Euro likely to be quiet most of the week

With the European Central Bank announcement on Thursday it is likely that we are going to be very quiet. That being the case, it’s likely that the market will simply be somewhat range bound between now and then, because there is always concerned about what the central bank will say, and more importantly what it will do. After all, we are in an environment where interest rates are extraordinarily low around the world, and it seems as if liquidity measures are going to be enhanced.

ECB versus Fed

EUR/USD

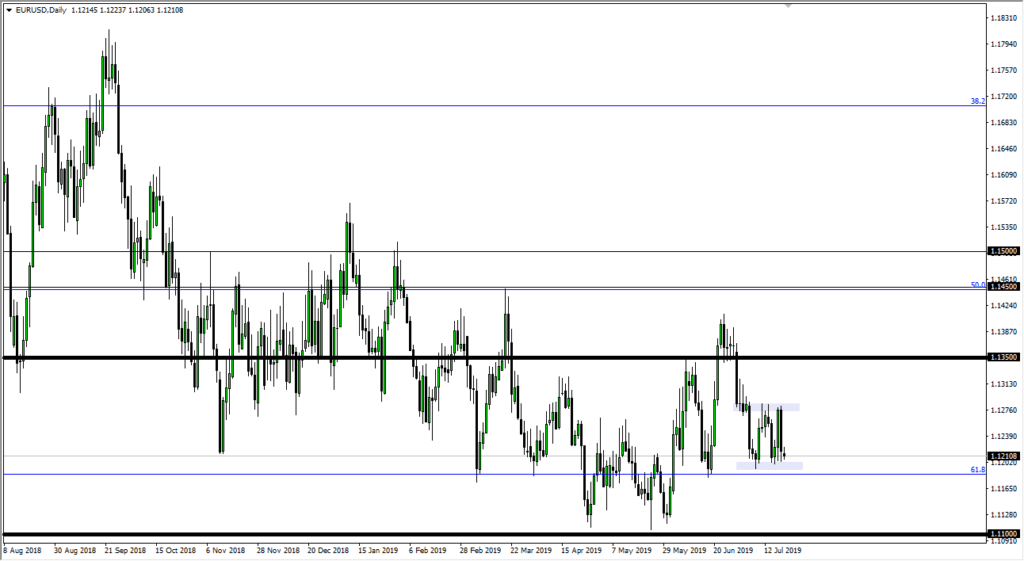

The European Central Bank and the Federal Reserve both look likely to cut rates or at least add liquidity measures in the short term, so that is negative for the underlying currencies, so at this point it’ll be interesting to see how this pair reacts. Looking at this chart, we could find ourselves going range bound for the rest of the week, as we wait to see what the ECB is going to do in reaction to the Federal Reserve essentially announcing that interest rates were coming.

In the short term, it’s very likely that the 1.12 level will continue to attract buyers, while the 1.13 level above offers resistance. Market participants will be lulled to sleep over the next couple of days until we can discern what the ECB is in fact going to do. Ultimately, it does look as if we are trying to form some type of bottoming pattern, as you can make out a bit of a “rounded bottom.”

Remember, the Federal Reserve gets what it wants given enough time, and anybody who has been in the market for long enough time knows that “you don’t fight the Fed.” Ultimately, the 1.10 level underneath will be difficult to break through, especially considering that the 1.11 level is also a massive support. This market will be very choppy going forward regardless of what happens, but anybody who has traded the Euro for more than about 10 minutes knows that’s the normal state of things.

The trade going forward

Over the next several days, it’s simply a matter of employing some type of range bound system in this 100 point range that we are stuck in. If we do break out of there, then it opens up a potential 100 point move based upon the measured move. That being said though, it’s very unlikely this happens between now and Thursday, but you should be aware of all possibilities.

I would simply look to short-term charts to take advantage of the range that is clearly laid out on the chart, and not try to over complicate things. The ECB will do what he can to show signs of weakness, but at the end of the day the Federal Reserve is more likely to win the fight, and of course send cuts into the marketplace and perhaps even a dovish statement to turn things around and even if we do break down. Expect a lot of choppiness, but take advantage of that over the next couple of days.