British Pound Sells Off Against Yen

- GBP/JPY major risk barometer

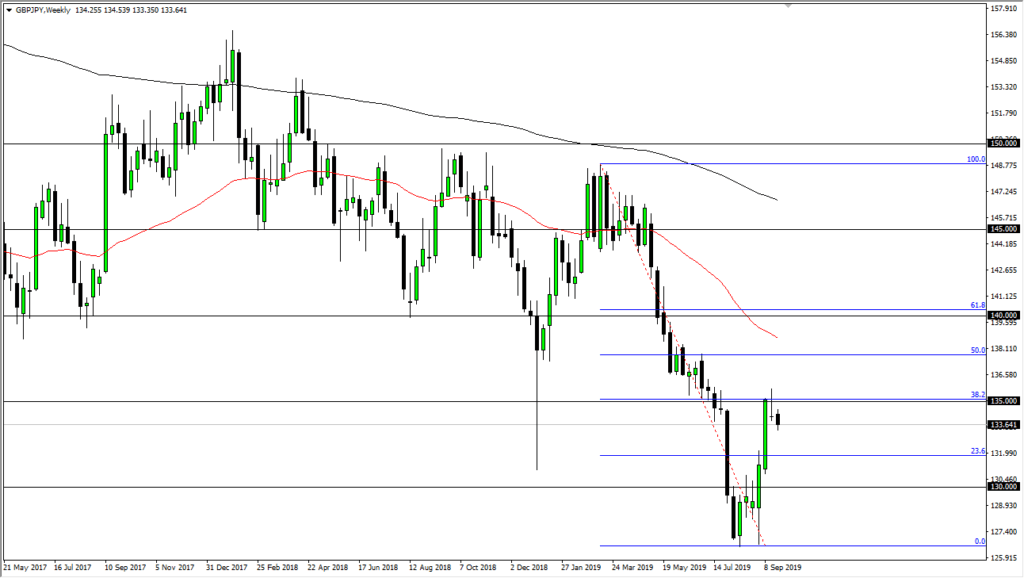

- British pound breaks bottom of shooting star on weekly chart

- Major Fibonacci retracement level

- Downtrend continues

The British pound broke down through the bottom of a shooting star on the weekly chart to kick off Monday, showing signs of negativity yet again. This is a currency pair that is highly sensitive to risk appetite in general, as the British pound is considered to be a riskier currency, especially these days with Brexit. Meanwhile, the Japanese yen is the exact opposite, being the first place money runs to when looking for safety.

Technical setup

GBP/JPY weekly chart

The technical setup for this pair is quite interesting as the ¥135 level has offered significant resistance. The shooting star from the previous week is a very negative sign, and the fact that the pair gapped lower to start the shooting star suggests there is plenty of negativity out there. Typically, when a shooting star gets broken to the downside, it brings in more sellers as a lot of people start to get trapped.

The 38.2% Fibonacci retracement level was right at the ¥135 level as well, so it is most certainly an area of interest. By breaking down through the shooting star, it opens up a move to much lower levels – possibly the ¥130 level next, as it was previous resistance. The 50-week EMA is just above the 50% Fibonacci retracement level, closer to the ¥138 level. The fact that the market has bounced as high as it has over the last couple weeks suggests that a bit of a “dead cat bounce” has come into play.

Fundamental issues

There are many reasons to think that perhaps traders would be a bit skittish. For one, the Brexit situation doesn’t seem to be getting any better. That obviously has an effect on the British pound, but beyond that, it has a major effect on global growth. Speaking of global growth, that too is something a lot of traders are concerned about as trade wars, economic weakness, and a potential global recession continue to be a major issue.

Rallies at this point will probably further be sold into, as there are a lot of concerns out there geopolitically as well. It seems the Japanese yen is probably going to continue to attract a lot of monetary flow, not only from the British pound, but also from several other currencies around the world.

Longer-term, the world certainly looks to be taking on a “risk off” scenario, unless something drastic changes. Going forward, at the very least this pair should pull back, even if the trend were to change simply because 800 pips in two weeks is a bit much. In other words, it makes much more sense that the pair drops in the short term.