Global Markets Slump as China Trade Threat Intensifies

Indices around the world endured a difficult trading day on Wednesday. These look set to continue in a negative pattern an open lower again on Thursday. This negative market sentiment comes as China attempts to ramp up the pressure, particularly on US markets. The latest comments from Beijing have sparked fears. These are particularly prominent in the rare earth minerals market where Chinese dominance is very strong.

Rare Earth Minerals the Latest Battleground

The US has said they are continuing work to reduce the American reliance on China for rare earth minerals. This word has come directly from the Pentagon amid Chinas threat to use this reliance as a countermeasure in the ongoing trade war. These minerals are crucial in the production of a host of tech goods including phones, and advanced military hardware.

Beijing knows well that this could be a difficult area that could afford them some leverage in the current situation. They issued the warning directly through a Chinese state newspaper. “Don’t say we didn’t warn you” was some of the strongest commentary to emerge from the People’s Daily article. Such rhetoric has rarely been seen in recent decades, particularly toward a world leader such as the US. This has culminated in a general nervousness throughout the markets.

US Tech Under Pressure

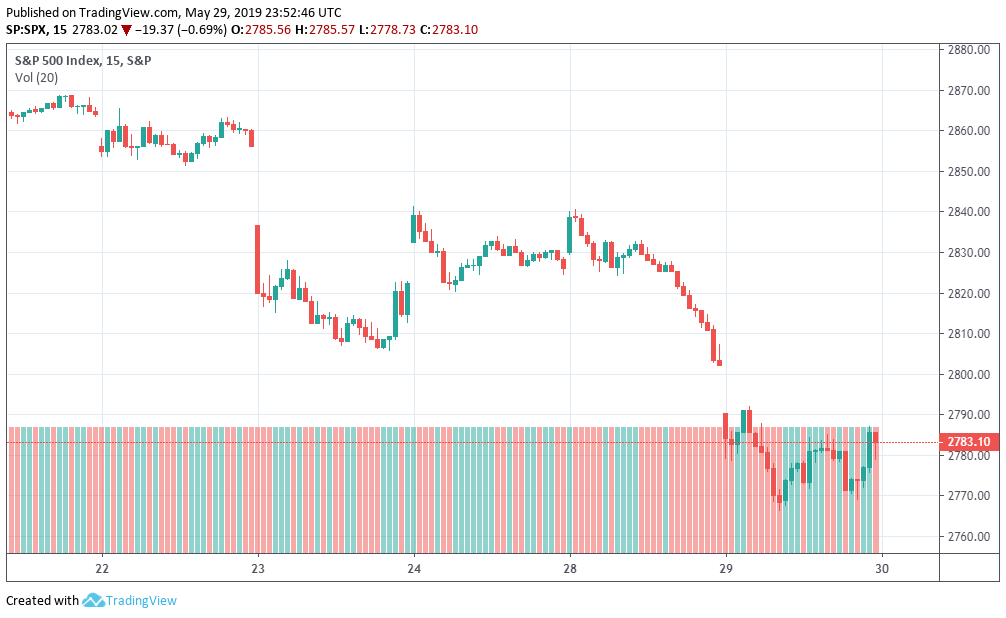

The Dow Jones and S&P 500 both traded downward today. 0.87% and 0.69% losses respectively posted for the day. This means the S&P has lost almost 6% on the month. These losses were led today by the major tech stocks of Nvidia and others. Many are closely linked and reliant upon China and were left shaken by the latest developments in the market.

At the same time, the 10-year Treasury bond rate dropped to a new low for the year. This market closed at 22.36. This left investors continuing to fear a recession as the yield curve deepens. In defense of the inversion, some experts say the reading the position in this instance could be a false positive, although the ongoing trade battle is certain not to be helping.

S&P Daily – May 30th

Euro Indices also Struggling

American markets were far from alone in their struggles on Wednesday. They were joined by almost all of Europe’s major indices. These also posted varying losses in an anxious market. This anxiety was certainly not helped by the upheaval and uncertainty of the recent European elections, not to mention the ongoing Brexit saga.

The FTSE 100 index, as well as both German and French markets, struggled on the day. More than 1% slumps were noted in each. While the election of many Euro-skeptics in recent days has played its part, there is also the ongoing dilemma of a potential fine from the European Commission for Italy. Couple this with the upheaval at Downing Street, and in Austria, and investors are suitably timid.

Overall, there is little sign of daylight for the markets heading into the second half of the week. More positive tones from US-China trade relations being the thing which most are continuing to wait for.