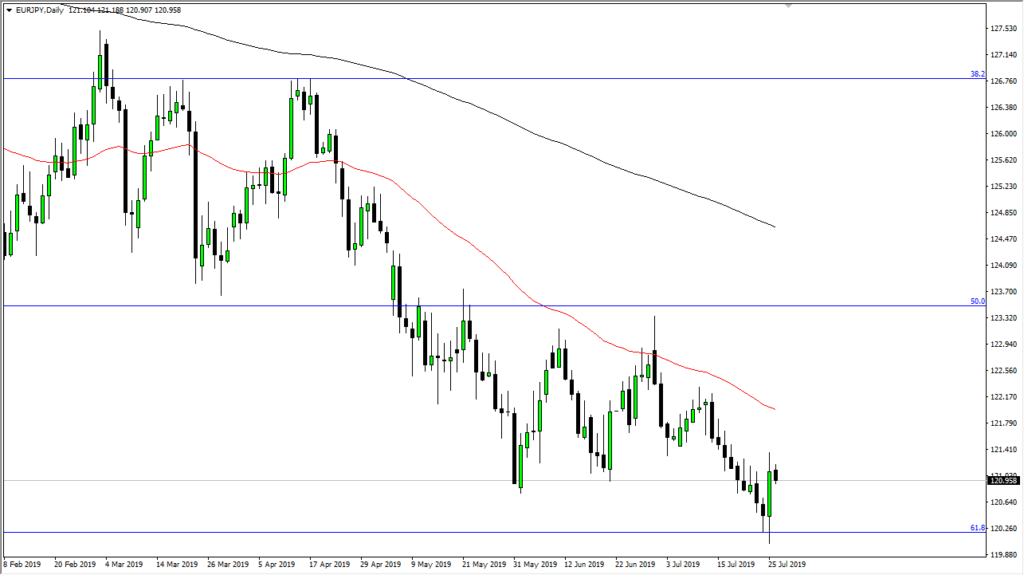

Euro looks likely to bottom against Japanese yen

The Euro formed a massive candlestick after the ECB meeting on Thursday, one of which would be called a “bullish engulfing candlestick.” This is a very bullish reversal signal and now has more or less put a “line in the sand” at the ¥120 handle. Because of this, we could be in the midst of a trend change.

Bullish engulfing candlestick

The candlestick that formed for Thursday does look very bullish, especially considering that we have broken above the top of the several inverted hammers in the process. Now that we have gotten the ECB meeting and press conference out of the way, it’s very likely that we can start to trade out of facts and a lot less from fear. This pair is obviously very choppy to the downside, and the fact that we formed such a bullish candlestick does suggest that perhaps we are starting to turn things back around.

What’s even more important to me is that we found this candlestick at the 61.8% Fibonacci retracement level and of course the ¥120 handle. These large, round, psychologically significant figures can be the scenes of turnarounds, but obviously, we need to see a bit of stability in the short term before a potential turnaround.

EUR/JPY Chart

Risk appetite

Keep in mind that this pair is highly sensitive to risk appetite, as the Euro will gain against the “safety currency” Japanese yen. I think at this point we will see a lot of choppiness as the market tries to gain its footing. Quite frankly, I think one of the things working against the move on Friday is probably the fact that we are heading into the weekend, so I would read too much in the way of negativity based upon the slightly negative candlestick. I think at this point we could continue to drift a little bit lower, but if we can get some type of “risk-on” signal from the world stock indices or commodity markets, that could turn things around right here as well.

The trade going forward

The trade going forward, of course, is to buy this market as long as we can stay above the ¥120 level. Ultimately, this is a market that will be very noisy, but from a longer-term standpoint, this could be an excellent entry point if you can position size your trade correctly. Short-term pullbacks continue to offer buying opportunities, just as a break above the ¥121.50 level, which would be a break of the thick candlestick from Thursday, should also offer a buying opportunity as it would show strength.

That being said, if we wipe out the candlestick from the Thursday session and close below the ¥120 level, that means that we not only fall from there, but we probably fall quite significantly. That could open up a move to the 100% Fibonacci retracement level, which would be the ¥110 level. Either way, I think we are about to see a significant move in one direction or the other. Currently though, it looks like we probably are trying to change the trend overall to the upside.