GBP/JPY looking to recover

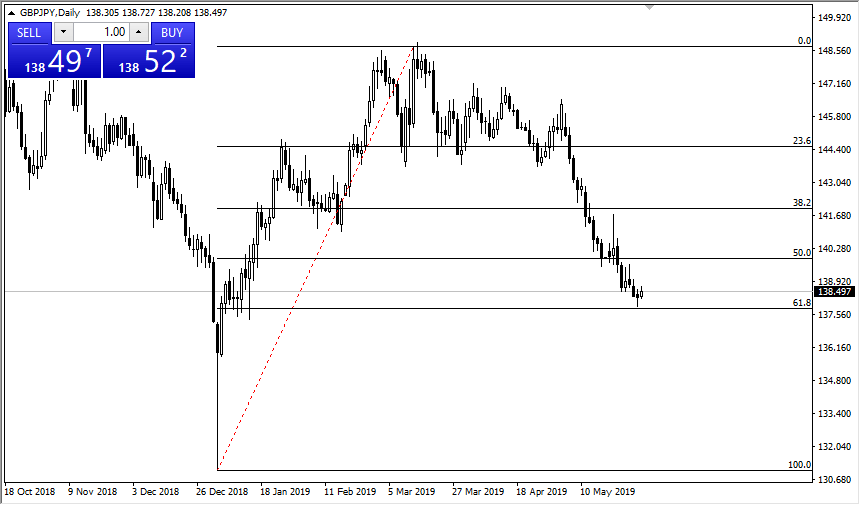

The British pound has reached the 61.8% Fibonacci retracement level against the Japanese yen. This coincides nicely with the ¥138 level, so there’s a very strong chance that some technical buying could be occurring in this area. The candlestick action for the trading session on Thursday of course has done nothing to dissuade this line of thinking. It would make sense to get a bit of recovery after the massive selloff that we have seen, as the market has certainly found itself to be oversold.

British pound undervalued

Unless you believe that the United Kingdom is going to collapse, it’s a bit difficult to justify some of the selling of the British pound at this point. After all, the Brexit is no longer a mystery, and at this point things are so oversold one would have to think that a “hard Brexit” is already priced in. If that’s the case, we will probably get one more final flush lower, and that will be it.

Technical levels

GBP/JPY

You always have to watch technical levels one trading Forex, as it is such a technically driven market for major moves. There are a lot of algorithms the trading here, and of course large, round, psychologically significant figures always attract a lot of attention. With that being the case, I find the 61.8% to the not you retracement level certainly interestingly an area to find buyers. The fact that it is at the ¥138 level, an area that has caused some significant move in the past makes a lot of sense as well.

To the upside, you could see the ¥140 level be tested on a bounce, which of course makes sense to me as well, as it is a round figure and an area that has caused the line of noise. That being the case it’s likely that we will see a lot of back and forth between the ¥138 and the ¥140 level. However, I do think that this is upper in a short-term buying opportunity from an oversold market condition.

The alternate scenario of course is that we break through all of the noise at the ¥138 level, which I have determined to be the is ¥137 level. Of below there opens up the market down to the ¥135 level. In a sense, this has become a “binary trade.”

The main take away

Short-term traders will probably look to take advantage of the selloff that we have seen. That being the case, it’s very likely that the market will have a bit of a bounce but those of you who are a little bit more macro oriented will probably look to be selling at the ¥140 level. If we do breakdown below the three level, then the market should unwind rather drastically and reach towards the ¥135 level.

It’s somewhat unlikely to see a major move in the short term, because the Brexit is still somewhat up in the air and of course we are heading into the summer time which is historically quiet anyway.