Euro range bound against Canadian dollar

The Euro rallied slightly in early trading on Wednesday, as we continue to see a range hold in this pair. With the ECB looking to loosen monetary policy, or at least suggest that it was going to extend bond purchases, it makes sense that the Euro might be a bit soft. Simultaneously, the Canadian dollar is highly levered to the crude oil markets, which of course have been relatively soft as well. With all of that, we have a fight between a couple of lightweights here, so it makes quite a bit of sense that the market can’t go anywhere. However, this can provide a nice trading opportunity for those who are diligent.

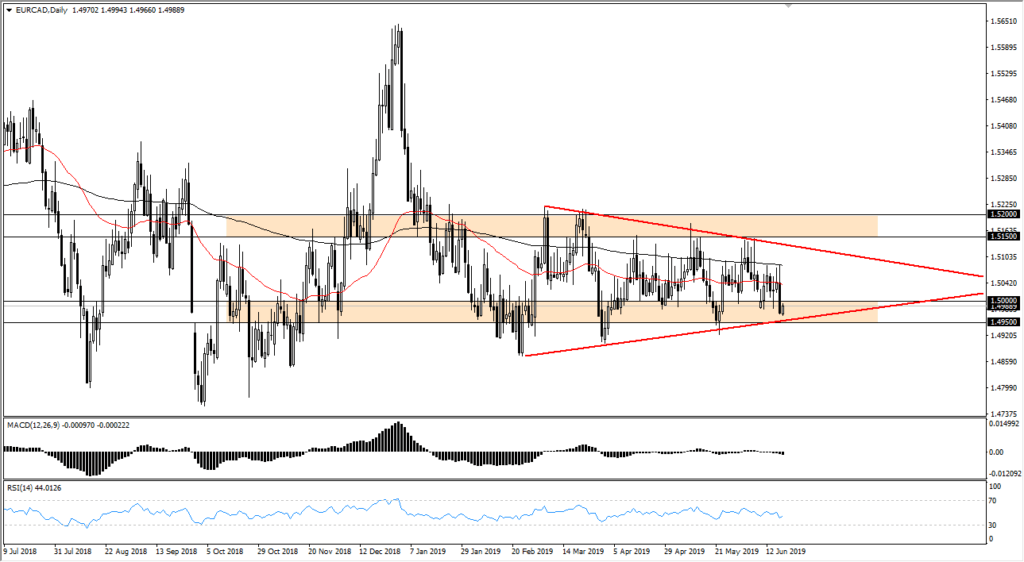

Support and resistance levels

EUR/CAD chart

In this pair, we have a couple of obvious support and resistance levels that we can look for guidance. The 1.50 level is the beginning of support down to the 1.4950 level, while the 1.5150 level above is significant resistance that extends to the 1.52 handle based upon historical trading. As both of these currencies don’t really have much to drive them higher, this is essentially a fight between two major lightweights.

Not only do we have the support ranges, we also have the ability to mark out a bit of a symmetrical triangle, so short-term trading is probably going to continue to be the best way to play this market, as there is a lot of tension. The great thing about this is that the market will eventually make a decision, and it should unleash a lot of inertia to make this move quite drastically.

Short-term consolidation

not only do we have the short term consolidation based upon the price levels, but we also have the 50 day EMA and the 200 day EMA going sideways. That obviously shows no signs of going anywhere. However, we will eventually break out of this consolidation, and once we do, it’s likely that we will have a move that is congruent with the overall consolidation area. If we break down below the 1.4950 level, it’s very likely that we move to hundred pips to the downside.

Alternately, if we can break above the 1.50 level, then another 200 pips to the upside could be captured. Having said that, those of the longer-term prospects for the market. In the short term, it looks like we are going to bounce slightly, and therefore using the small back and forth types of positions between these levels should continue to work. However, pay attention to the large levels and as soon as we get a daily close outside of the range, that should work in your favor as far as clarity is concerned.

Beyond that, you should also pay attention to the crude oil markets. If crude oil markets start to strengthen, and they do look like they are trying to find support, that could send this pair lower. Obviously, the exact opposite is true as a move in the WTI Crude Oil market breaking down below the $50 level will send this pair higher.