Euro looking supported against Canadian dollar

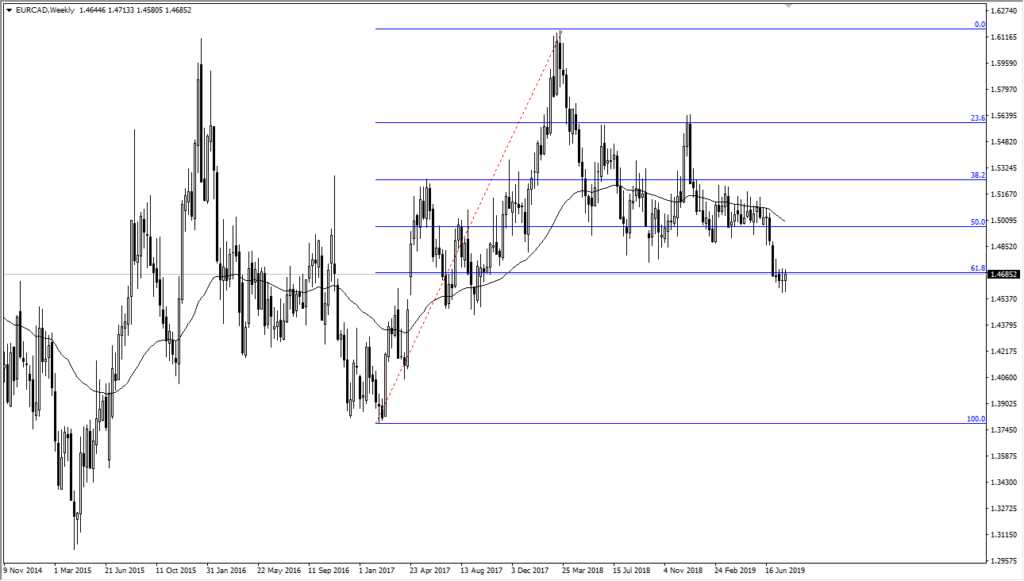

The Euro has had another week of support against the Canadian dollar at a crucial level again. The 1.15 level course has attracted a lot of attention, but we also have the 61.8% Fibonacci retracement level in this region. The fact that we have formed a couple of hammers again also suggests that perhaps the Euro is ready to start rallying.

Beyond that, we also have the Canadian dollar falling against the US dollar, it’s main measure of strength. Overall, it looks like the Canadian dollar continues to struggle, and therefore it shouldn’t be a huge surprise that the Euro is rallying from here. All things in equal though, we have to point out the fact that a break down below these couple of candlesticks could be negative, perhaps reaching down towards the 1.39 level.

Setting up for a larger move?

EUR/CAD Weekly

The larger move that could be setting up is pretty significant. As I mentioned previously, if we break down below the previous couple of candlesticks, that could send this market much lower. At this point, I think that the 1.39 level would be a potential target, considering that the 100% Fibonacci retracement level is at that area.

The alternate scenario is that if we break above these couple of candlesticks, then it could send this market to much higher levels, probably the 1.50 level after that. That is an area that has a lot of noise, and therefore it makes sense that it would be difficult to break through there.

Being patient will be rewarded

Being patient with this market is going to be rewarded from what I see. This is because we have the potential move of five or six handles. With that, I look at this as a trigger that would be fired off on a daily close either below this candlesticks or above the last couple of ones. Ultimately, I think that this market is also being moved by the oil market, and therefore we should pay attention to that as well. The market of course will be just as choppy as the rest of the markets are. However, once we get some type of impulsive candle stick we can then start to put serious money to work.

As this is a longer-term set up, you can probably use a smaller position, as it gives you the ability to hang onto the trade until we get clarity. If we do break down, then I would be looking for selling opportunities on short-term rallies that show signs of exhaustion on lower time frames. To the upside, I might not be as aggressive, because quite frankly there isn’t as much room to get moving. All things been equal though, it’s very likely that if you just wait, the trade should make itself very apparent. The 1.50 level above being broken would of course be an extraordinarily bullish sign. That would obviously create a lot of attention for this market, so at this point I think that the prudent thing is to let the signal fire off.