Do you love range bound markets? Try this one

There are different types of strategies out there to employee. Some traders are better at trending markets, some players in the market like the idea of trading countertrend moves, and some of you out there love range bound markets. Unfortunately, far too many people focus on the obvious markets.

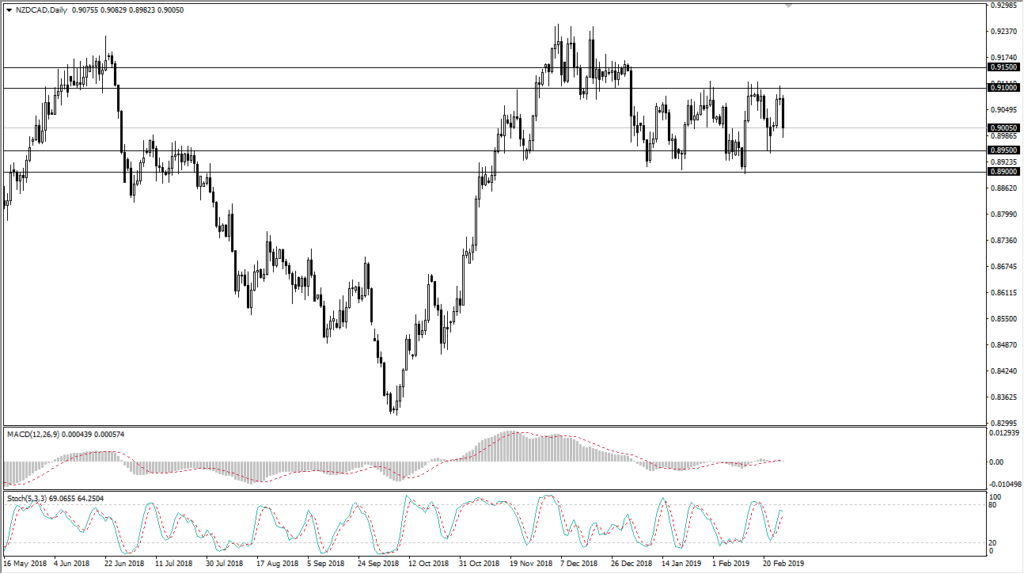

Enter NZD/CAD

When you are trading the New Zealand dollar against the Canadian dollar, you are trading a couple of commodity currencies against each other. That in and of itself will quite often cause a lot of confusion and noise, and therefore you will see high correlation between most currencies that follow commodities. In this case, New Zealand is a bit of a proxy for agricultural markets in Asia, while the Canadian dollar is obviously highly levered to oil. When you look at commodities, they are starting to stall a bit, and therefore it’s difficult to pick a clear winner. Beyond that, you have the Canadian economy that seems to be slowing in general so there’s no reason to think that suddenly were going to see massive Canadian strength.

Consolidation lasts until it doesn’t

This is in exactly the most comforting statement, but it is true. Looking at this market, we have gone back and forth over the last couple of months, and there’s nothing out there that tells me things are going to change. However, if we break down below the support level that I have marked on the chart that extends down to the 0.89 handle, and we get some type of break out in the crude oil markets, then you have a strong case for shorting this pair. That makes quite a bit of sense, as the two are so highly levered to each other.

However, if the market breaks out to the upside and above the 0.9150 level, and we get some type of deal between the Americans and the Chinese, that might be enough to push this market towards the 0.9250 level. It’ll be very interesting to see whether or not that can happen as there are so many different inputs.

Simple back and forth trading can be profitable

If you use a relatively small position and simply trade back and forth, you can make quite a bit of money in the Forex markets, especially in these cross currency pairs. This is an example of one of those markets, just as the CHF/JPY pair will be, because both of them are safety currencies at times. With that in mind, this is one of the more interesting pairs right now, because it has been so reliable as of late. If we do break down below the cluster at the 0.89 level we could go as low as 0.87, which is a much bigger move than I would expect to the upside. However, until we are told different this looks like a short term back and forth situation.

The main take away

Simply put, selling at the 0.91 handle has worked for several months, just as buying at the 0.8950 level has worked. These are massive moves, but if you can catch these moves time and time again, you’ve done quite well. If we break down below the 0.89 handle on a daily close, the games up and we need to break down. At that point, you can start shorting and aiming for larger moves. If we can break above the 0.9150 level, then we may have about 100 pips to the upside before we face major resistance.