EUR CHF continues to chop back and forth

The EUR/CHF pair continues to chop back and forth, but on Friday did see a bit of buying underneath the turn things around. In fact, we are currently forming a technical pattern, or at least look like we are, that could be very bullish. So with that being the case I think that it’s very difficult to start shorting this market, which makes a lot of sense considering that the Swiss franc has been hammered against many other currencies.

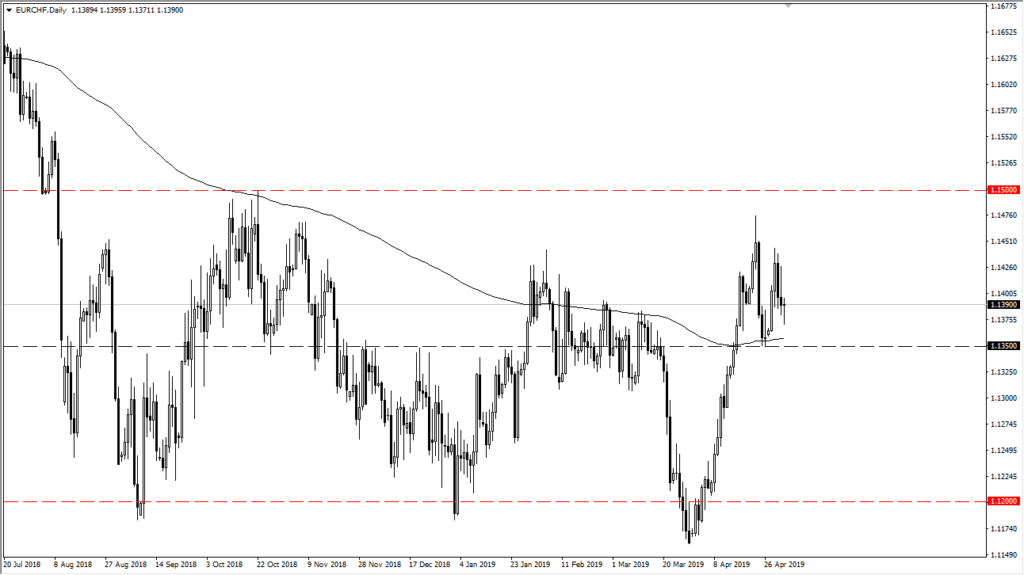

EUR/CHF Daily

Support just below

Keep in mind that there is significant support just below, in the form of the 1.1350 level. We have seen a bounce from there, and as a result it makes sense that we did in fact rally a bit. The 200 day EMA underneath, pictured in black on the chart, should continue to offer technical support as well. Ultimately, this is a market that has been very volatile over the last several days, but as you can see on the chart, I have significant levels marked quite clearly.

If we were to break down below the 1.1350 level, that would also be very negative. If we break down below that level, we could open up the door to the 1.13 level, perhaps even the 1.12 level over the longer-term. That would continue the Euro selling overall and would be extraordinarily negative in this pair as the Swiss franc has been so soft.

Resistance to the upside

there is resistance to the upside though, so you should keep the level of 1.15 level above in the back of your mind. Overall, if we were to break above there the market should continue to go much higher, perhaps reaching towards 1.18 level longer-term. This is a pair that is sensitive to the risk appetite as well, as the Swiss franc is the ultimate safety currency.

I would expect a lot of choppiness though, so it may be better suited for short-term back and forth trades, using the 1.1350 level as support, and the 1.1450 level above as resistance. It simply trading back and forth is a viable strategy when the market does this type of action. I do favor the upside in general though, but I recognize that the 1.15 level is a major area that will take a lot of effort to get above, but if we do then the momentum will really start to pick up.

The main take away

The main take away for this pair of course is that you can expect a lot of choppy volatility but given enough time it’s likely that the ultra-short-term charts could be the way to go, with an eye on these larger levels that I have mentioned. I like the idea of playing this range back and forth, taking my profits at the extreme outside of the 100 PIP in a range, but getting even more aggressive on a break to the upside. The downside would only be aggressive if the EUR/USD pair continues to break down, as it would show significant weakness in the common currency.