Crude Oil at a Crossroads

- Crude oil markets continue to face demand destruction

- Saudi production back to full capacity

- Break of support could lead to a big move

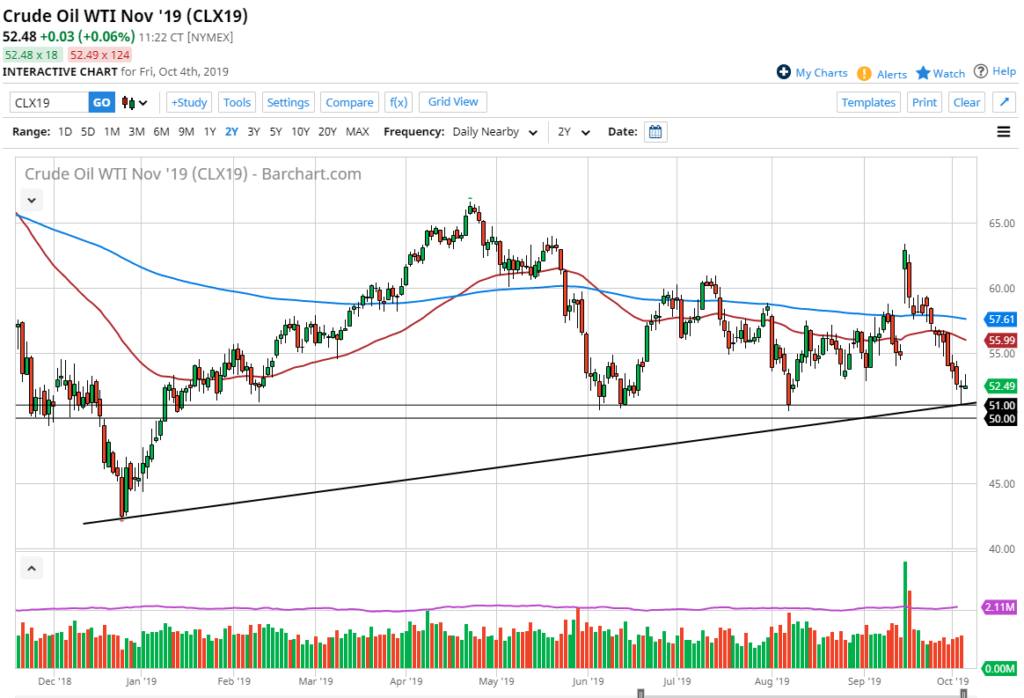

The West Texas Intermediate Crude Oil market has initially tried to rally during the trading session on Friday, but it has turned around to show signs of weakness again. As we had formed a hammer during the trading session on Thursday, it could be thought that a bounce could be coming. However, that has failed to materialize, or at the very least, it has failed to stay intact. Ultimately, this foretells potential moves to the downside.

Major confluence of support

There is a significant amount of support to be found just below, as made evident by the hammer that formed on Thursday. The $51 level was where the market stopped and turned around, but it is also the scene of a potential uptrend line. Furthermore, there is a thick “zone of support” that has held this market higher for some time. Now that the drone strike news has abated, it looks as if we may be running out of steam based on the shooting star being formed after the reactionary bounce.

At this point, a break down below the $50 level would, of course, be very bearish, and could open up the floodgates for a larger move to the $45 level. Keep in mind that we have already wiped out the gap from the drone strike in Saudi Arabia, so it’s obvious that the markets are extraordinarily bearish. By blowing through that gap, it means we are actually worse off from a pricing standpoint than we were before the attack.

Fading rallies

The market could rally from here, and the fact that the daily candlesticks over the last 48 hours will form a hammer and a shooting star suggests we are going to try to build up enough inertia to make a move. If the market breaks to the upside, the 50-day EMA painted in red on the chart will more than likely be the first technical barrier of significance, although market participants could see some selling pressure at the psychologically important $55 level. It probably makes the most sense to look for a daily shooting star or some type of bearish candle and take advantage of it.

October 4 oil chart

Demand uncertainty

The biggest issue that crude oil faces right now is that demand has been falling. The inventory numbers coming out of the United States have been showing large builds, meaning there is a lot less in the way of demand. With that, it’s very likely that the bearish pressure will continue, and that will be especially true if the US does in fact slow down. There seems to be a serious lack of demand from other parts of the world, including China and the European Union, which of course puts bearish pressure on energy in general.