Crude Oil Markets Looking for Buyers

- Crude oil pulling back to the technical indicator

- Fibonacci studies suggest buyers in the area

- Stability after a couple of rough trading sessions

Friday trading saw more negative momentum for crude oil as the market dropped just below the close of the Thursday session.

This would have been somewhat influenced by the jobs number coming out lower than anticipated, but they were within the realm of tolerance, so that will probably be limited in the influence that is seen in this market.

Technical analysis

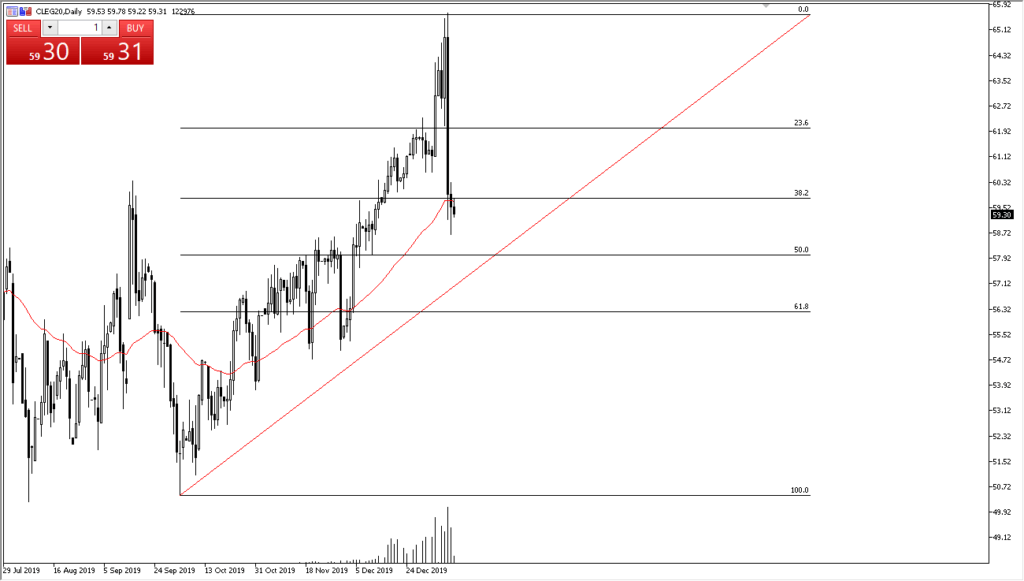

WTI futures chart

The West Texas Intermediate Crude Oil market got absolutely pummeled once it became obvious that the United States and Iran were not going to war. Because of this, a massive negative candlestick was formed for the Wednesday session. But Thursday was quite interesting in so much as the market fell, but then turned around to form a hammer.

This is what’s going to make the Friday close so crucial. If the market breaks above the top of the hammer from Thursday, then it’s very likely to recover some of those losses, although recovering all of them would be a bit of a stretch. In other words, there may be a bit of a short-term bounce.

The 50-day EMA cuts right through the candlestick on Thursday and Friday as well, so that will attract a certain amount of attention. Beyond that, we are trading between the 38.2% Fibonacci retracement level and the 50% Fibonacci retracement level, a “zone” that people will go looking to for opportunity. After all, there are going to be people out there that missed out on the grind higher.

It was a very sleepy market which then reached towards extremes after the assassination of General Soleimani of Iran and the subsequent missile strike in retaliation. However, cooler heads have prevailed and it’s obvious that there will be no war, so that takes some of that risk premium out of the market.

It is because of this that it shouldn’t be overly surprising if the market does in fact recover, albeit in a much slower manner than it fell apart. That being said, if the market breaks down below the $56.32 level, the trend will be decidedly negative as we will have taken out the 61.8% Fibonacci retracement level.

Still a positive trend

The main takeaway from this market is that, although there has been a massive move lower, the trend is still positive. On a break above the top of the Thursday session, that would show some resiliency that leads to a bounce to the high as $62.

However, if the market does in fact break down from here, the 50% Fibonacci retracement level at $58, and eventually the 61.8% Fibonacci retracement level at $56.50, both need to hold. If not, crude oil will be in serious trouble.