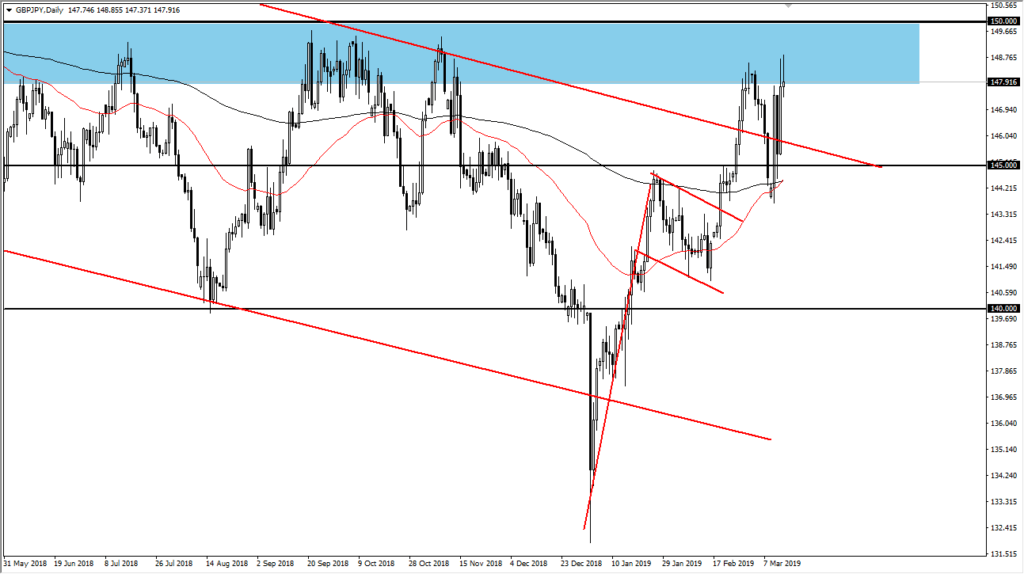

The British pound rallied a bit during the trading session on Thursday, reaching into the resistance area that has been so crucial in the past. We gave back quite a bit of the gains to turn around and form a slightly negative looking candle stick, as we continue to struggle to reach higher.

Just above, we have the ¥150 level, an area that will cause a lot of concern and resistance based upon the previous action, and of course the large come around, psychologically significant figure. If we were to break above the ¥150 level, obviously that would be a very bullish sign, sending this market much higher.

Crucial votes this week

there have been a handful crucial votes during the week, coming out of the United Kingdom Parliament. That being the case, the market looks very likely to remain noisy, as we try to figure out exactly how the United Kingdom is leaving the European Union, if at all. At this point, there are a lot of questions when it comes to the procedure for leaving the European Union, and that in and of itself will continue to cause significant trouble for Sterling. It doesn’t necessarily mean that we are going to break down drastically, but we will have both up and down momentum in order to try to break out for a longer-term move.

Expect a lot of headline risk and headline noise, which should continue to cause major issues in this pair, as it is not only sensitive to all things Britain, but it is also going to be sensitive to headline risk in general as this pair is highly reactive to global markets and economic headlines.

Support below

There should continue to be plenty of buyers underneath, based upon the previous downtrend channel, and of course the ¥145 level. Looking at this chart, there should be plenty of buyers in that area based upon previous action and of course the psychological importance of that level. I think in the short term, we should see plenty of support underneath that will continue to attract a lot of interest. Looking at this chart, the 200 day EMA is just below as well, and we are looking at the 50 day EMA pictured in red getting ready to cross above the forming a “golden cross.”

Both of those moving averages will more than likely be crucial and attract a lot of attention. The fact that they are just below the ¥145 level of course adds even more strength to the support level. Ultimately, when I look at this chart the first thing I notice is a bullish flag, and therefore it’s likely that we will continue to see a lot of buyers underneath. Overall, I am still bullish of this market but I also recognize that there is a lot of noise just waiting to happen.

Buying on the dips

Looks very likely that this market will continue to attract a lot of buyers, so the main take away is that buying on the dips should continue to be the best way forward as we try to build up enough momentum to finally break above the ¥150 level and go towards the ¥155 level based upon the bullish flag.