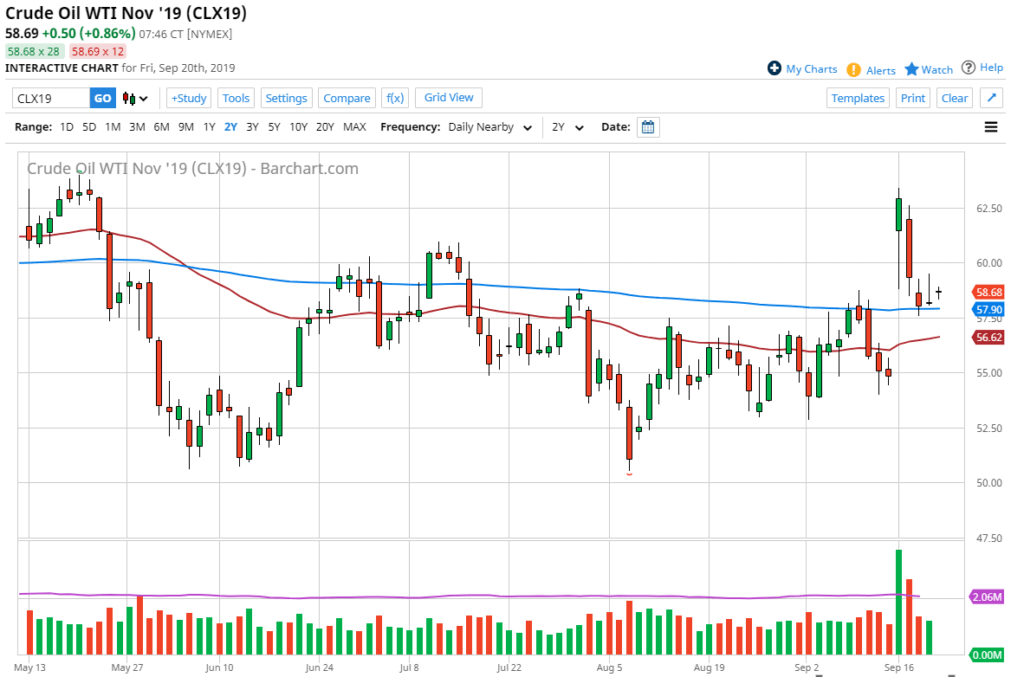

Crude Oil Begins to Stabilize

- Crude oil markets still have a gap to fill from Saudi drone attack

- Currently sits above 200-day EMA

- Oversupply will be a longer-term issue

West Texas Intermediate Crude Oil futures have been slightly bullish in early trading on Friday, but at the end of the day, the market still has plenty of negativity attached to it. This is despite the fact that there was potential fear about a disruption of supply coming out of Saudi Arabia.

After the drone attack, the initial gap was brutal. It was the single most explosive gain that the futures market has ever seen in certain grades of crude oil. However, since then the Saudi Arabian government has announced that production should be back online in normal amounts by the end of the month. This obviously was a huge relief for the market, and we are starting to see prices reflect that.

Filling the gap

There is a big gap underneath that still needs to be filled. This tends to happen in futures markets. As the fundamental reason for the gap is going away, it is only a matter of time before this move takes place.

With that being the case, the market is very likely to continue to drift towards the bottom of the gap which is closer to the $55 level. However, the market is currently just above the 200-day EMA, which may factor into the speed of the move. With that being said, there have only been two gaps left unfilled in the last 30 years, so odds certainly favor falling from here.

Technical analysis

Crude Oil technical analysis

The technical analysis for WTI Crude Oil is relatively simple. The gap needs to be filled and the $55 level is at the bottom of that gap. The $55 level has historically been important, as this market is very sensitive to $5 and $10 intervals. If you lay a grid on the chart, you can clearly see how important these levels are.

If we do rally from here, the $60 level will offer resistance. Most certainly, the $62.50 level will do so too, as it was where the market gapped to at the open this week.

Reaching that level would be rather surprising, and going above would almost certainly need some type of catalyst to make that happen. Currently, it doesn’t look likely and therefore a simple drift lower is the most predicted of outcomes.

Once the market breaks below the blue 200 day-EMA, it’s very possible that the “bottom will fall out”. A lot of the longer-term algorithms will recognize the market as entering a bearish position.

When the market fills the gap, it will be time to reevaluate the entire situation. Between now and then, it’s the most important factor in this chart, and it will certainly drive quite a bit of flow into the market.