Gold Breaks Through $1500 Level

- Gold markets break down through $1500 level

- Still in an uptrend

- Looking for value

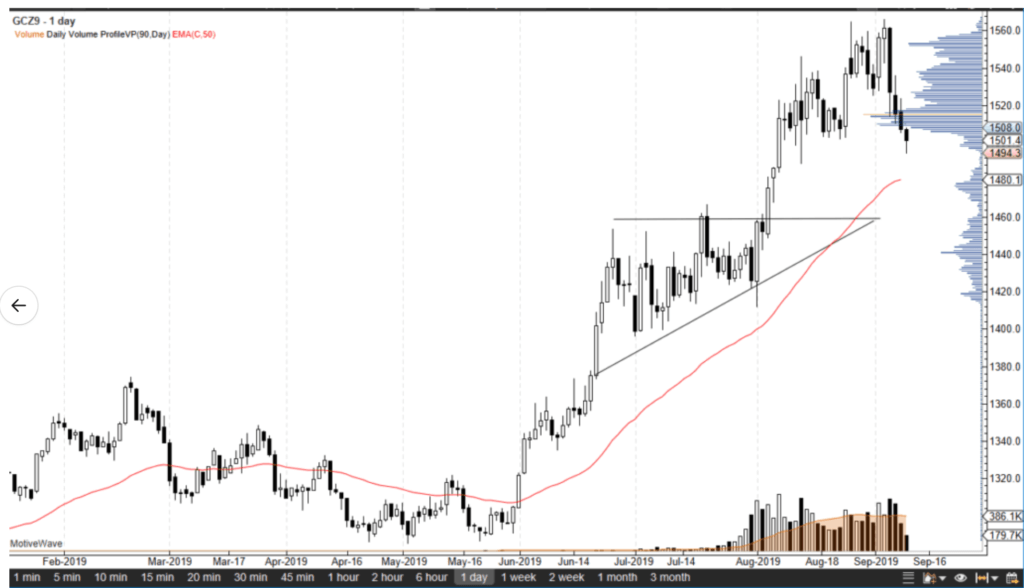

Gold markets broke down during the trading session on Tuesday, slicing through the $1500 level. This is a very psychologically important figure, but at the end of the day, it’s not the be-all-and-end-all of support. The fact that we have sliced through that area will attract a lot of headlines in news outlets, which could cause concern among retail traders.

Futures markets volatile

Gold daily chart

The gold December 2019 contract has been relatively negative over the last couple of days, but the fact that we have stalled a bit just below the $1500 level suggests we are in fact still in an uptrend, although we have seen quite a bit of downward pressure. Ultimately, this market is still much higher than it was six months ago, and it should be recognized that gold tends to be more of a safety trade, so therefore traders will hang onto their positions much longer.

Technical analysis

The technical analysis for this market is still very strong, although we have broken through the big figure. The 50-day EMA, painted in red on the chart just below at the $1475-ish level, should offer some support. That is the beginning of massive support, which extends down to the top of the previous ascending triangle that kicked off the latest leg higher. It would not be surprising at all to see this market end up down there, because that is a resistance barrier that has not been retested. Regardless, there’s a theme here: there are plenty of buyers underneath, and obviously, there will be plenty of traders looking to pick up a bit of value.

The ascending triangle underneath shows signs of potential support as well, so ultimately this is a market that is simply looking for buyers. Beyond that, you can see that the 90-day volume on the right-hand side of the chart was very thin on the way out, and we are starting to see a break down through thinner volume. The thinner volume will be tested, at which point it’s likely that the market will try to consolidate at one of the support levels underneath, build up volume in that area, and then continue the uptrend.

Safety trade

Keep in mind that the safety trade is very much in effect. As we get negative news coming out of the US/China situation, Brexit, global growth, and possibly the ECB meeting later this week, we could get traders coming back into this marketplace. Looking for volume to pick up underneath and a bounce will be crucial for the longer-term directionality of this market. As far as selling gold is concerned, it’s very difficult to do so due to the fact that the global marketplace is essentially on pins and needles. At any moment, we could see a complete turnaround and the market racing to the upside.