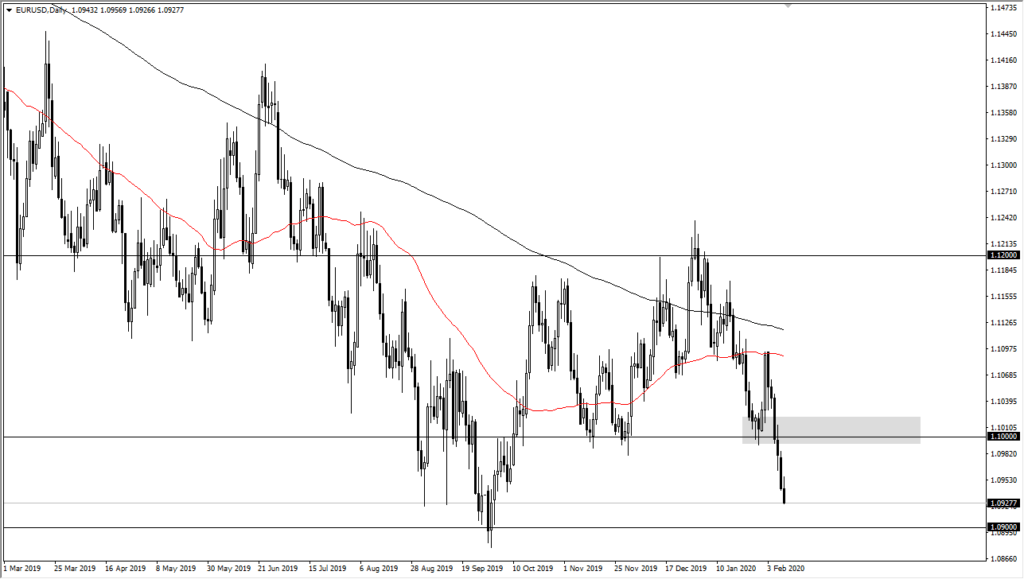

Euro Falls With Sentix Showing Signs of Further Weakness

- Sentix measures weakness in investor sentiment

- Euro has been accelerating to the downside for months

- US dollar continues to work against euro

The euro fell again on Monday, while the Sentix Investor Confidence month over month figures came out worse than anticipated. The Sentix is considered to be a leading indicator of economic health in the European Union, as roughly 2800 analysts and investors are surveyed about the relative economic outlook for the European Union for the next six months. Obviously, with much more in the way of optimism, the theory is that asset prices and currency should rise.

The Sentix numbers

The Sentix announcement came out at 5.2, much less than the anticipated 6.1. The previous one had been 7.6, showing a decline in investor sentiment that is rapidly accelerating. This should continue to weigh upon the euro and all assets related to the European Union in general. Furthermore, it shows just how divergent the European Union is from North America, with the United States in particular. The market continues to favor safety in general, and it is not only the euro that is getting hammered. That being said though, the EUR/USD pair is essentially the easiest way to measure US dollar strength or weakness.

The announcement shows just how pessimistic the market is becoming, especially with the coronavirus now starting to work against growth and the sentiment as well. It therefore looks like an acceleration of negativity will be the way going forward, at least in the short term. The euro has been in a negative test for some time, dropping for the last several years in a row. This should be a continuation phase, as there is no reason for the markets to suddenly turn around. The lack of news flow for the next 24 hours could also have been a major contributor to the fact that there is no reason to get overly optimistic, and therefore the greenback will continue to attract flow from not only the euro, but from commodity markets as well.

The EUR to continue dropping

EUR/USD yearly chart

Going forward, it’s very likely that the euro will drop to the 1.09 USD level, followed by the 1.08 level and then finally the 1.0750 level as it is a major gap on longer-term charts. That gap has not been filled, and markets over the longer term do tend to try to do such things. Rallies at this point continue to show plenty of exhaustion, and therefore it should continue to be a nice shorting opportunity. The 1.10 level above should offer resistance, as it was previous support.

Pay attention to US numbers as it could give a boost to the euro, as it would rebalance US dollar demand. Ultimately, trying to buy this market is somewhat like “catching a falling knife.”